The history of energy drinks in the United States can be traced back to the introduction of Jolt Cola in 1985, which was cheekily advertised as having “all the sugar and twice the caffeine,” but the grandfather of modern energy drinks was Lipovitan, which was introduced in Japan in 1962, featuring taurine, an ingredient still found in many energy drinks. Red Bull made its US debut in 1997, establishing the archetype for the energy drink as we know it today. Whether used as a study aid, productivity-enhancer, or simply as an invigorating mixer, energy drinks have become emblematic of a fast-paced American lifestyle. Below, occam analyzes the unique demographics of the consumers behind this $63 billion market and attempts to predict consumption trends.

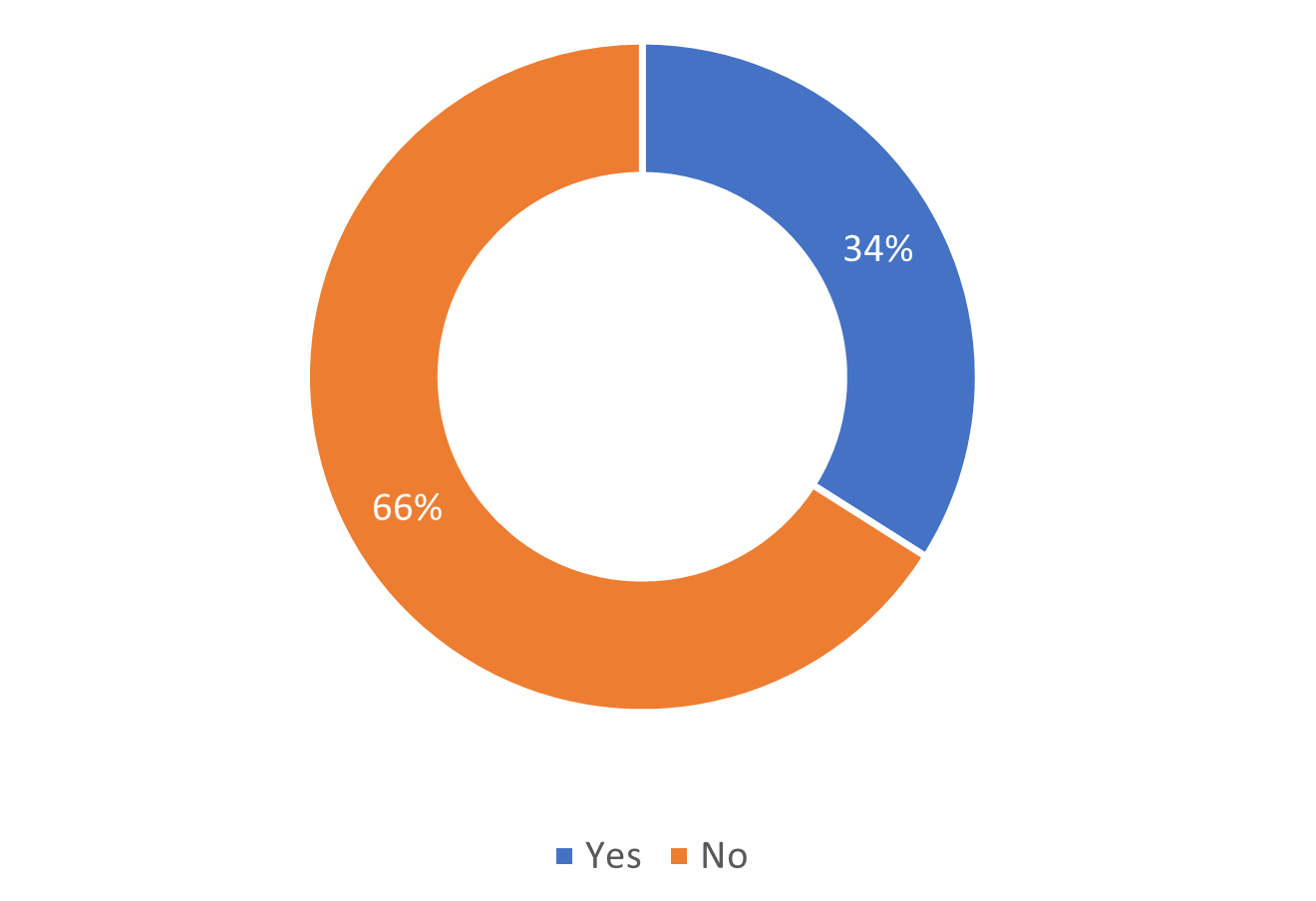

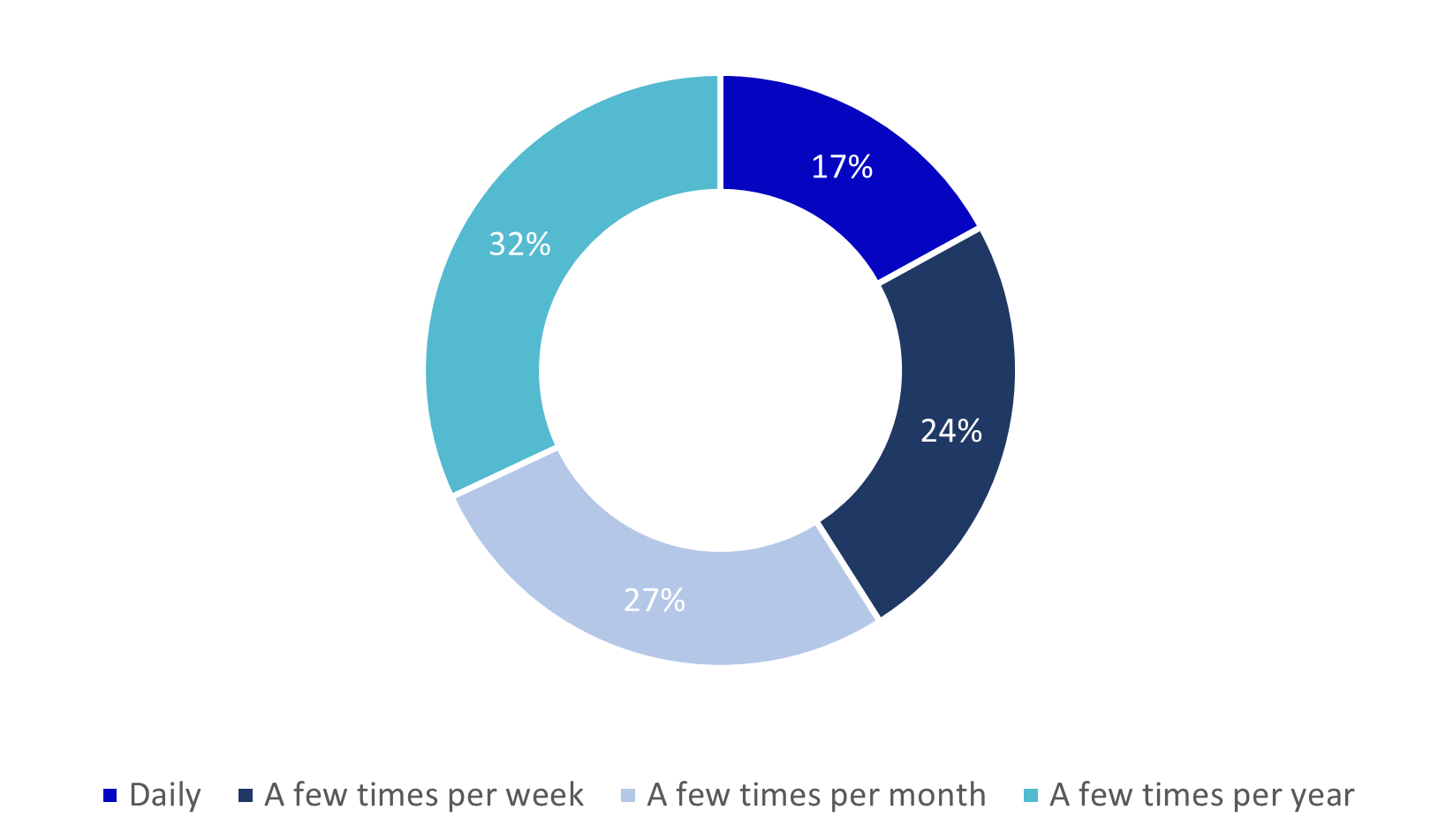

There’s little doubt that energy drinks are wildly popular with Americans – 34% say they indulge at least occasionally (Figure 1). Figure 2 shows that of those who consume energy drinks, a “healthy” 41% partake at least a few times a week.

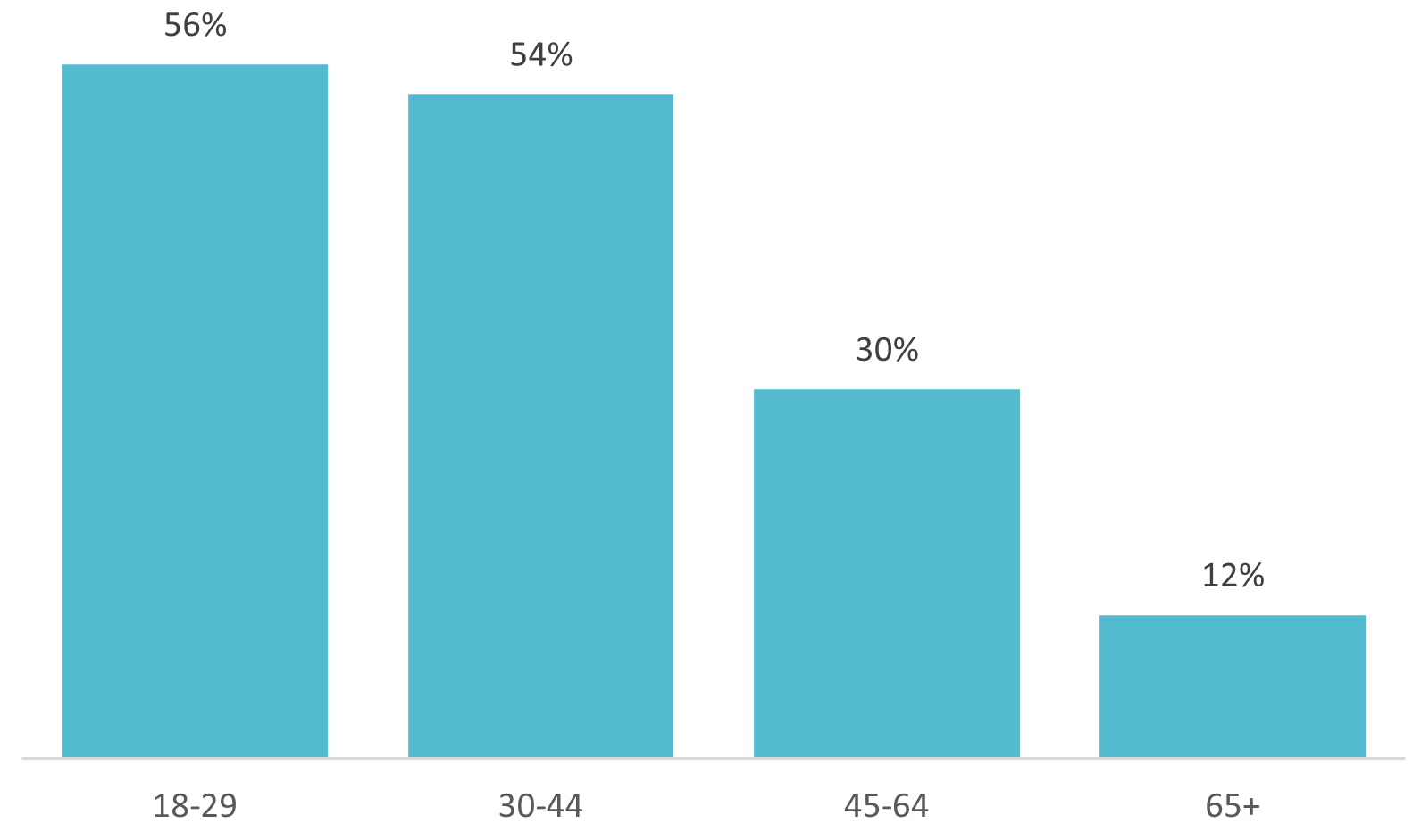

While traditional coffee beverages remain the most popular caffeinated drinks in the United States, energy drinks skew towards the highly coveted younger demographic and are often promoted at music festivals, concerts, and sporting events. That said, it’s not only the majority of 18-29 year olds who consume energy drinks (Figure 3) – the majority of 30-44 year olds do also.

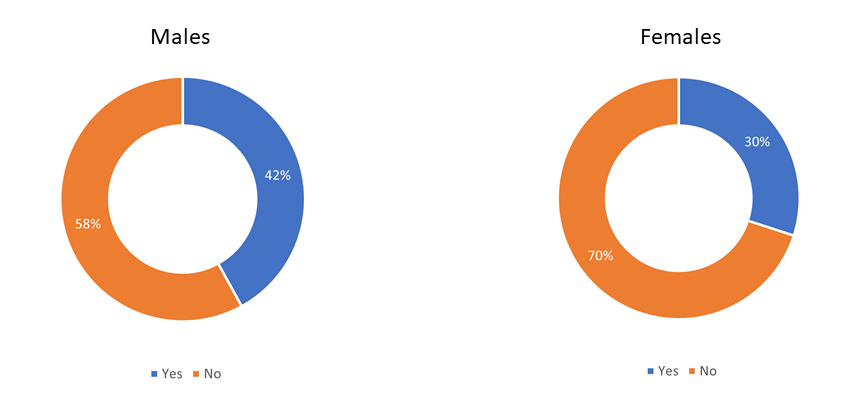

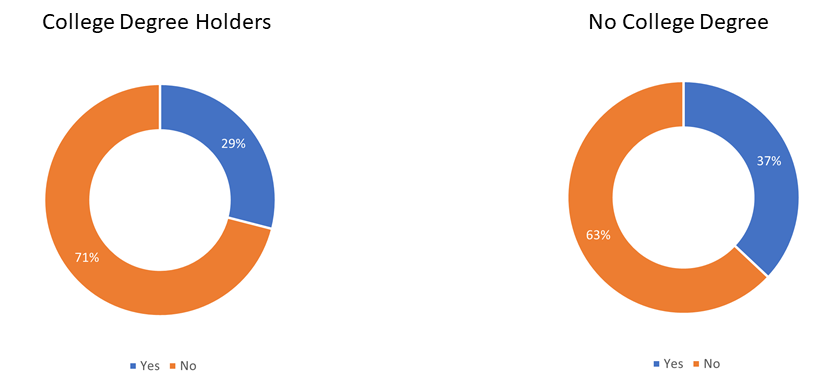

Not surprisingly, the gender balance skews male (Figure 4). What’s more surprising is that there is a relatively small difference in energy drink consumption between those with college degrees (28.5%) and those without (37.2%), particularly when considering that college students likely contribute to the higher usage of the latter group (Figure 5).

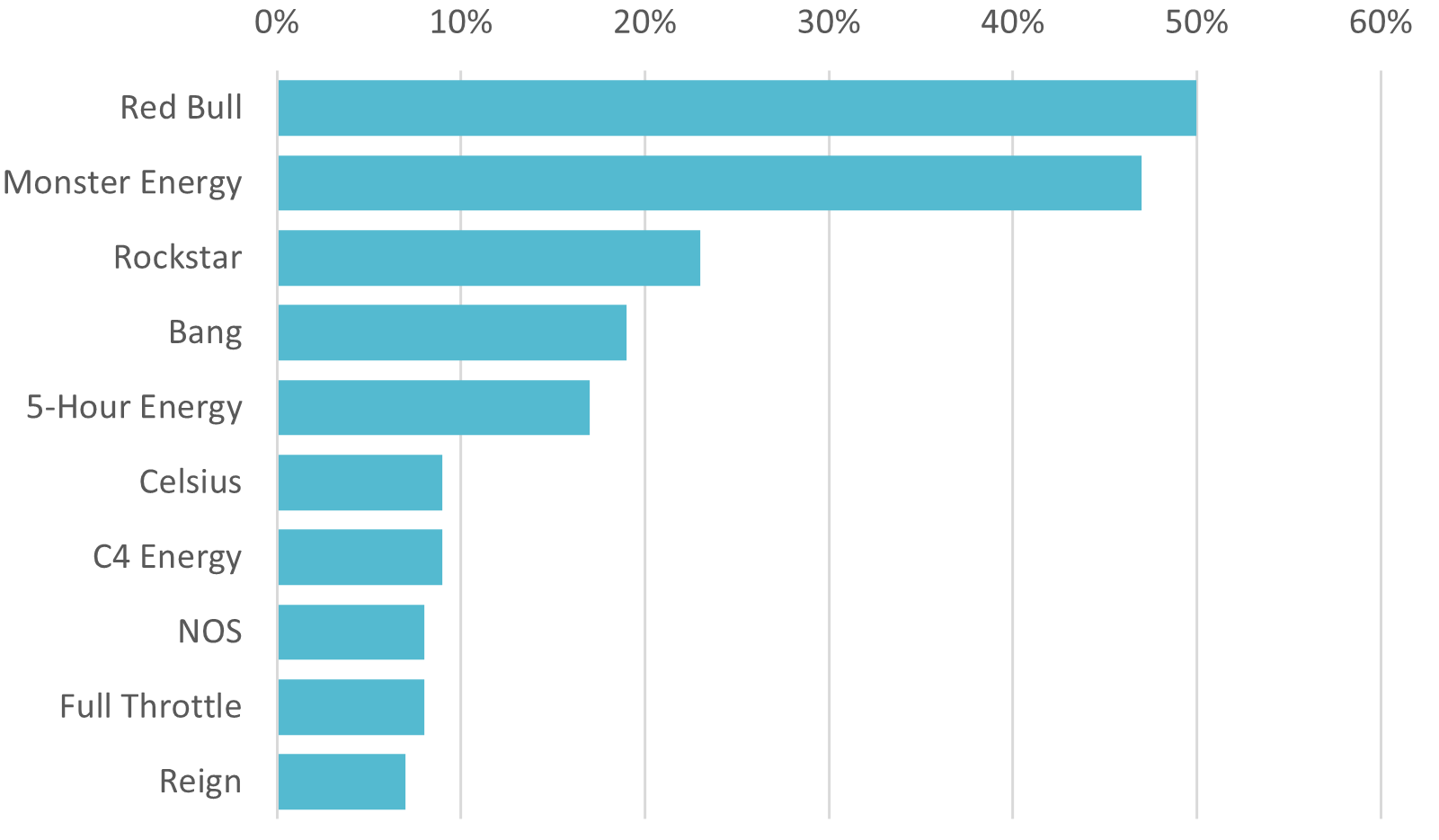

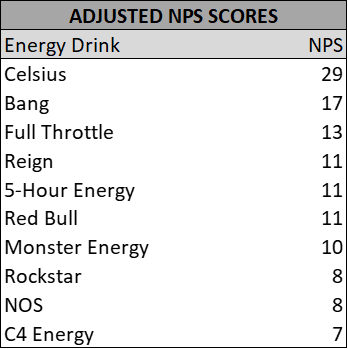

Among respondents who say they consume energy drinks, 50% say they drink Red Bull, 47% say they drink Monster Energy, and 23% say they drink Rockstar (Figure 6). However, emerging brands like Reign, Energy, and Celsius are capitalizing on the growing demand for healthier options, a challenge to better established products that not-so-subtly imply they’re designed to push consumers past their normal physical limits. Remarkably, despite its lower profile, wellness-focused newcomer Celsius leads our Net Promoter Score ranking with a score of 29 (Figure 7), well ahead of market leaders Red Bull (11), Monster Energy (10), and Rockstar (8). Although Celsius’s market share remains a small fraction of the market leaders, we believe its steady ascendance over the past two years has been driven by the high consumer satisfaction that’s evidenced by its high occam NPS rating.

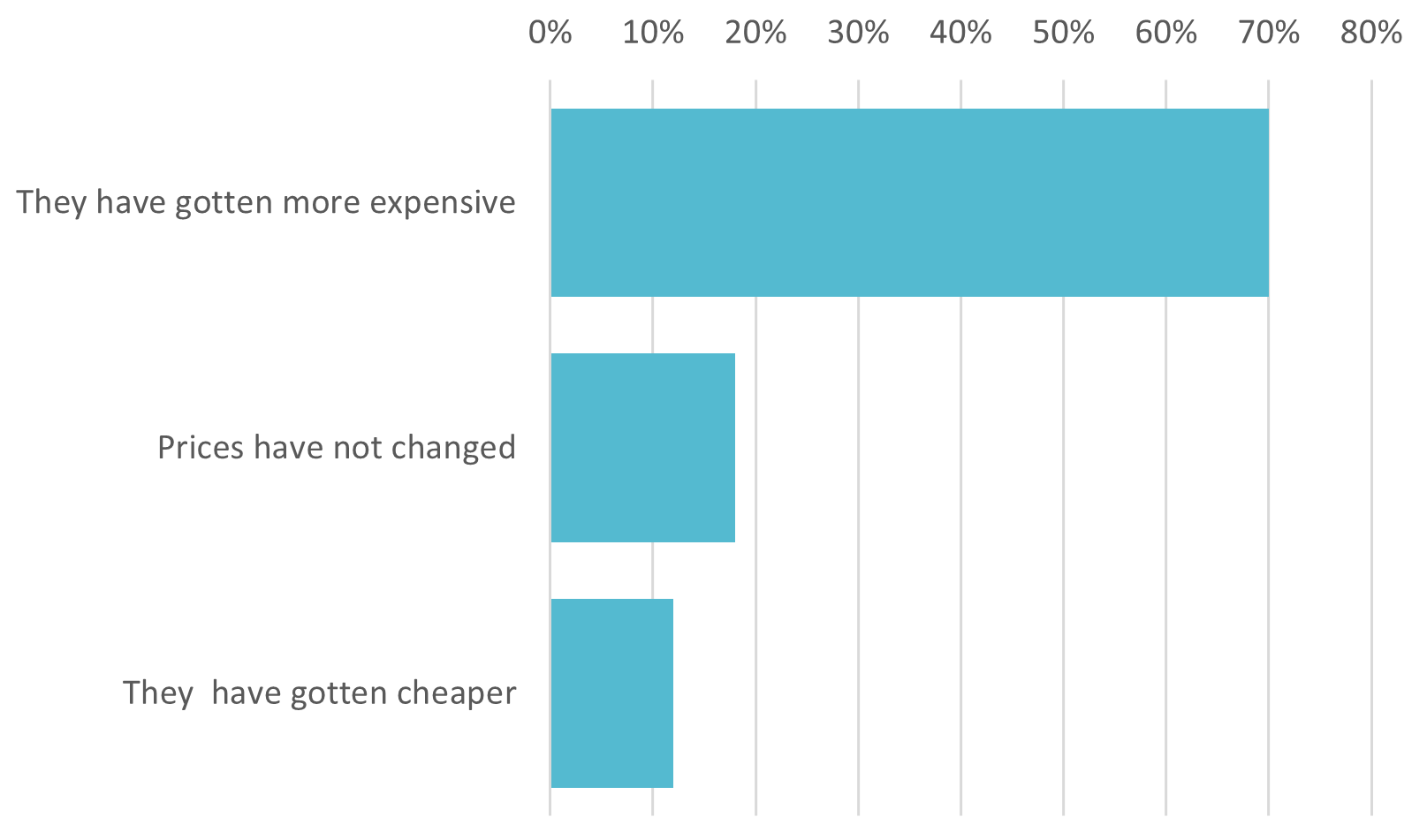

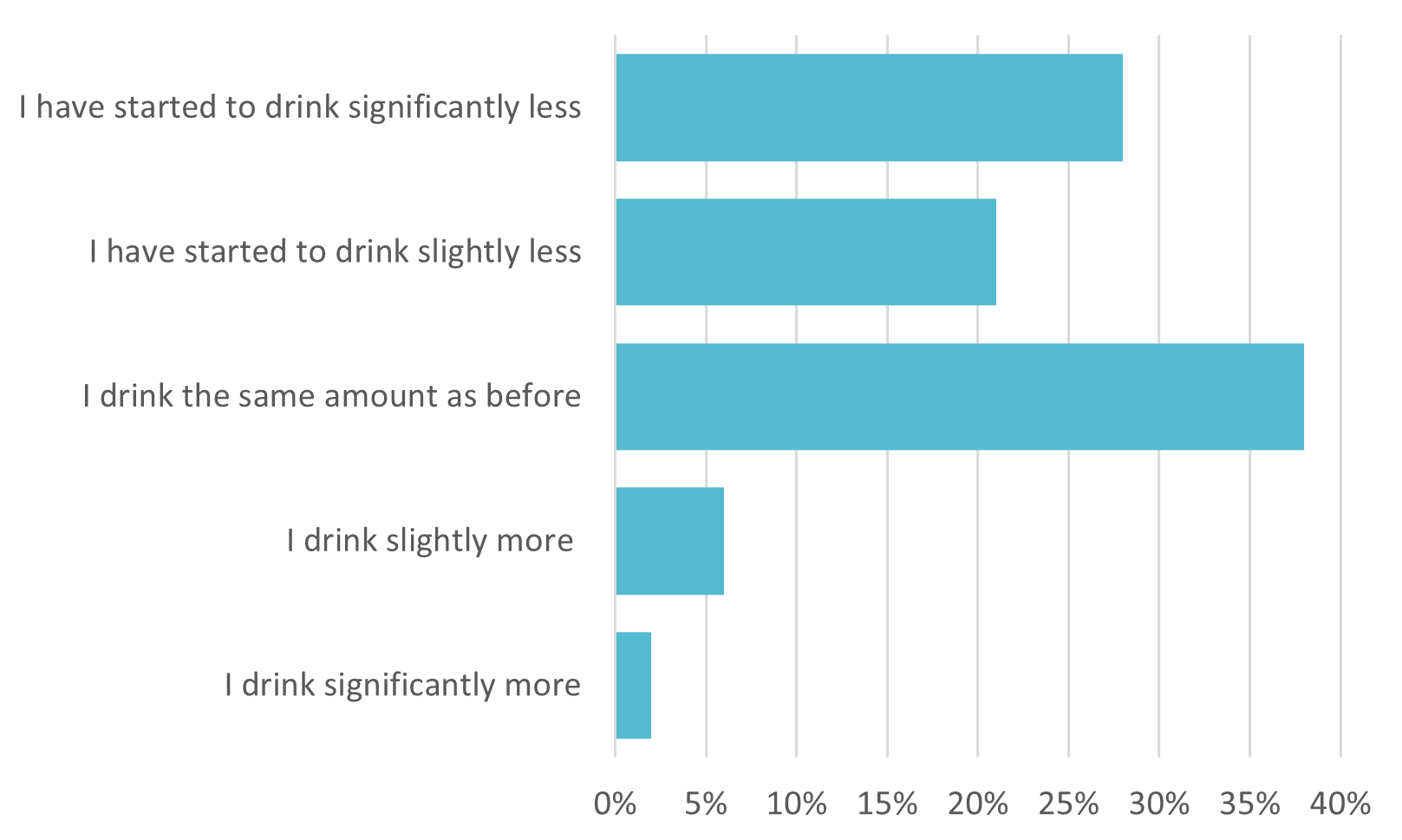

High inflation has impacted nearly all consumer-facing industries, and the energy drink sector is no exception. The increasing prices of energy drinks have caught the attention of consumers, with three out of four noticing the higher prices (Figure 8). Almost half indicate they are starting to reduce their energy drink consumption (Figure 9). We suspect that the decrease in consumption is partly due to the rise in prices but might also be attributable to concerns about the healthfulness of the mainstream energy drinks.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

Consumption Behavior

1. Power Potion Posse

At least 1 in 3 Americans drink energy drinks

Consumption Behavior

2. Fuel Fix Frequency

Almost 1 in 5 of those who consume energy drinks do so every day

Energy Drink Demographics

3. Generational Guzzle Gap

Gen Zers and Millennials are a crucial base for energy drink brands

Energy Drink Demographics

4. Gender Guzzle Gap

Males are more likely to consume energy drinks

Energy Drink Demographics

5. A Fuel for All Minds?

A larger fraction of those without a college degree consume energy drinks

Energy Drink Brands

6. Chasing the Bull

Legacy brands still maintain their dominance after two decades

NPS Scores

7. Celsius: Sizzling Standout

Healthier energy drink options are grabbing the attention of consumers

Energy Drink Prices

8. Costly Quench

Consumers have noticed the rise in energy drink prices

Consumption Behavior

9. Fizzling Out?

Almost 1 in 2 energy drink consumers recently cut down on their intake

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.