As the dust settles from the unveiling of Apple’s state-of-the-art Vision Pro AR/VR headset, there’s not only excitement, but also a palpable air of reservation among consumers. Its hefty price tag of $3500 is raising eyebrows, with many wondering if the headset will primarily be a toy for high-income early-adopters. Data from occam supports this notion: a substantial fraction of potential buyers are balking at the cost. Below, with the help of occam data, we explore consumer interest level in the headset, the implications of the high pricing, and how the headset might still provide a quiet win for Apple and its sticky ecosystem.

Willingness to Purchase

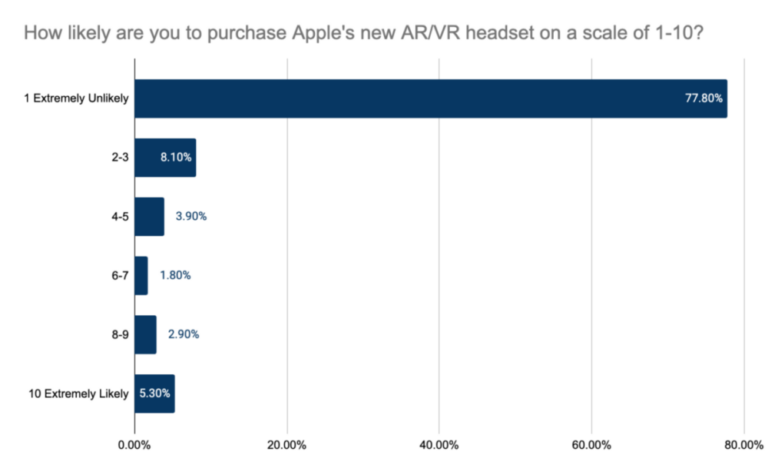

- Occam reveals that the Vision Pro’s high cost is a deterrent for many — almost 80% of respondents say they’re unlikely to purchase one.

- Not surprisingly, occam also shows interest in purchasing the headset has a clear relationship to income — the higher the income, the stronger the interest (not depicted).

- Male respondents were twice as likely as female respondents to express strong interest (a score of 8, 9, or 10).

Price Elasticity

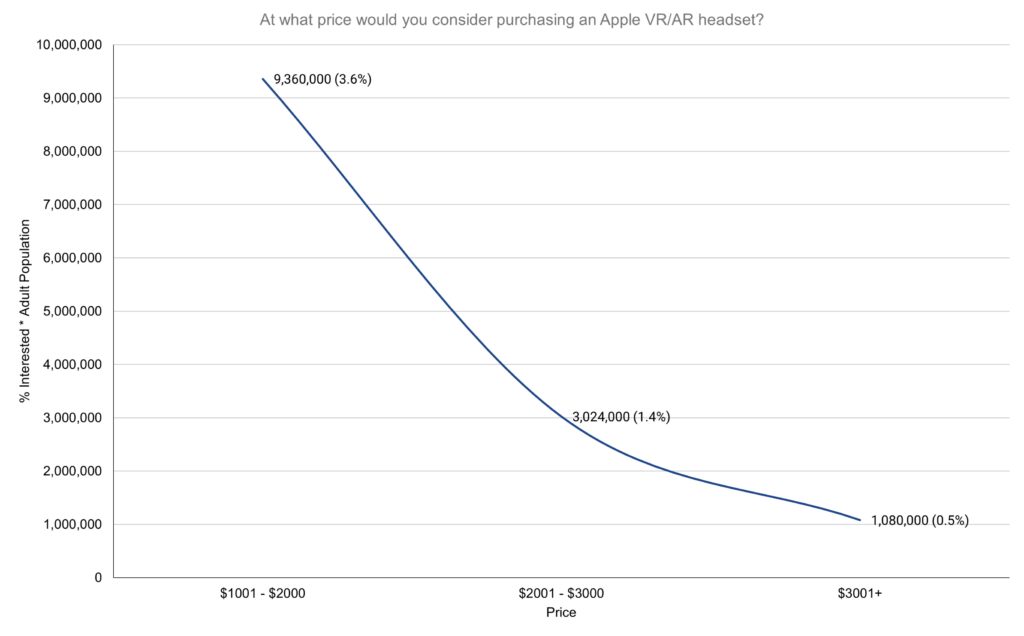

- Below, we see how respondents answered the following question: “At what price would you consider buying Apple’s Vision Pro?”

- Only 0.5% of respondents (the equivalent of about 1,080,000 US adults) say they will consider the headset if the price is $3001 or higher (announced price is $3500). We need to reconcile 0.5% with the 5.3% who say they are “extremely likely” to buy (Figure 1). We believe this inconsistency arises from the 5.3% of respondents in Figure 1 being mostly unaware of the announced $3500 price.

- It’s worth keeping in mind while considering the “demand” graph below that press reports have suggested 2024 production of the Vision Pro will be limited to about 400,000 units (source). Given occam data and the 400,000 unit figure, we speculate that though there will likely be a shortage of supply at launch, Apple will be able to mostly satisfy demand by the end of 2024.

Competitive Impact

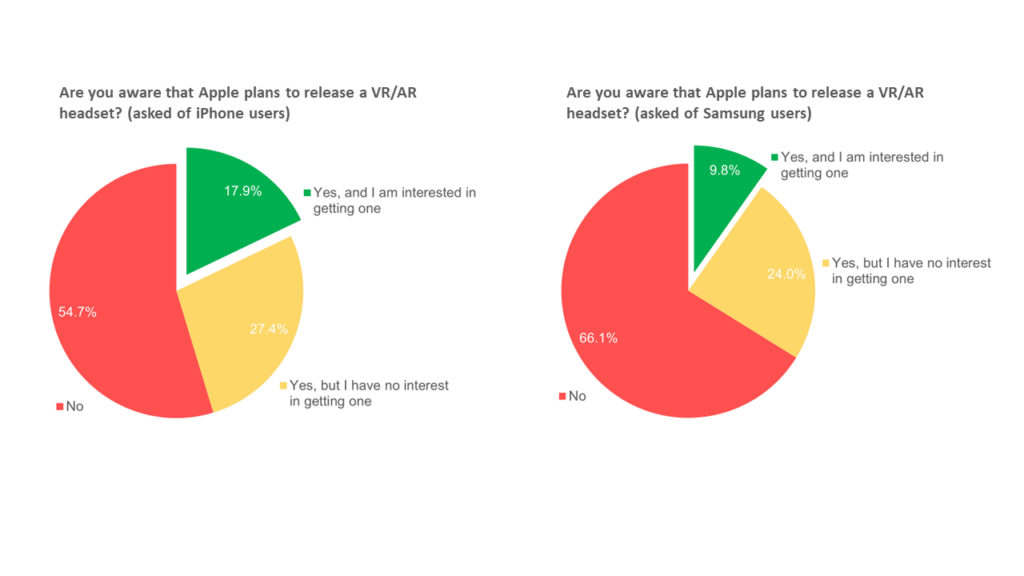

- Occam reveals that a meaningful fraction of Android users would consider the Vision Pro, despite the fact that the headset falls outside the Android ecosystem. (Below, we assume Samsung smartphone owners are a reasonable proxy for premium Android phone users.)

- We believe Apple may be able to use the headset to score a healthy number of Apple ecosystem “conquest” wins simply because there is no comparably sophisticated headset in the Android world.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.