The back-to-back failures of Silicon Valley Bank (SVB) and Signature Bank, as well as lingering uncertainties about the viability of First Republic Bank, have subjected regional lenders to heightened scrutiny. As others have chronicled, the confluence of three elements made for the perfect run-on-the-bank storm: 1) a backdrop of banks with significant asset-liability duration and liquidity mismatches (bond-heavy portfolios held against demand deposits); 2) a backdrop of multiple banks where a large fraction of deposit balances were in excess of FDIC coverage limits; and finally, 3) the Fed’s tardy and therefore unusually aggressive attempts to control inflation with rate hikes. Below, we query occam to evaluate how the resulting bank runs have affected consumer sentiment towards banks and preview what might lie ahead for the industry.

SVB and Signature Bank collapsing in quick succession, Silvergate Bank shuttering, and Credit Suisse being taken over under extreme distress culminated in a rapid drop in confidence around the banking system. The FDIC, Fed, and Treasury acted together to backstop depositors and grant immediate access to all deposits held at SVB and Signature, invoking powers under the “Systemic Risk Exception.” This intervention helped halt the decline in confidence, while the subsequent announcement of the BTFP (discussed below) further allayed concerns. However, as occam data demonstrates, even though sentiment stabilized, consumers are more circumspect about banks than before the crisis.

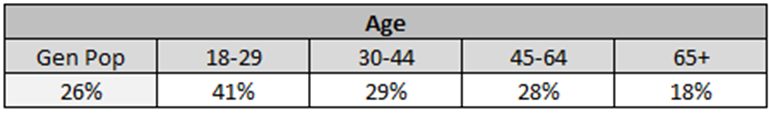

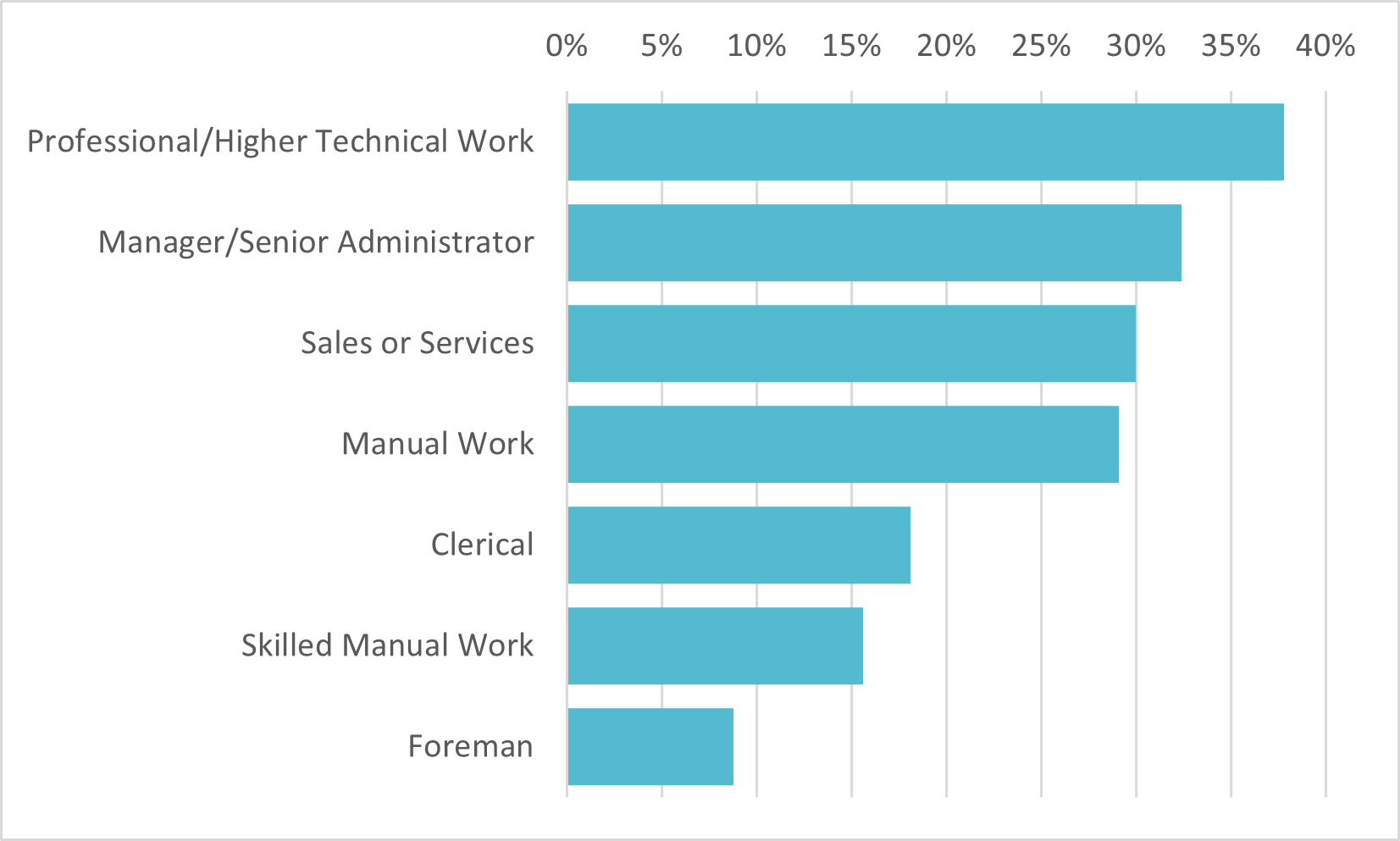

Occam data reveals in Figure 1 that about a quarter of Americans are worried about the health of their banks. Curiously, the 18 to 29 age cohort seems the most apprehensive, even though it stands to reason that the members of this cohort are the least likely to have deposit balances that exceed FDIC coverage. We think the most likely explanation is that this young cohort has markedly higher engagement with technology and cryptocurrencies – SVB was a banker to tech startups, and Signature and Silvergate were crypto focused – so information about distress of these banks likely figured more prominently in this group’s news and social media feeds. Additionally, Figure 2 shows that irrespective of age, concern about banks is greatest among the professional class.

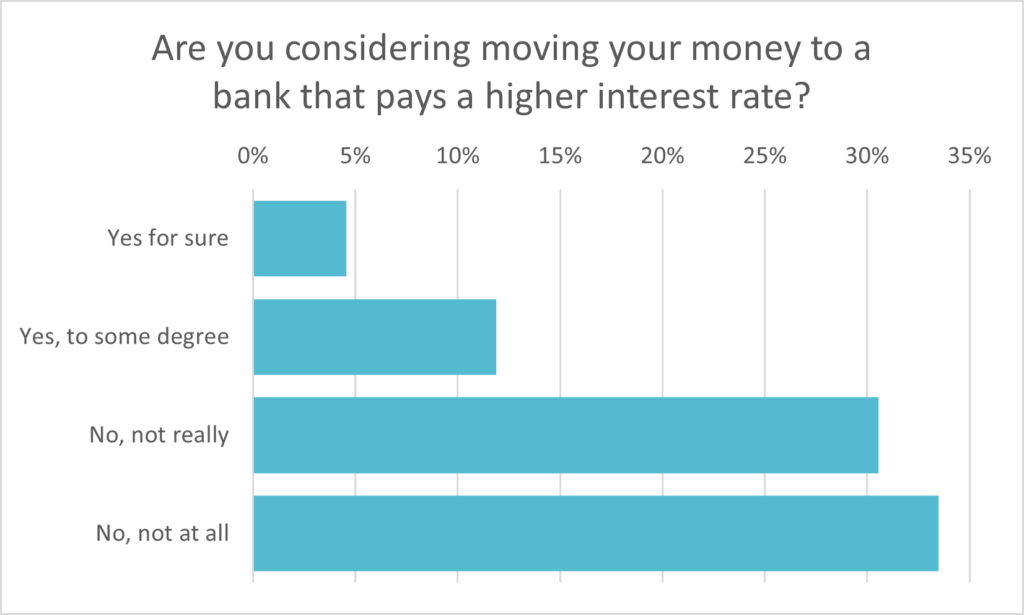

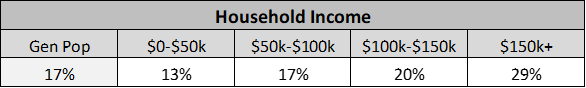

Remarkably, even though the average deposit yield is 0.39% (according to the FDIC), occam shows in Figure 3 that a significant majority of Americans (2 out of 3) say they have no interest in switching banks to secure a higher yield. We hypothesize that this is due to the prioritization of safety, as it’s been our observation that high-yielding accounts are usually linked to less creditworthy regional banks, while low-yielding accounts are typically found at too-big-to-fail banks that hold the majority of deposits (in fact, the top 15 banks hold about two-thirds of all deposits in the US). Not surprisingly, Figure 4 shows that the highest income cohort is the most interested in moving money to earn a higher yield.

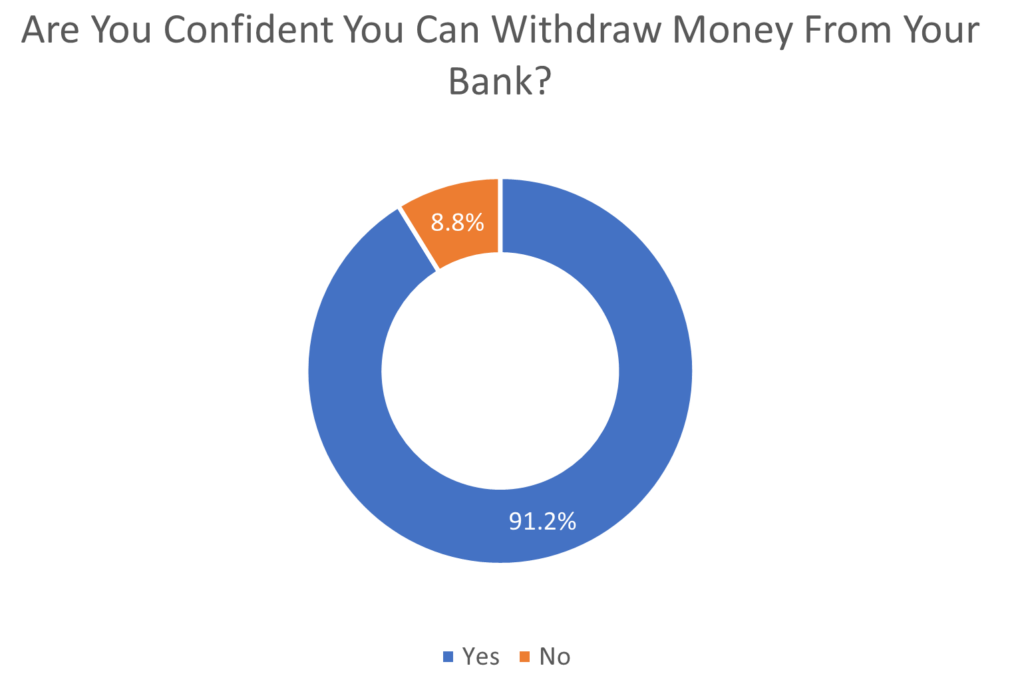

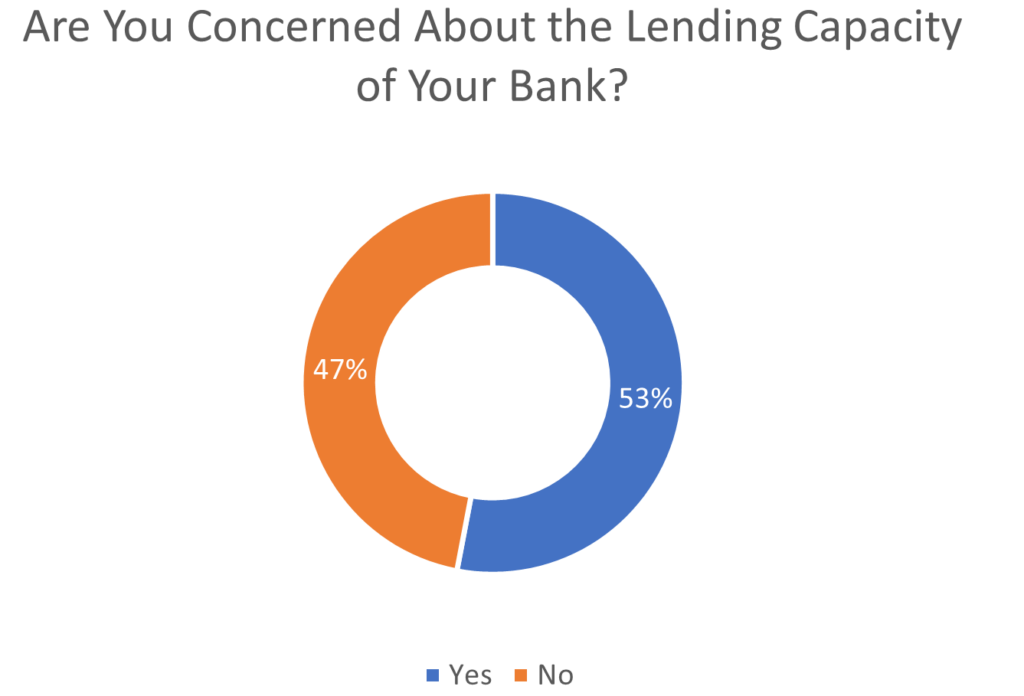

Shortly after the collapse of SVB and on the day Signature Bank shuttered its operations, the Federal Reserve announced the Bank Term Funding Program, or BTFP, to provide financial institutions a stronger foundation to “meet the needs of all depositors.” Encouragingly, Figure 5 shows that 9 out of 10 Americans indicate they have little to no concern about the ability to withdraw cash from their banks. Yet, as Figure 6 indicates, consumers are less sure in this new environment about their banks’ ability or willingness to extend loans. Now that First Republic’s troubles are back in the spotlight after a somewhat cryptic Q1 earnings call (notably, with no Q&A), occam will monitor to see how sentiment evolves from here.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

Bank Strength

1. The Young and Apprehensive

Younger cohorts are understandably the most concerned about their banks' viability

Bank Strength

2. They Work Hard For The Money

The professional and managerial class are the most concerned about their banks' viability

Interest Rates

3. To Yield or Not to Yield?

Most Americans do not want to move to a bank that pays higher interest rates

4. Higher Interest in Higher Interest

The most affluent are more willing to switch banks for higher interest rates

Consumer Confidence

5. Banking on Accessibility

Less than 10% of Americans are worried about being able to withdraw cash from their banks

Lending Power

6. Will They or Won't They?

Americans are questioning banks' lending capacity

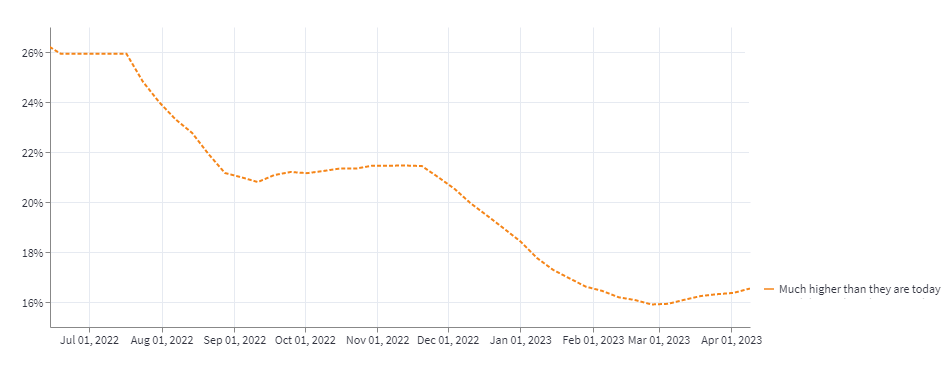

Interest Rates

7. Look Into the Seeds of Time

Interest rates, at least in the public eye, are expected not to rise significantly from here

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.