Coffee culture in the United States has never seen more of an explosive presence than it has now; there are at least 50,000 coffee shops in the country and it is the largest market for coffee in the world. This being the case, how coffee chains navigate current economic conditions and consumer behavior as a result will serve as a useful tool to understand wider trends in the industry.

As Americans continue to face price pressures we explore if coffee chains will be affected as they have had to raise prices to maintain margins. Our data show that the response to price increases by chains such as Starbucks and Dunkin' have left them unable to achieve any significant visit growth. However brand affinity remains high which should be a positive when prices abate. A trend to watch is competition as we have seen success from up and comers including new IPO Dutch Bros and trendy chains like Blue Bottle.

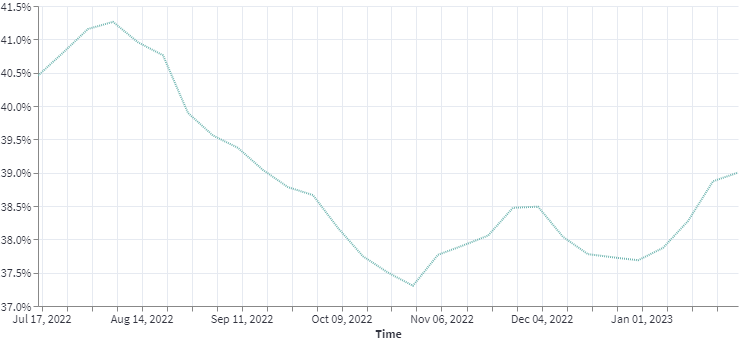

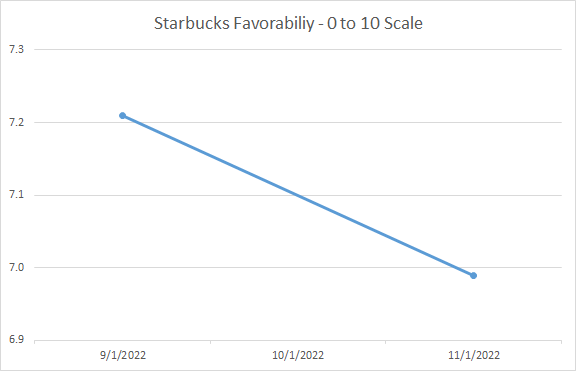

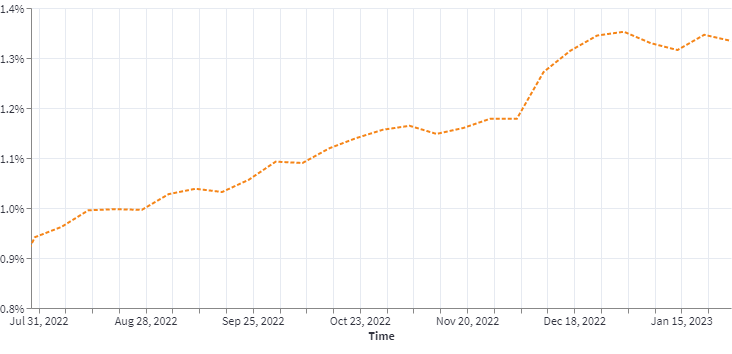

Starbucks recently announced they grew 10% in the U.S. but almost all their growth was a result of pricing. Our data show that through the second half of 2022 visits were relatively stable but overall they declined (see fig. 1). Recent trends since the start of the year suggest visits remain stable and have in fact started to recover slightly as the bulk of price increases seem to be behind them. However consumers are very aware of the price increases (see fig. 4) and this has led to a slight reduction in customer satisfaction as seen in figure 2. Starbucks maintains an industry leading NPS score, but our data show the brand has been tarnished slightly due to the price increases instituted in 2022.

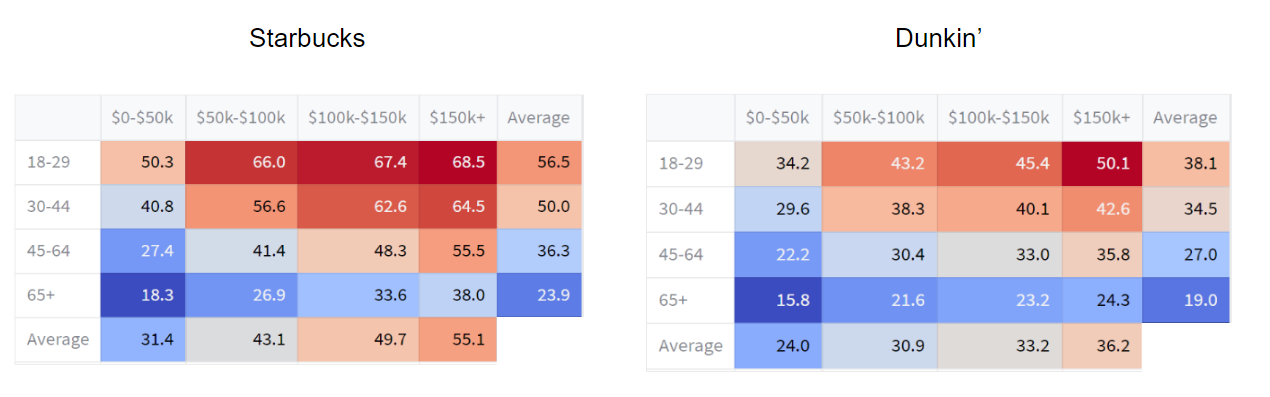

Figure 3 shows more than 1/2 of those older than 30 are Starbucks patrons, and equally impressive more than 1/2 of those earning over $100k also frequent the coffee chain. If investors are looking for businesses that target the right demographic group in an inflationary environment, Starbucks screens well. Less known and equally impressive is Dunkin’ which also skews affluent and young which should help them weather inflationary pressures as well (see fig. 3).

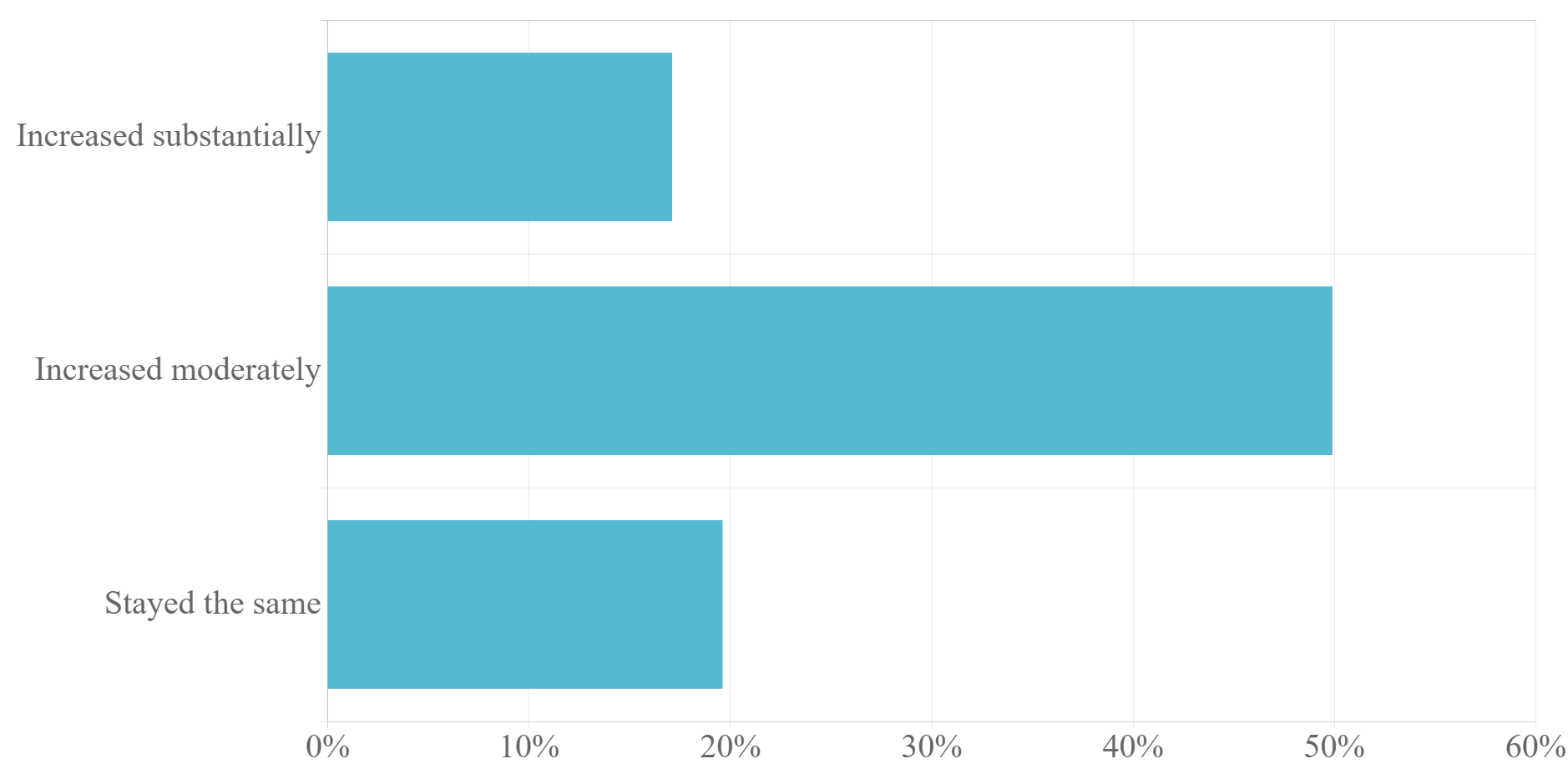

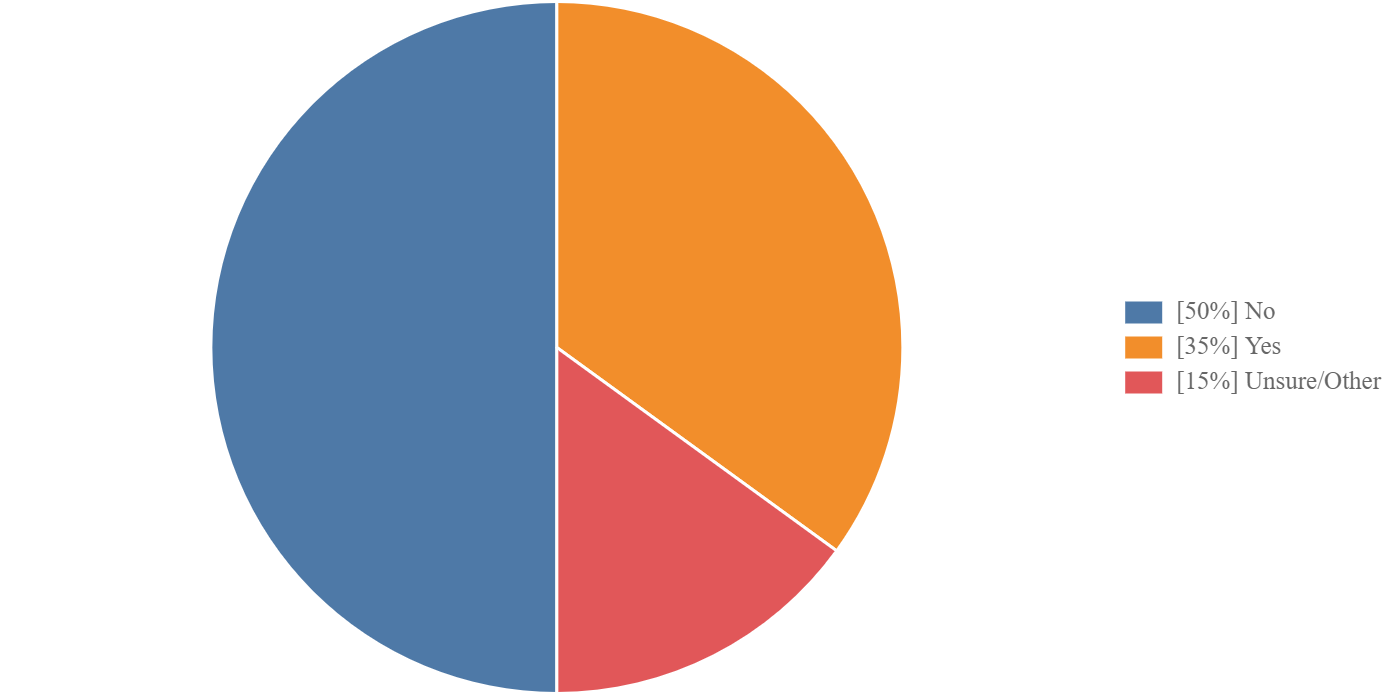

On the cautionary side, while demographics are in their favor, consumers are very aware of recent price hikes and many are changing visit patterns. As seen in figure 4, almost 70% of Starbucks patrons have said prices have increased, and 1 in 3 (see fig. 5) have said they are likely to visit less as a result.

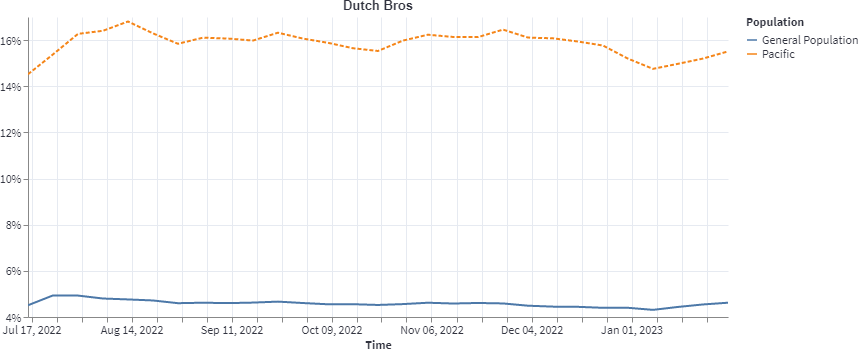

Competition in coffee is not a new trend, however some of the recent concepts seem to have taken hold. Drive-through chain Dutch Bros Coffee filed its IPO in September of 2021, and already has ~650 locations mostly in the West. They have a plan to expand to 4000+ stores over time with most of the growth planned for the South. Our data show that they have high share in the markets they enter. While only ~5% of Americans have visited a Dutch Bros overall, ~15% of people in the Pacific region have recently visited a Dutch Bros (see fig. 7). The strategy of expand and they will come seems to be working for them. Similarly, trendy Blue Bottle is also doing well. As seen in figure 6 as they expand they too are gaining in popularity. While coffee chains come and go our data is constantly monitoring fads versus trends.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

Starbucks

1. Fresh From the Mountains of Colombia

Starbucks visits declined last year and have started to rebound

% of Americans That Have Visited a Starbucks Recently

Starbucks

2. Boost Your Mood!

Starbucks favorability rating, while still high, has deteriorated as the chain raised prices

Demographics

3. Hooked on Caffeine

Starbucks is more popular in general, but impressively both Starbucks and Dunkin' skew young and affluent

% of Americans by Age and Gender That Visit Starbucks and Dunkin’

Starbucks

4. When the Secret Menu Can No Longer be a Secret

Almost 7 in 10 Starbucks customers have felt the price increases

Starbucks

5. Try Exercise Instead

More than 1 in 3 say they will likely visit Starbucks less

Are Starbucks Patrons Likely to Visit Less Given Price Changes

Competition

6. Room for More

Emerging brands like Blue Bottle and Dutch Bros are growing in popularity

% of Americans That Have Visited a Blue Bottle Recently

Competition

7. Turf War

Dutch Bros Coffee begins to take its stand on Starbucks' ground with almost 1 in 5 West Coasters visiting the brand

% of Americans That Have Visited a Dutch Bros Recently, Nationwide and Pacific Region

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.