Since its debut in fall 2022, Pinduoduo Holdings’s Temu has experienced a meteoric rise rare for a new entrant in the competitive e-commerce space. Temu consistently tops the charts in Apple’s App Store and Google Play store, and it has dethroned Alibaba as the largest Chinese e-commerce company by market cap, though it has arguably achieved these feats by prioritizing rapid growth over profitability. To understand Temu’s swift rise and its potential for sustaining its rate of growth, we consult occam to examine shifting trends in consumer spending habits, the demographics of Temu’s sizable user base, and the platform’s impact on competing retailers. Our exploration leads to some intriguing findings about Temu’s less-than-ideal customer satisfaction compared with giants like eBay and Amazon, and what improvements Temu users seek from the platform.

Retail Spending Behavior

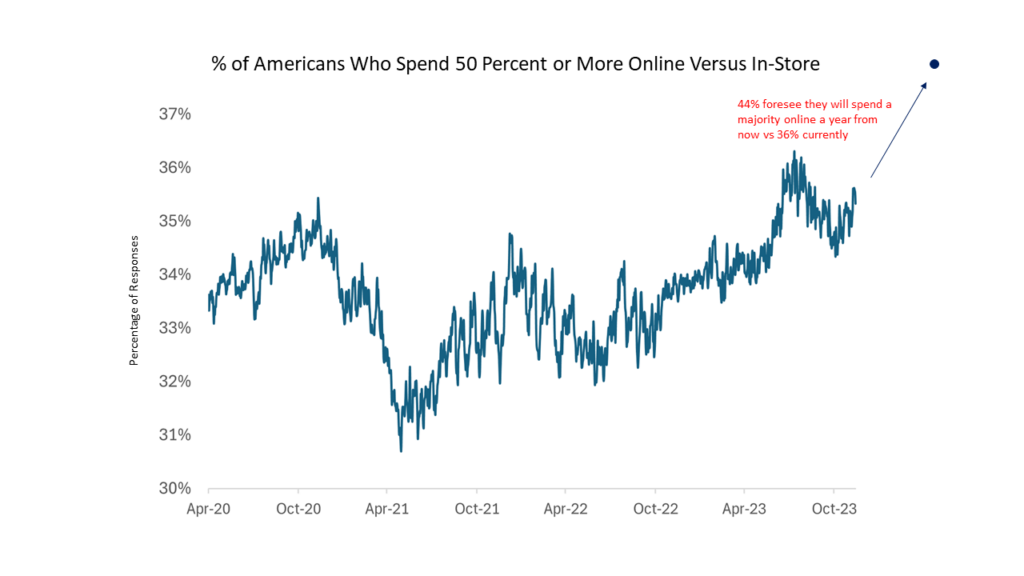

- Whereas currently 36% of respondents spend at least half their shopping budgets online, a significantly larger 44% of respondents predict that this will be the case a year from now.

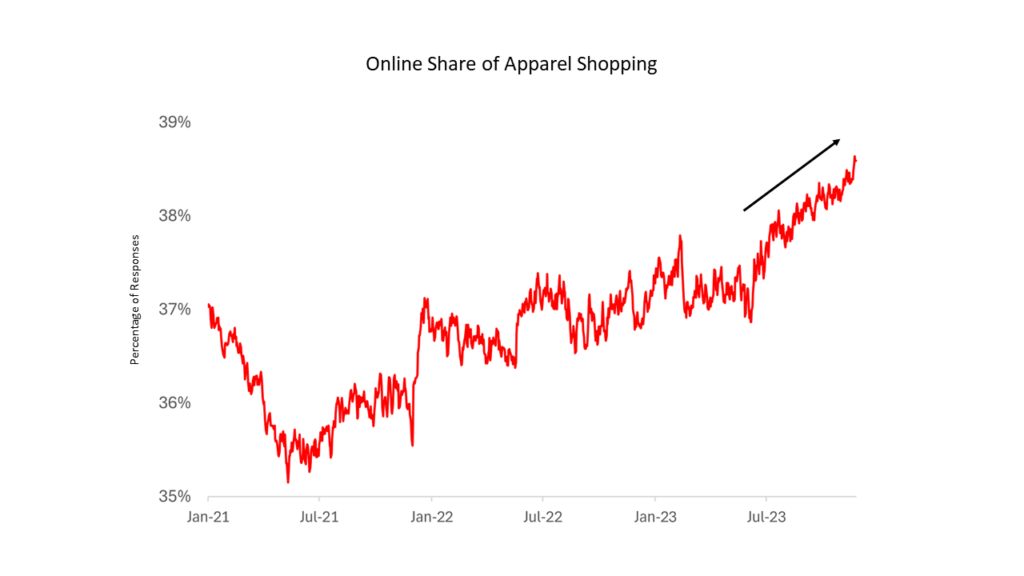

- There’s been modest but clear growth in the percentage of apparel budgets spent online.

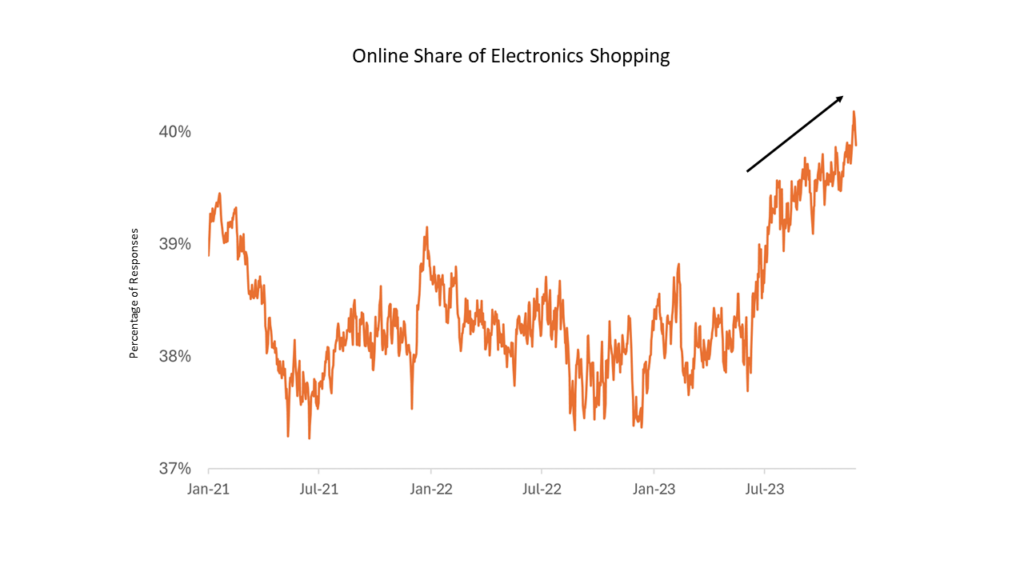

- The upward trend of online spending on consumer electronics isn’t quite as clear as it is for clothing, but it still stands near record highs.

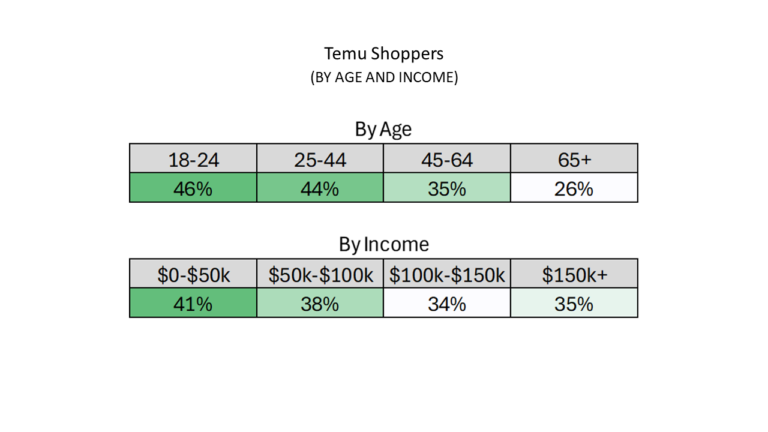

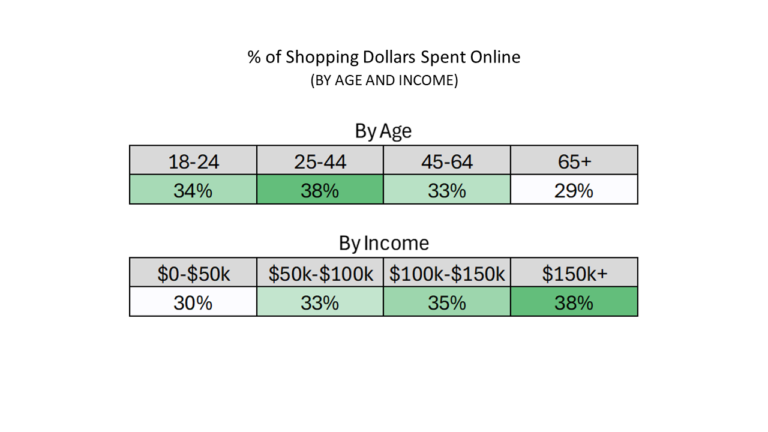

Temu Shoppers

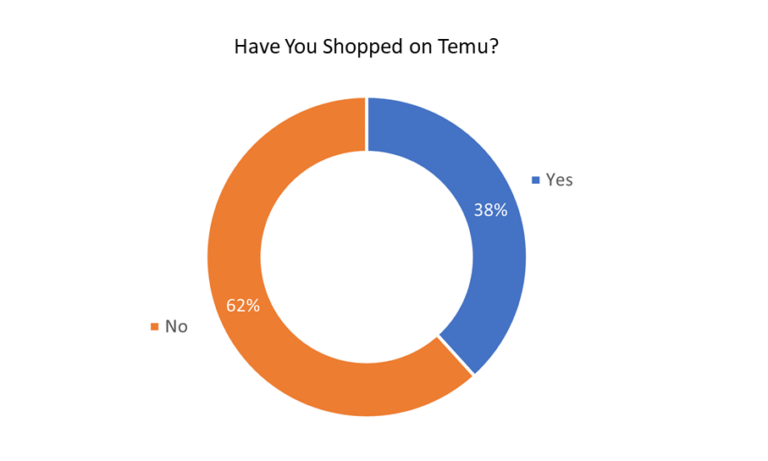

- Despite going live only in September 2022, an impressive 38% of respondents say they’ve made purchases on Temu.

- Temu shoppers clearly skew younger.

- Below, we provide baseline online shopping demographics data (independent of retailer) to help interpret the Temu figures above.

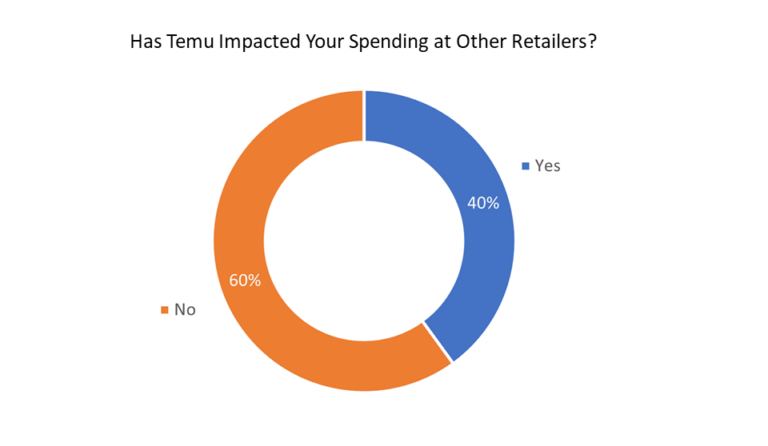

- 40% of Temu shoppers say their spending at other retailers has decreased because of their purchases on Temu.

- Temu’s loss-leader strategy includes subsidizing transactions through heavy discounts and gamification that allows users to win generous coupons.

- Amid fluctuating consumer confidence, Temu and other rapidly expanding deep discount online retailers are attracting the scrutiny of Amazon and online retailer peers.

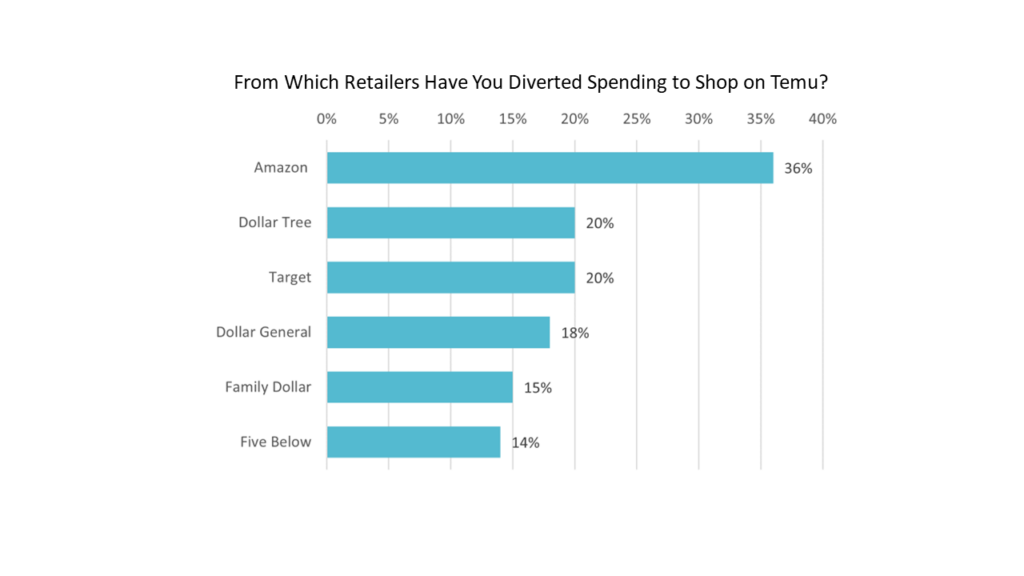

- Below, we show a ranking (not adjusted for market share) showing which retailers have lost customer spending to Temu.

- Notably, “dollar stores” and Five Below are standouts after accounting for their small market shares. This is likely due to a greater similarity to Temu in their core product offerings.

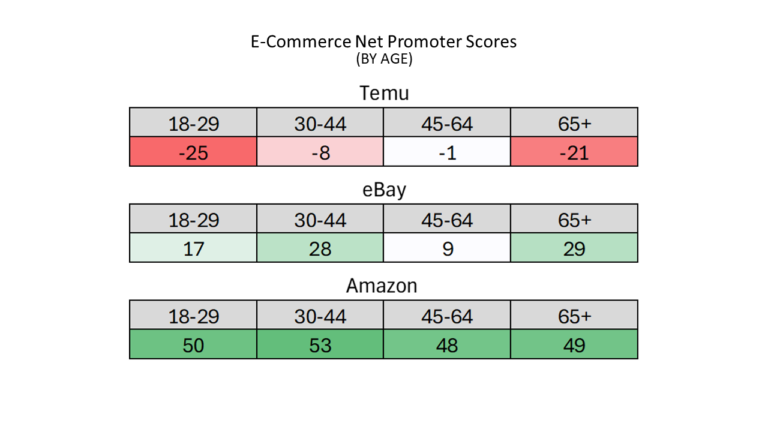

- Temu Net Promoter Scores are negative across all age cohorts and especially low among the 18-29 and 65+ age cohorts.

- eBay and particularly Amazon earn soundly better NPS.

- In the face of mediocre customer satisfaction, low prices may not be enough to sustain robust and organic repeat business for Temu. Given the already high prevalence of Temu usage, continued growth leans materially on repeat customers.

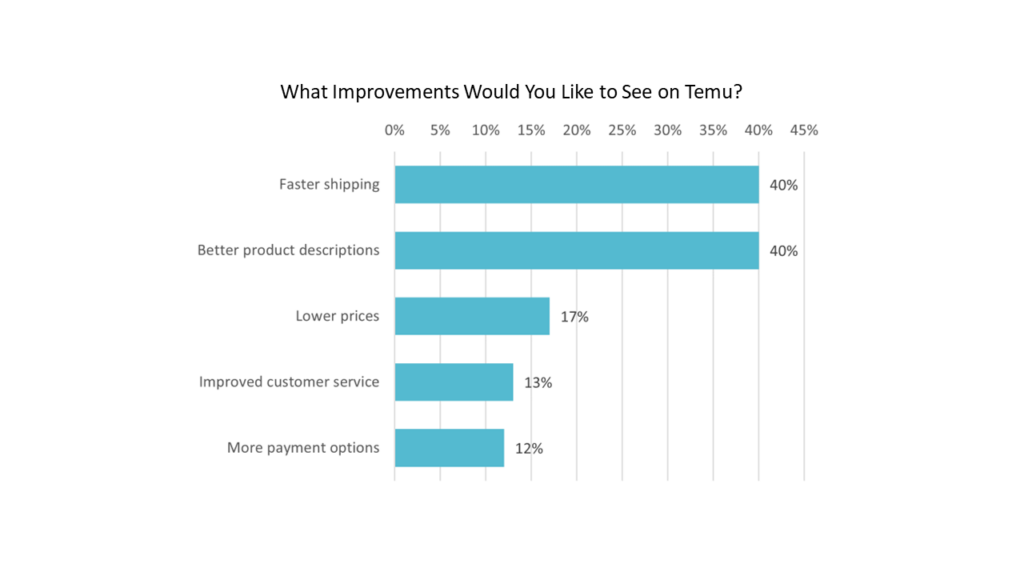

- The top two improvements Temu customers would like to see are “Better product descriptions” and “Faster shipping,” which in part likely reflect the elevated expectations set by Amazon’s fast delivery times and comprehensive product details and reviews.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.