One of the most popular New Year’s resolutions (as well as one of the most abandoned) is increased exercise. The question is, how dramatic will such trends change in a post-pandemic and recessionary environment, if at all.

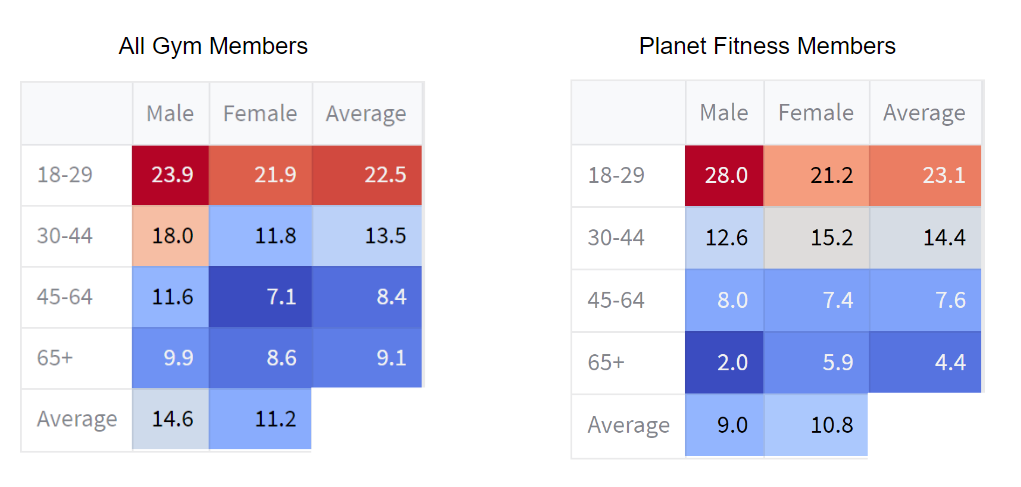

In a post pandemic world, our data show that working out at home remains as popular as ever and COVID has structurally affected demand for gyms. However, young people overwhelmingly prefer exercising in a gym, which benefits chains like Planet Fitness that skew younger (see fig. 4). Another trend worth following is older and less affluent demographic groups don't exercise nearly as much as their younger and more affluent counterparts.

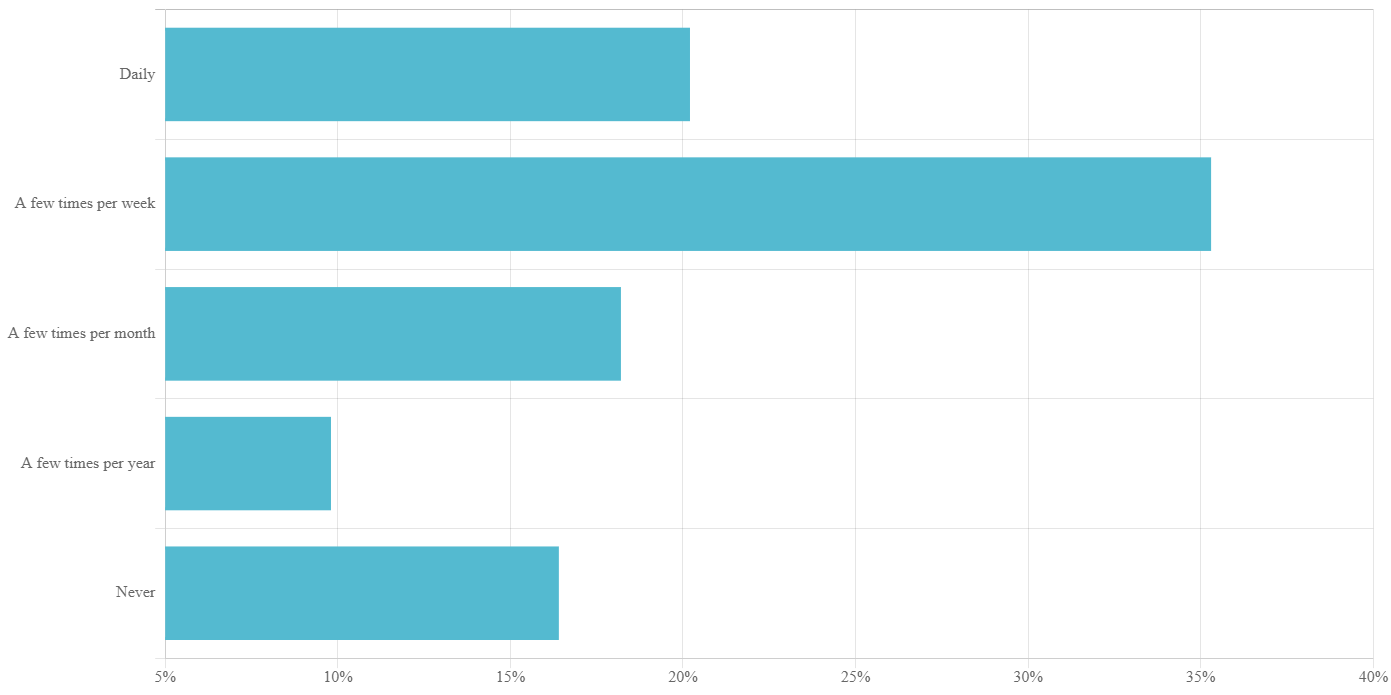

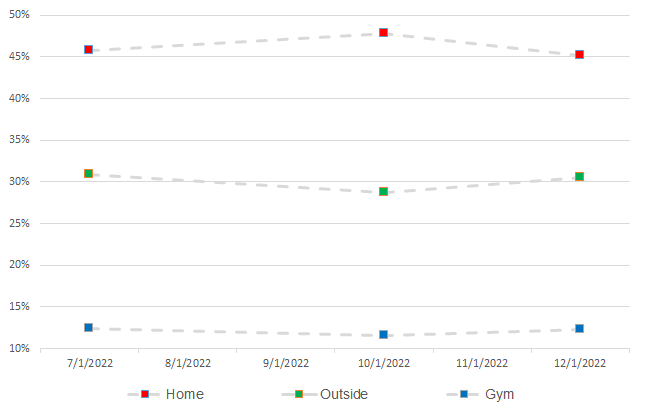

As a general activity, exercise is important to most Americans. Our data show that at least one out of three people exercise a few times per week, and 1 in 5 are exercising daily (see fig. 1). Americans are overwhelmingly choosing to work out at home (45%), 30% are choosing to exercise outdoors and only about 12% choose the gym (see fig. 2).

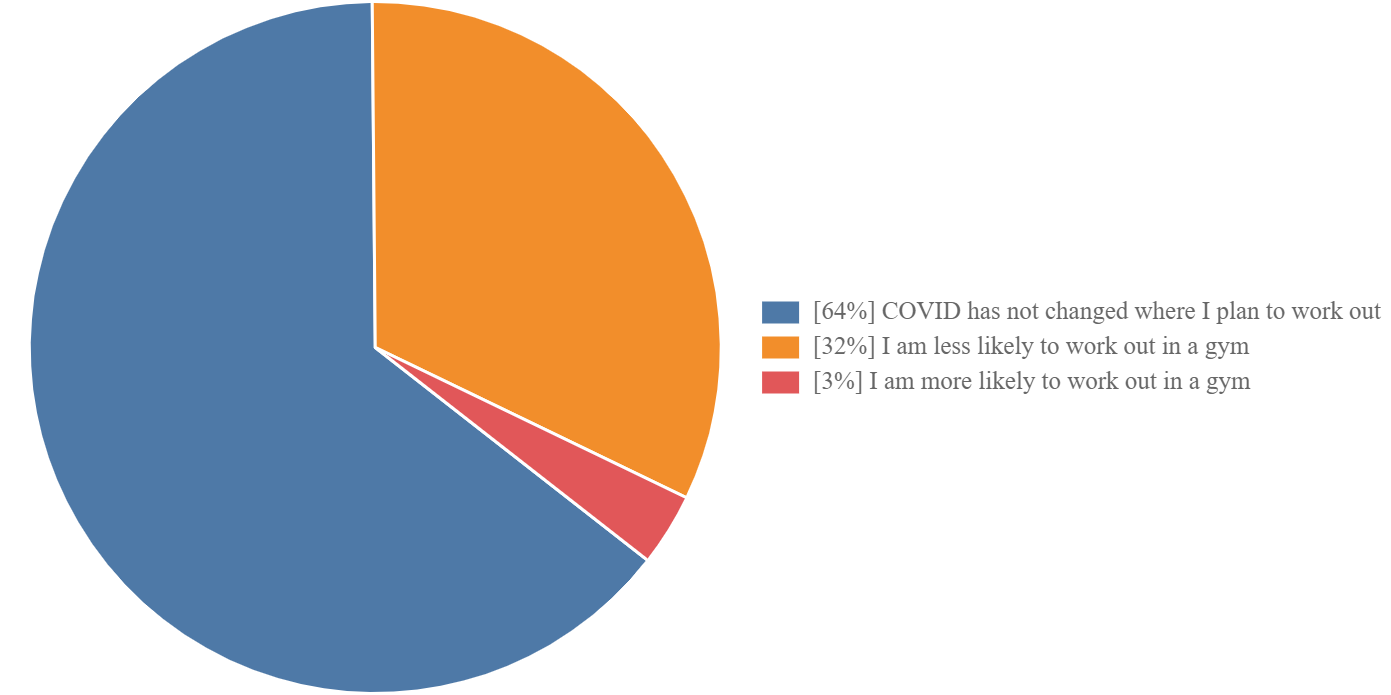

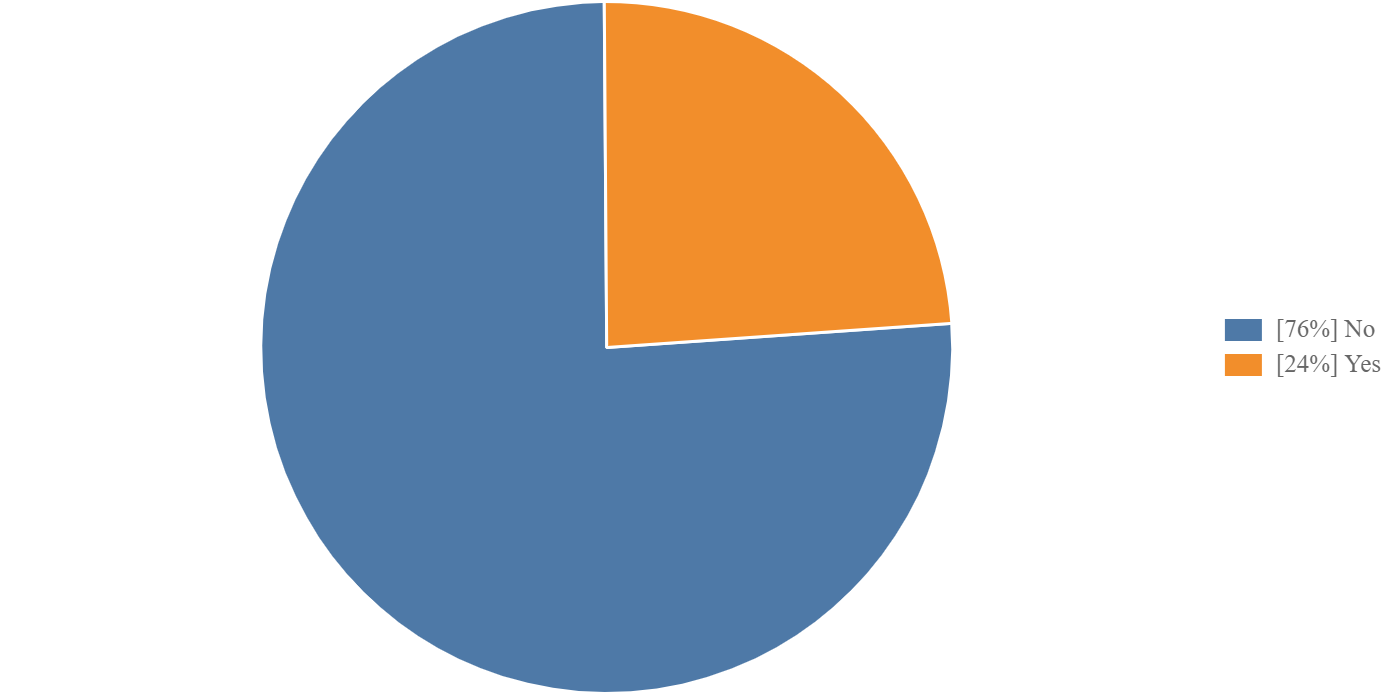

The pandemic has impacted the perception of gyms (see fig. 3) but usage trends remain stable. Not surprisingly, gym goers skew younger and the focus for some of the largest fitness chains continues to be younger cohorts as they try to expand their user base in the post COVID reality. Almost 1 in 4 young men, and 1 in 5 young women continue to prefer exercising at gyms as shown in figure 4.

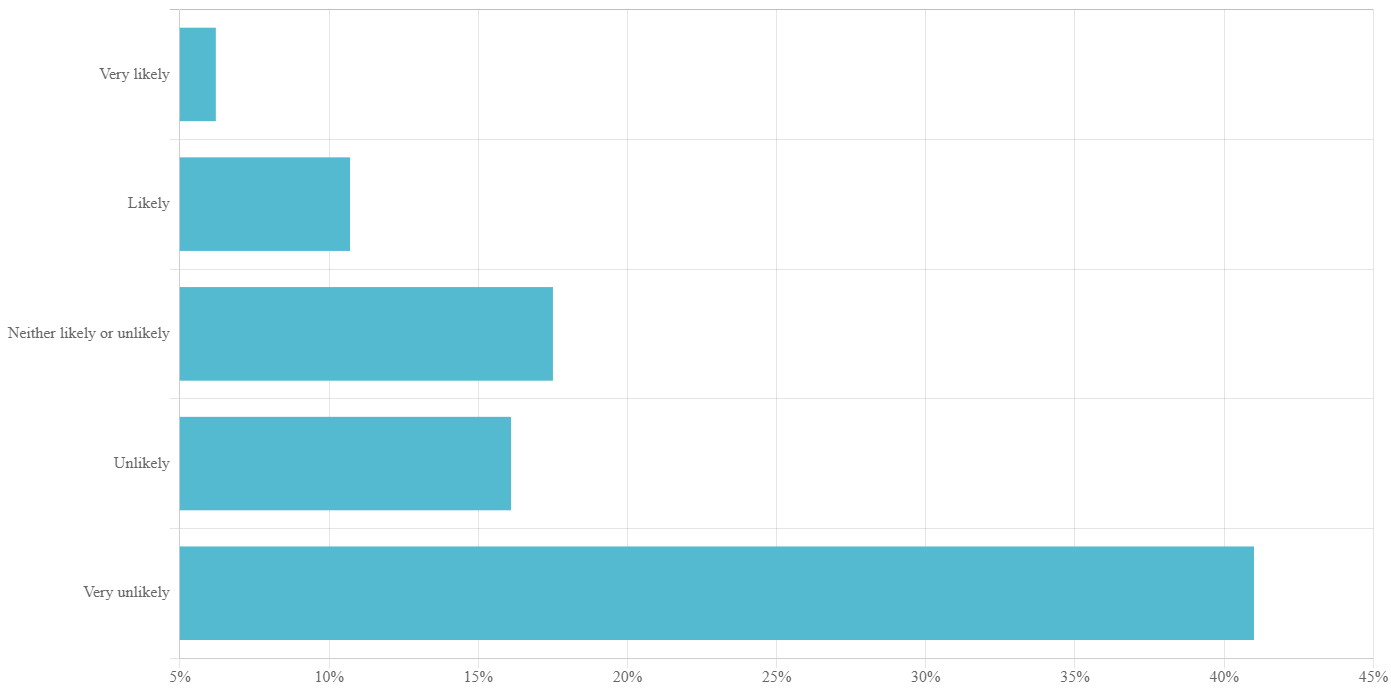

Exercise equipment demand has fallen precipitously post COVID, solely due to the amount of equipment that was purchased during the pandemic. As shown in figure 5, 1 in 4 Americans bought some form of equipment during the pandemic. When asked of future purchase intentions only 6% say they are very likely to buy exercise equipment in the next six months (see fig. 6).

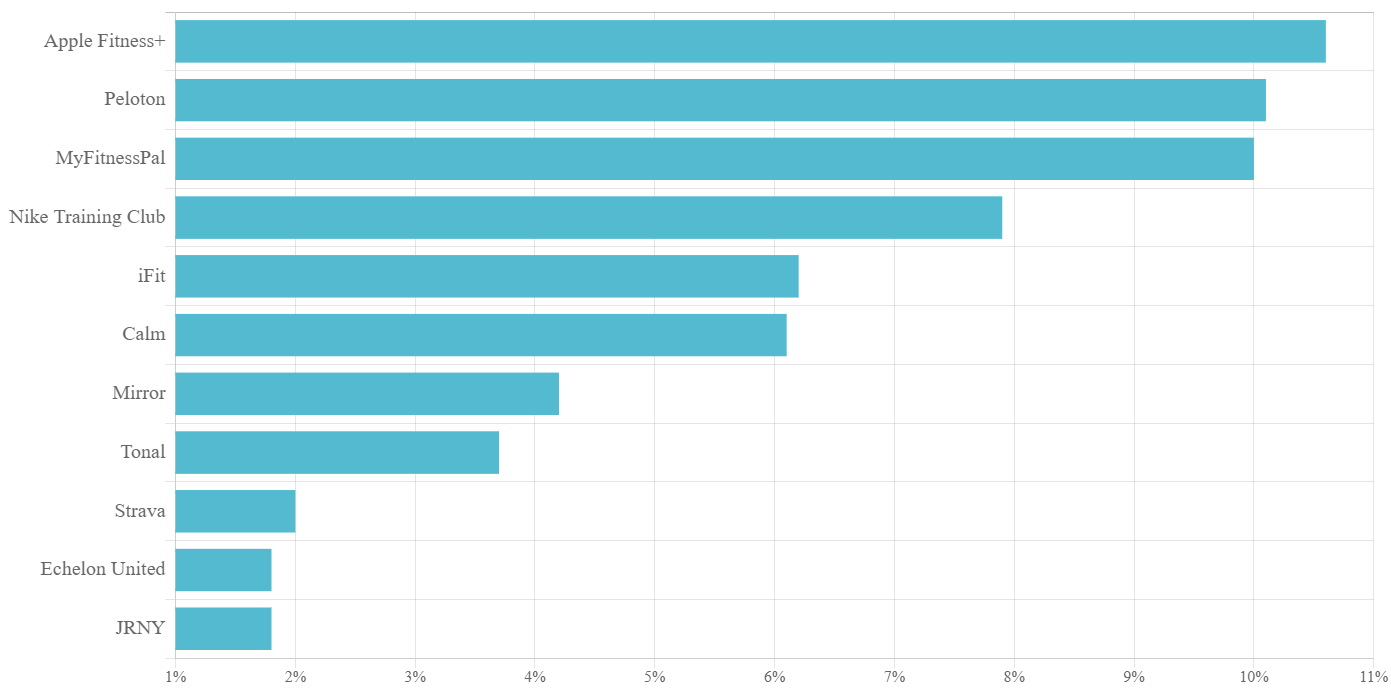

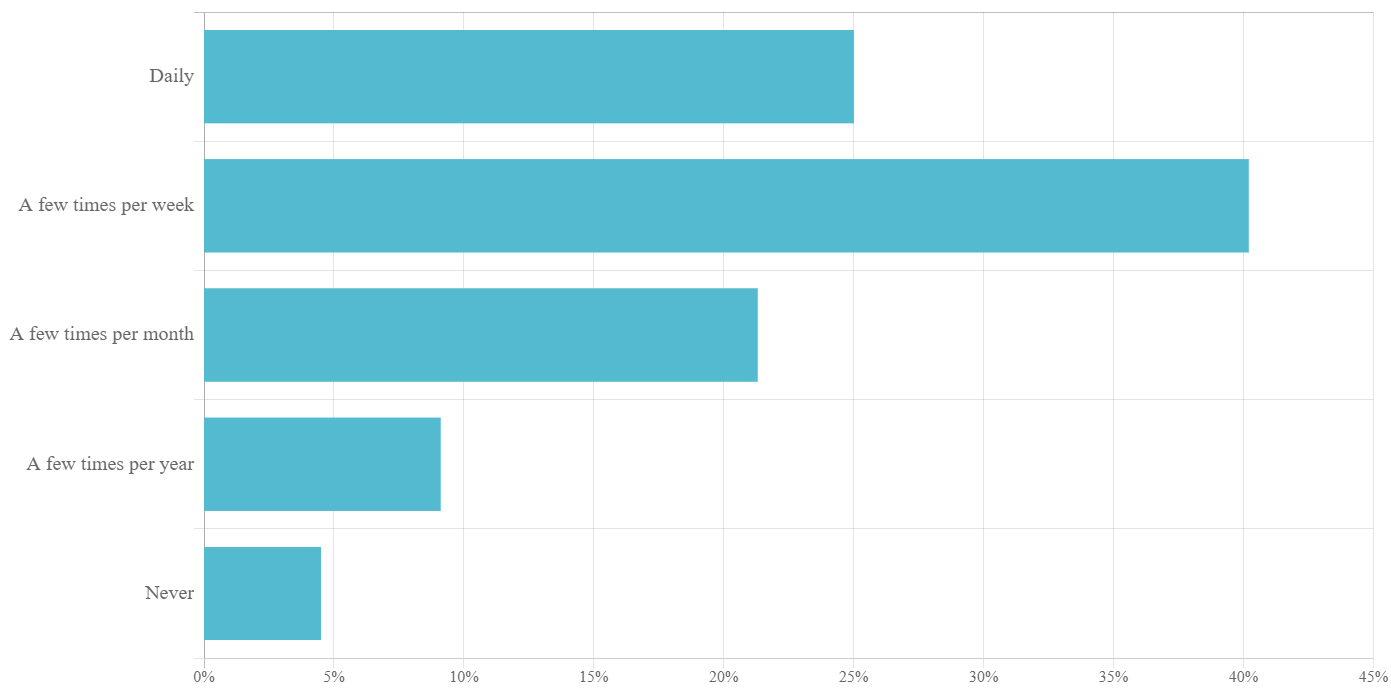

Fitness subscriptions, very popular during the pandemic, have now become a crowded space. Our most recent data show that Apple Fitness+ now has higher awareness than Peloton (see fig. 7) even with Peloton being an early mover in the space. However, as shown in figure 8, Peloton trends remain stable among active users, an encouraging fact for Peloton after going through significant churn post the pandemic. In fact, 86% of remaining users use their Peloton’s at least a few times per month, and 2 out of 3 use them at least a few times per week.

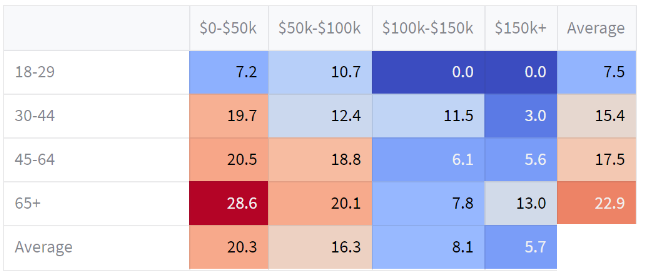

Demographics factors are essential when looking at exercise trends. While figure 1 suggests a healthy America, one needs to dig deeper to see which Americans are actually exercising. The unfortunate truth is older and less affluent Americans are the least likely to exercise. As seen in figure 9, over 20% of those earning $0-$50k NEVER exercise, while 29% of 65+ Americans earning $0-50k also NEVER exercise. In fact, our data show that young, affluent Americans disproportionately make up Americans who exercise.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

Exercise

1. Pace Yourself

One out of three people are exercising a few times per week, and 1 in 5 are exercising daily

How Often Americans Exercise

Location

2. It Ain’t Much, But It’s a Home Gym

Fitness enthusiasts overwhelmingly choose their homes as their location of choice to exercise

Gyms

3. Gyms, Germs and COVID

Almost 1 in 3 people have changed their perception of the gym post COVID

Has COVID Changed Your View of Gyms?

Gyms

4. Gym Rats

Those who exercise at gyms are younger and male

% of Americans by Age and Gender That Work Out in Gyms

Exercise Equipment

5. Attics and Basements

Exercise equipment demand during the pandemic was extraordinary

1 in 4 Americans Bought Exercise Equipment During the Pandemic

Exercise Equipment

6. Diet Is More Important, Anyway

Suffice to say, exercise equipment will not be flying off the shelves anytime soon

How Likely Americans Are to Purchase Exercise Equipment in the Next Six Months

Fitness Subscriptions

7. Easy As 1, 2, 3, And Yet…?

Users have many more options yet overall interest remains relatively low

Fitness Subscription Services That Active People Would Consider

Peloton

8. Only The Loyal Shall Remain

Peloton has churned through many non-active users

Peloton Usage Among Their Member Base

Demographics

9. How to Look 20 Years Younger

Age and income are major factors that define who's keeping fit in America

% of Americans by Age and Income That NEVER Exercise

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.