The closely watched Core CPI (ex food and energy) for June 2023 came in at a 4.8% increase year on year. Occam’s estimate for Core CPI was 4.9% better than consensus of 5.0%. Overall CPI came in at a 3.0% increase year on year. Occam’s estimate for CPI was 3.1%, which was inline with the consensus estimate of 3.1%. Occam’s powerful ML model continues to outperform the consensus forecast on important macroeconomic releases. Occam has been correctly forecasting that inflation would be coming down at a record pace.

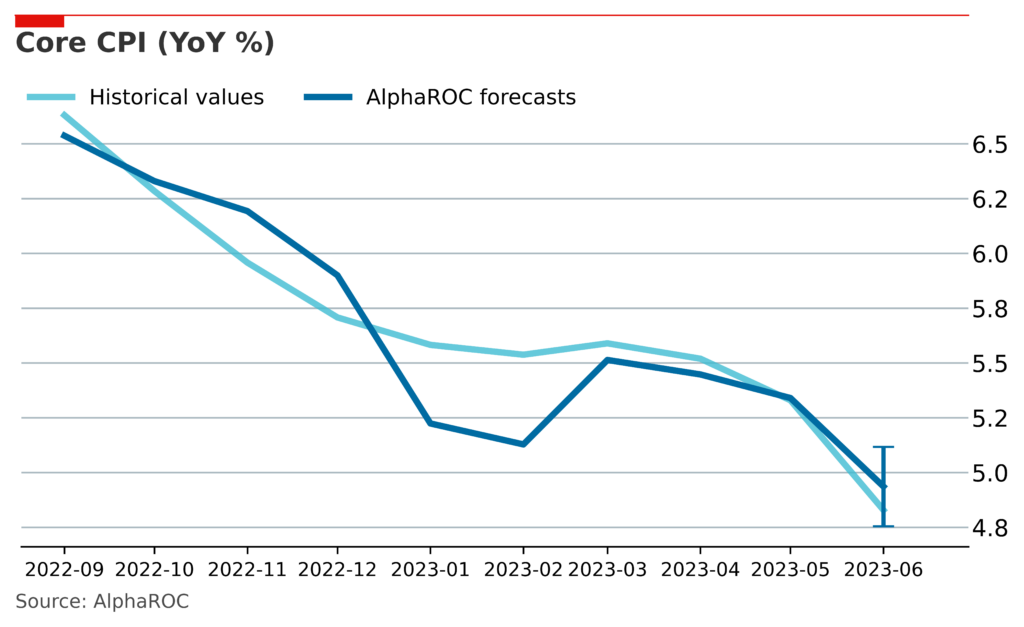

Core CPI Forecast vs Actual

- Occam’s June 2023 Core CPI forecast was 4.9%, which came in close to the reported number of 4.8%, and better than the consensus estimate of 5.0%.

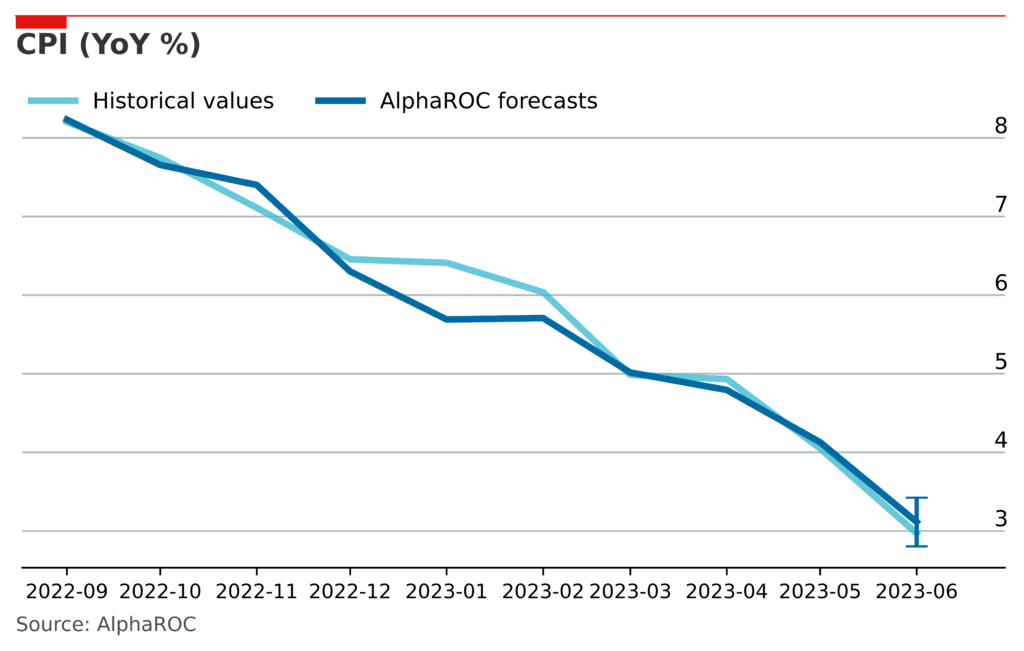

CPI Forecast vs Actual

- Occam’s June 2023 CPI forecast was 3.1%, which came in close to the reported number of 3.0%, and inline with the consensus estimate of 3.1%.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.