Leveraging daily survey data from a large pool of respondents and a range of macroeconomic variables, then applying a mix of machine learning methods, occam has shown promise in forecasting macroeconomic releases (10 are being forecasted today, with more on the way). Occam has produced notably accurate estimates for the Index of Consumer Sentiment published by the University of Michigan (UMCSENT). Below, we analyze occam’s performance in predicting UMCSENT and briefly describe occam’s data collection as well as its forecasting approach.

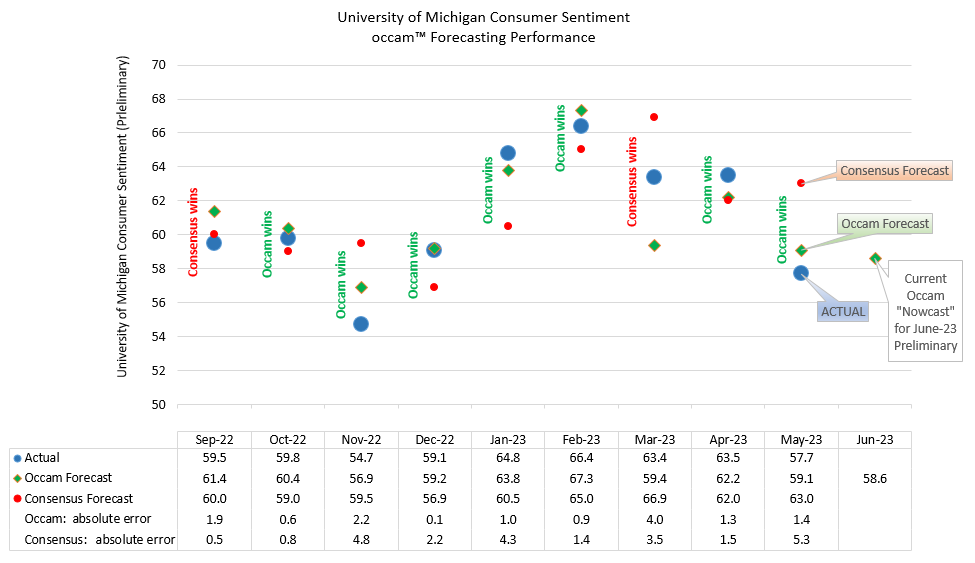

University of Michigan Consumer Sentiment: Occam Forecasting Performance

As evidenced by multiple metrics, occam demonstrates a significantly more accurate forecast of UMCSENT than the consensus forecast.

- Occam forecasts have been more accurate than consensus in 7 out of 9 forecast attempts (out-of-sample).

- The mean absolute deviation (MAD) of the consensus forecast is 2.70, whereas the mean absolute deviation for the occam forecast is 1.49.

- Similarly, the standard error (SE) for the consensus forecast is 3.36, whereas the standard error for occam forecast is 1.94.

- The mean forecast bias for the consensus forecast is +0.43, whereas the mean forecast bias for occam is +0.09.

- The occam “Nowcast” currently (as of 5/23/2023) anticipates a value of 58.6 for the preliminary release of the University of Michigan’s Index of Consumer Sentiment for June 2023. Subscribers to the occam platform can track the daily revisions to our Nowcast as the release date approaches.

*See data for consensus forecast here.

Occam Forecasting Approach

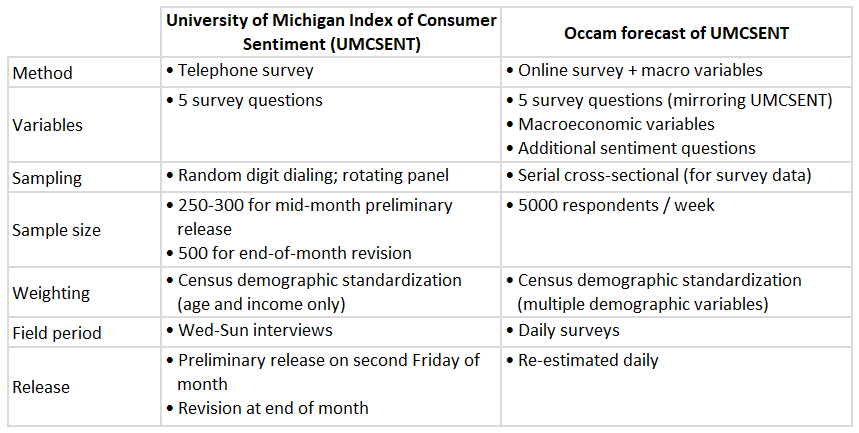

- The core set of five questions used by UMichigan to calculate UMCSENT are also used by occam. In addition, occam adds macroeconomic data and approximately ten survey questions that measure other facets of consumer sentiment about the economy.

- Machine learning techniques are applied to this expanded dataset to produce a daily, scaled forecast of UMCSENT. A key value offered by occam is this daily re-estimation, which enables portfolio managers to position themselves ahead of the official release of the Index of Consumer Sentiment.

- In the table below, we highlight a few key differences between University of Michigan index calculation and the approach that occam uses to forecast the Index.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.