Crocs, Inc. has had a dramatic impact on the footwear market over the last two decades, even if it hasn’t always been smooth sailing. Founded in 2002 and going public just a few years later, Crocs withstood vicious criticism of its signature shoe, dubbed the “world’s ugliest,” and almost collapsed during the 2008 financial crisis. However, its long-term success is undeniable, with sales now exceeding 100 million pairs per year. Not only did the company rise to the challenges of the pandemic, it actually thrived both during and after. Making use of occam data and analytics, we delve into Crocs’ remarkable brand recognition, loyal customer base, and diverse buyer demographics. We conclude with an examination of its recent Gen-Z-oriented acquisition, HEYDUDE.

The significant majority of apparel companies were impacted negatively and meaningfully during the pandemic, but in the face of these headwinds, Crocs was able to set new records for both revenue and profits. Crocs has faced skepticism periodically through its more than 20 years of operation, but a loyal customer base has steadfastly sought out Crocs’ comfortable and affordable footwear, even as numerous imitators emerged. Last year the company acquired modern shoe company HEYDUDE, which adds a meaningfully different style of casual footwear into the product mix.

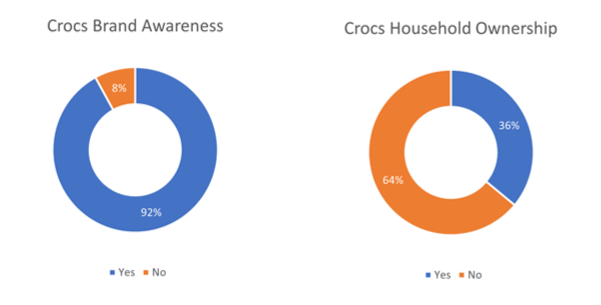

Occam data show that Crocs maintains an unbelievably high brand awareness of 92% (Figure 1), a testament to the lasting impact of its status as a cultural phenomenon in its formative years. Moreover, the brand’s power extends beyond mere awareness: a surprising 36% of households own a pair of Crocs footwear.

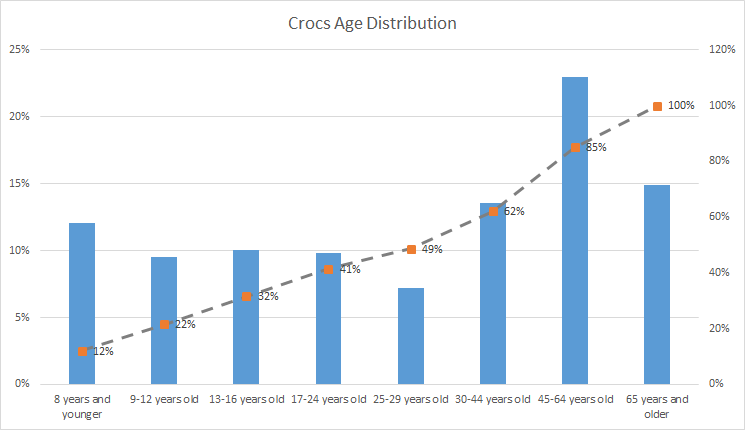

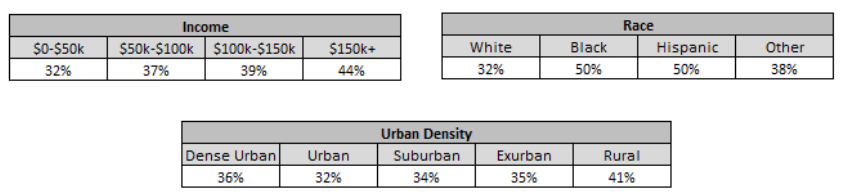

Figures 2 and 3 offer insights into the widespread appeal of Crocs. Although younger customers represent the majority of Crocs owners, there’s a substantial presence of baby boomers and Gen Xers (Figure 2). The universality of the appeal of Crocs is further demonstrated in Figure 3, where we see that ownership is distributed rather evenly across various demographic categories, including race, income, and urban density.

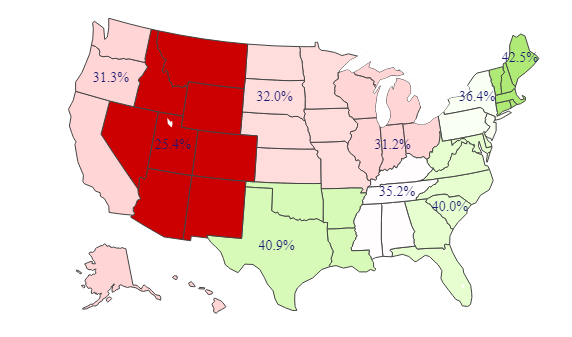

Figure 4 highlights household ownership of Crocs in the nine geographical Census regions. Notably, the highest penetration is observed in the New England, West South Central and South Atlantic Divisions.

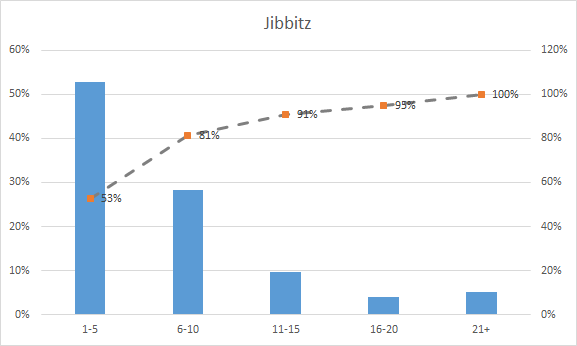

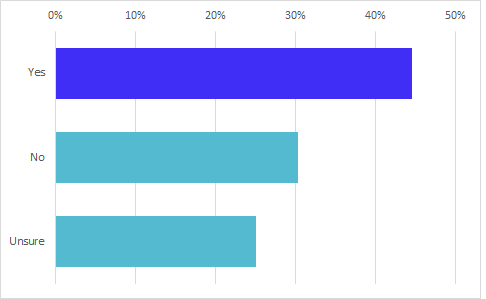

Crocs often touts its commitment to developing innovative ways to personalize its products as a major driver of its growth. Jibbitz (shoe charms that you add to Crocs) have been an essential component in this strategy. 35% of Crocs owners purchase on average seven charms at $5-$7 apiece (see Figure 5), which makes it clear that customers value the ability to customize their footwear. Another growth engine (and priority) for the company has been repeat purchasing; occam shows that almost 50% of Crocs customers intend to buy a new pair in the next six months (Figure 6).

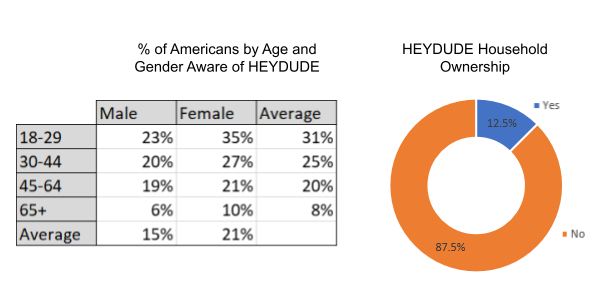

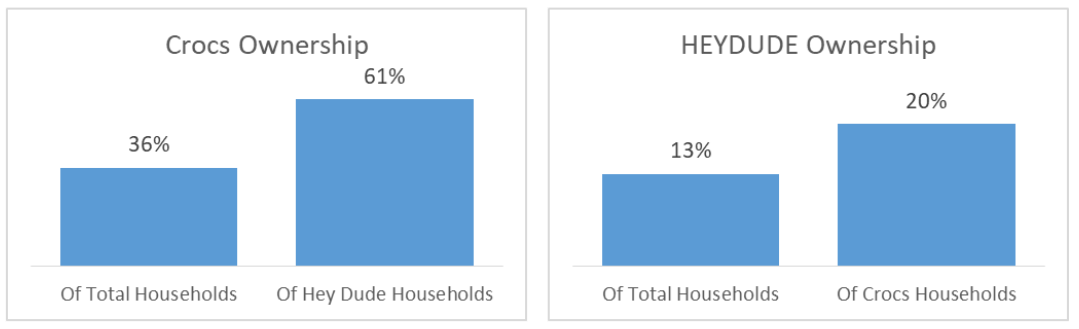

When Crocs acquired Italian specialty shoe company HEYDUDE Shoes, they cited as strategic rationale the brand’s “ideal fit with Crocs and long-term consumer trends”, as well as the potential to become a “global, scaled leader in branded casual footwear.” After only a year, the investment is showing promise. According to occam, about 1 in 8 households own a pair of HEYDUDE shoes despite brand awareness otherwise being fairly low (Figure 7). Figure 8 shows household cross-ownership of Crocs and HEYDUDE, which is impressively high and allows synergies in marketing and distribution. While only 13% of overall households own a pair of HEYDUDE shoes, 20% of Crocs households own a pair of HEYDUDE shoes. Similarly, while overall 36% of households own a pair of Crocs, 61% of HEYDUDE households own a pair of Crocs.

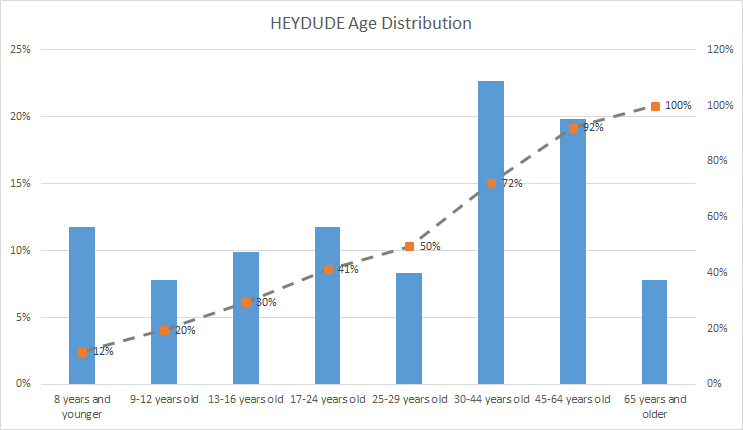

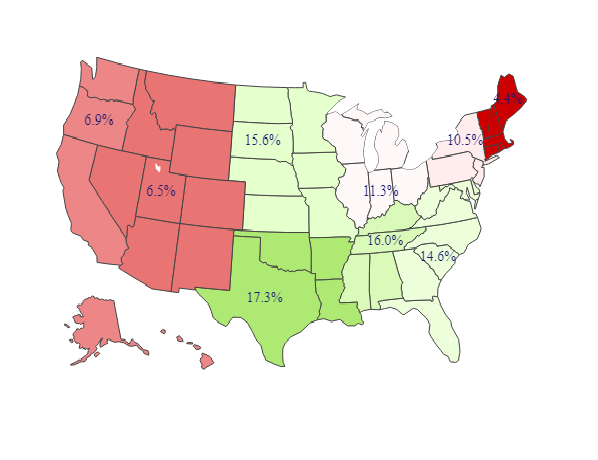

Figures 9 and 10 present demographic data for HEYDUDE, similar to the data shown for Crocs. HEYDUDE’s organic and unplanned appearances in social media, combined with the brand’s “eco-friendly” mission, have made it a popular choice among Gen Zers, who represent the brand’s fastest-growing demographic, and the age cohort with the highest market penetration (Figure 9). The regional distribution of HEYDUDE customers shows concentration in the South and Midwest (Figure 10). The brand currently has a limited market, so it will be interesting to see to what extent Crocs will help HEYDUDE broaden its appeal.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

Brand Power

1. I'm Not Famous to Me

Crocs thrives on near 100% brand awareness, with almost 40% of households owning a pair

Ownership

2. Count Your Age By Friends

Crocs wearers are spread out evenly across younger age tiers, while Gen Xers are the majority owners in the older groups

Ownership

3. Of Shoes, And Ships, And Luxury Tax

The mass appeal of Crocs makes it a firm competitor

% of Households by Income, Race, Urban Density That Own Crocs

Ownership

4. Keep Calm and Your Crocs On

Crocs dominate in the South and the East

% of Households by Region That Own a Pair of Crocs

Accessories

5. Being Youer Than You

Jibbitz buyers on average purchase 7 charms

Number of Charms Owned by Jibbitz Customer

Brand Power

6. These Things Are Fun, and Fun is Good

Nearly 1 in 2 Crocs owners are recurring customers

Brand Power

7. One Step At a Time

Purchased by Crocs in 2022, the HEYDUDE brand is picking up steam

Cross Ownership

8. Your Head Full of Brains, and Your Shoes Full of Feet

Even higher cross-ownership of Crocs and HEYDUDE over time would be positive for Crocs, Inc

Ownership

9. Find Comfort While You're Young

Skewing slightly younger than Crocs, HEYDUDE is yet to have the same universal identity

Ownership

10. But First, We Must Contend

The South and Midwest are popular markets for HEYDUDE footwear

% of Households by Region That Own a Pair of HEYDUDEs

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.