Federal Reserve Chair Jerome Powell has made good on his promise to burst the COVID induced e-commerce bubble. After continuous rate hikes, the consumer is finally starting to feel the pinch. Separately “Big Tech” is in the process of shedding the layers of fat they accumulated during the “Great Lockdown”. You didn’t have to look further than Amazon’s 3rd quarter earnings to learn: the recession is already here.

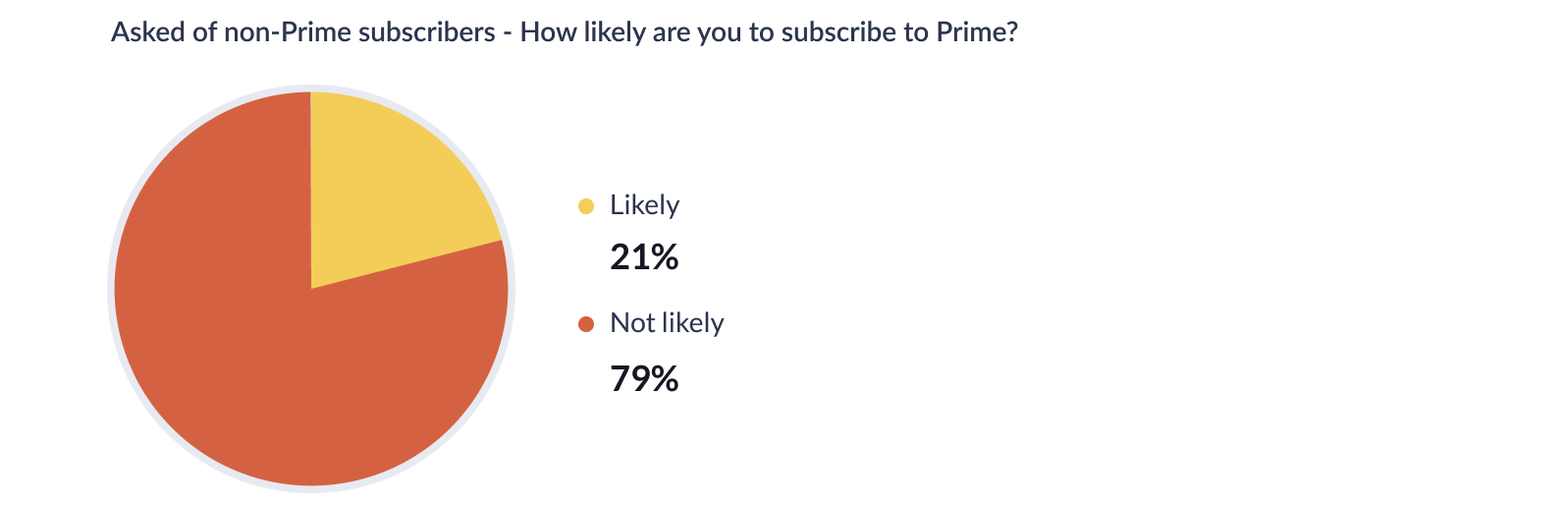

However, our data, shows that relative to other retailers Amazon is in a better position to weather the storm, thanks to Prime. Not only is the Amazon Prime customer base expected to expand within the next six months – with 20% of non-subscribers considering the service, current subscribers are not churning and are willing to tough out the recent price increase.

Demographics are also on their side – a closer look shows that Amazon Prime users are in fact the best customer demographic: young, affluent, and most importantly, brand loyal.

Bottom line, this winter stay inside and surround yourself with family and friends. It might just warm your heart when you watch them shop for the holidays. Odds are they’ll be using those Prime subscriptions as much as possible.

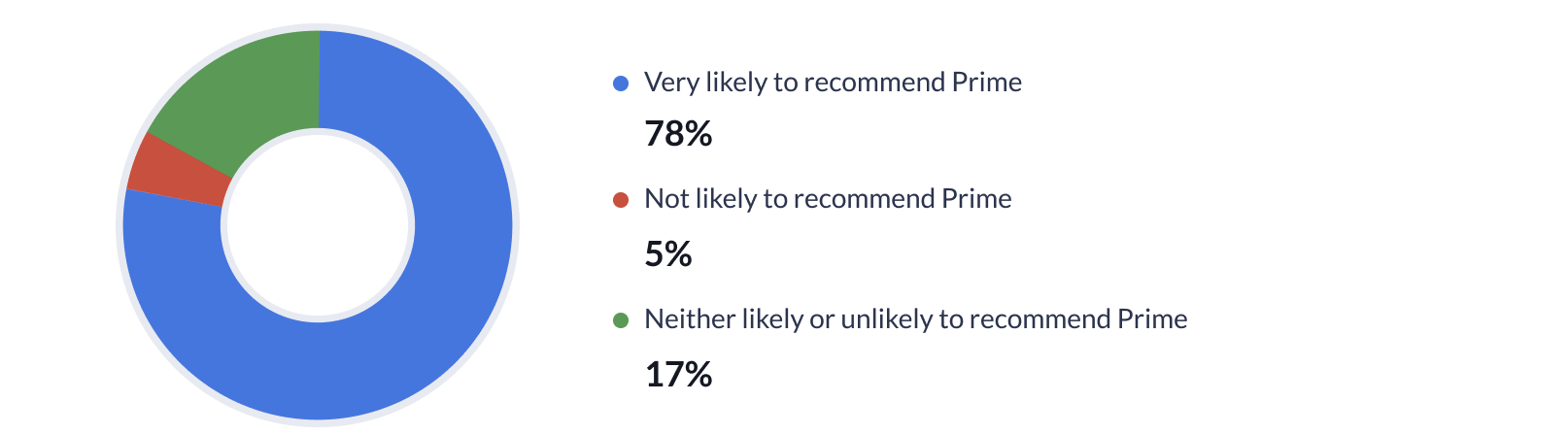

Customer Satisfaction

8 in 10 Prime subscribers would recommend the service

Customer satisfaction ranks highest amongst all subscription services we track

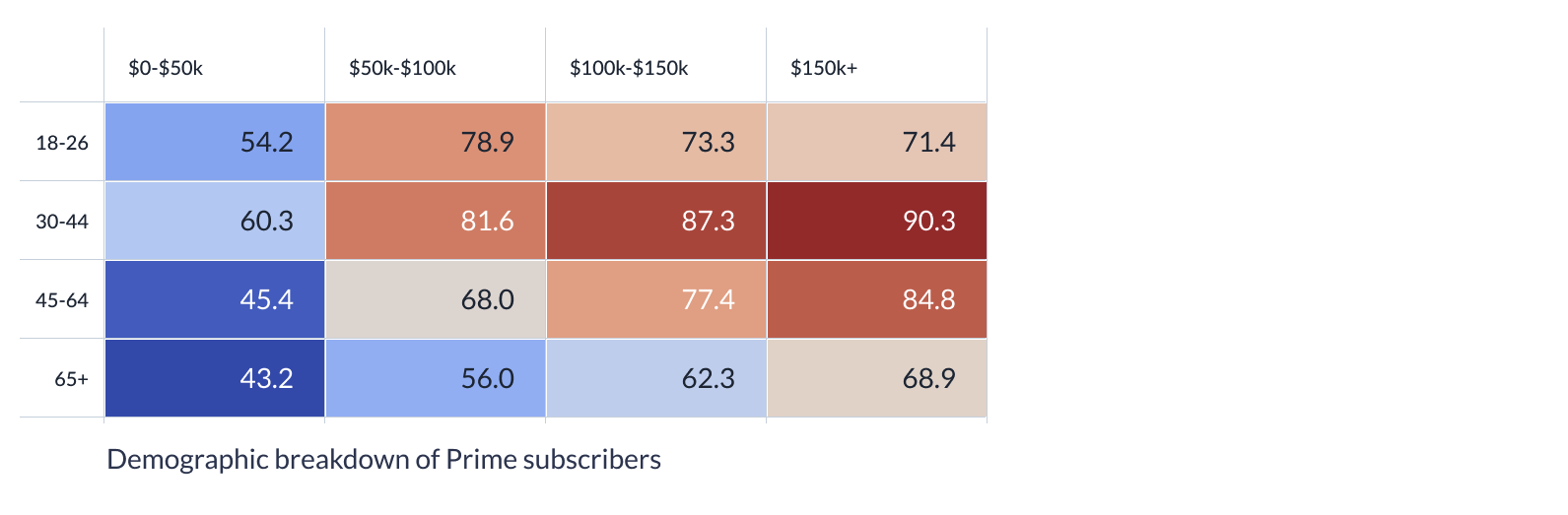

Best demographics

Prime customers skew richer and younger

90% of 30-44 year olds earning $100k+ are subscribers!

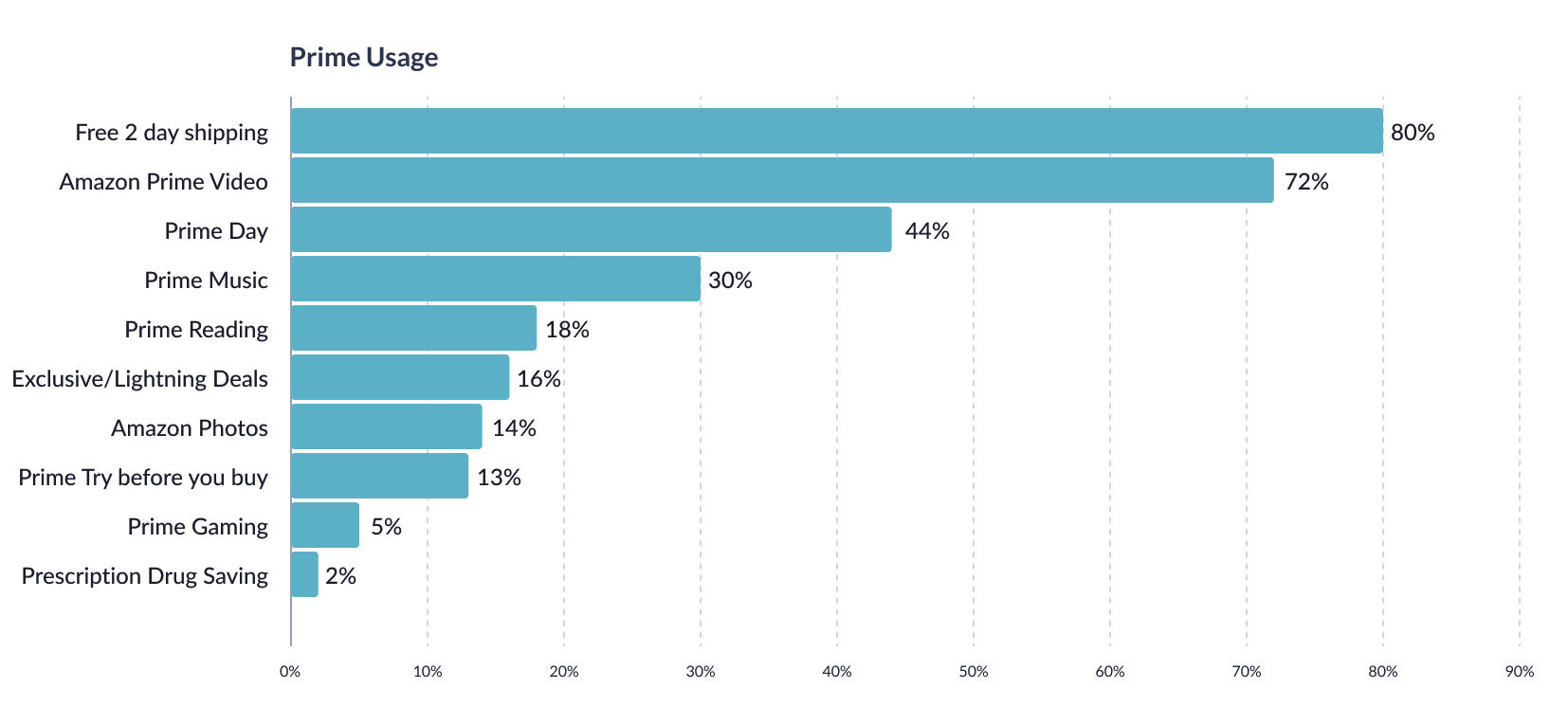

Usage is high

Not a 1 hit wonder

Subscribers value the Prime bundle

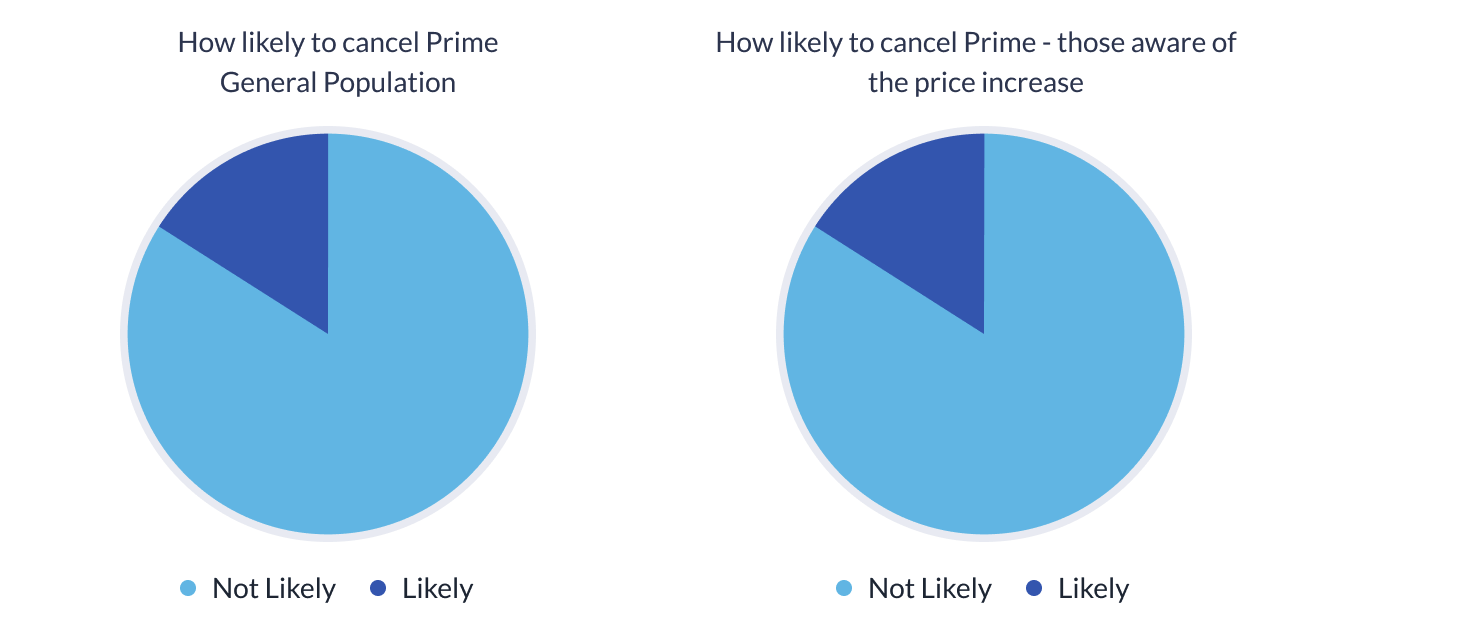

Price Increase

Price increase or not - only 1 in 10 are likely to cancel Prime

Despite a price increase to $139/year chances of churn are low

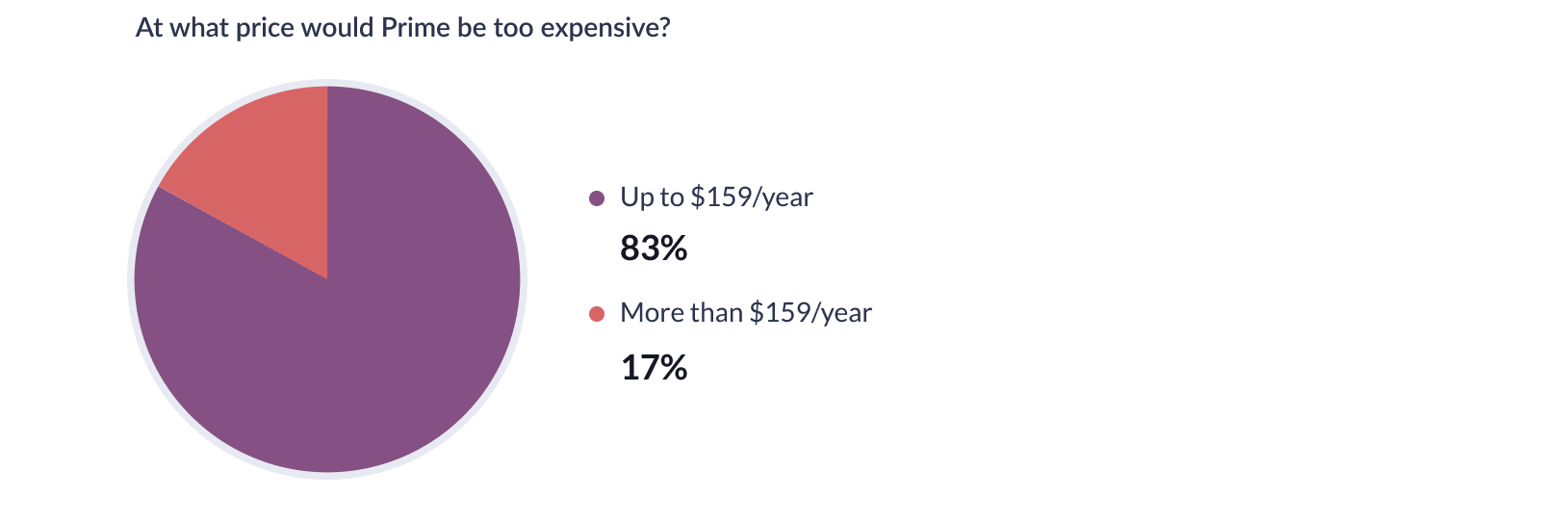

Pricing Power

Prime has further pricing power

Amazon can raise price to $159/year without substantially increasing churn

New Membership

Substantial room for expansion

While Prime is 60% penetrated overall, 1 in 5 non-subscribers are looking to join

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.