As broad-based economic uncertainty and workforce supply concerns persist, it’s evident that the U.S. labor market is a long way from optimal. But, as our data indicate, there are positive signs and that is certainly something to build upon.

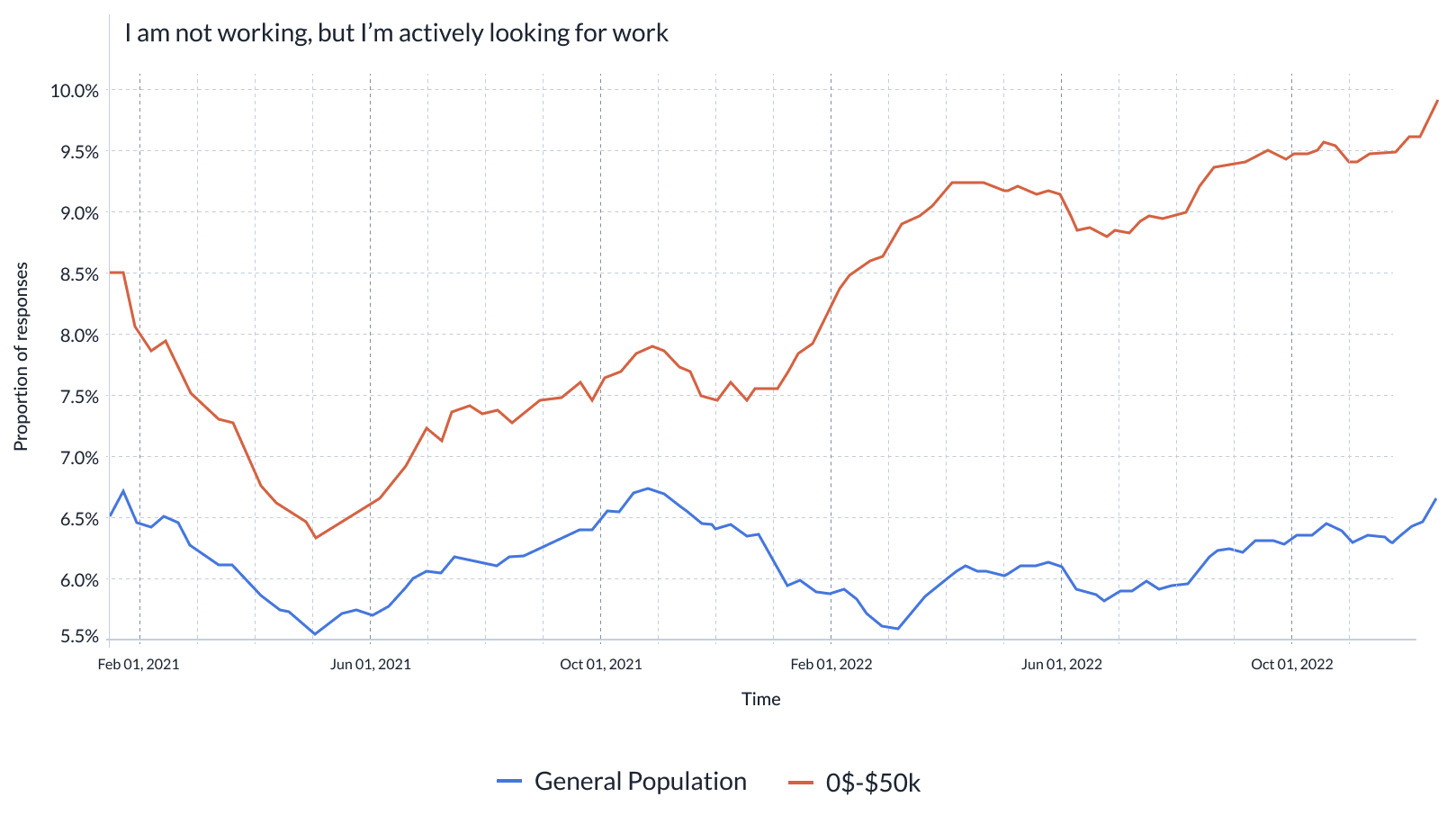

Our data shows that lower income workers – those earning up to $50,000/year- are coming back, and given the circumstances, a higher supply of lower-wage workers is exactly what the market needs.

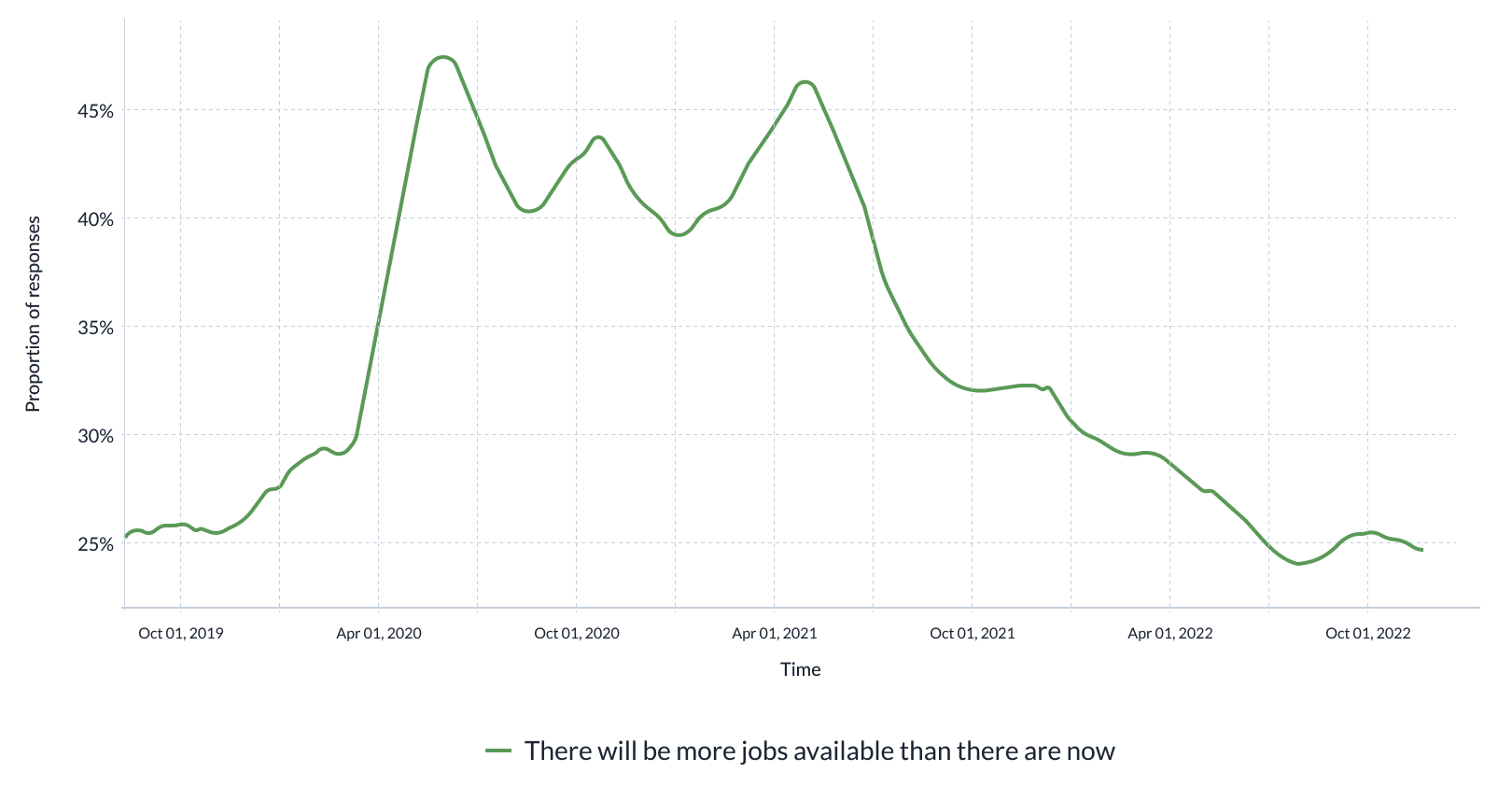

Interestingly, moreover, they have come into the market right when overall worker insecurity is rising. This dovetails with our figures showing that labor force optimism peaked late last year and has been declining ever since.

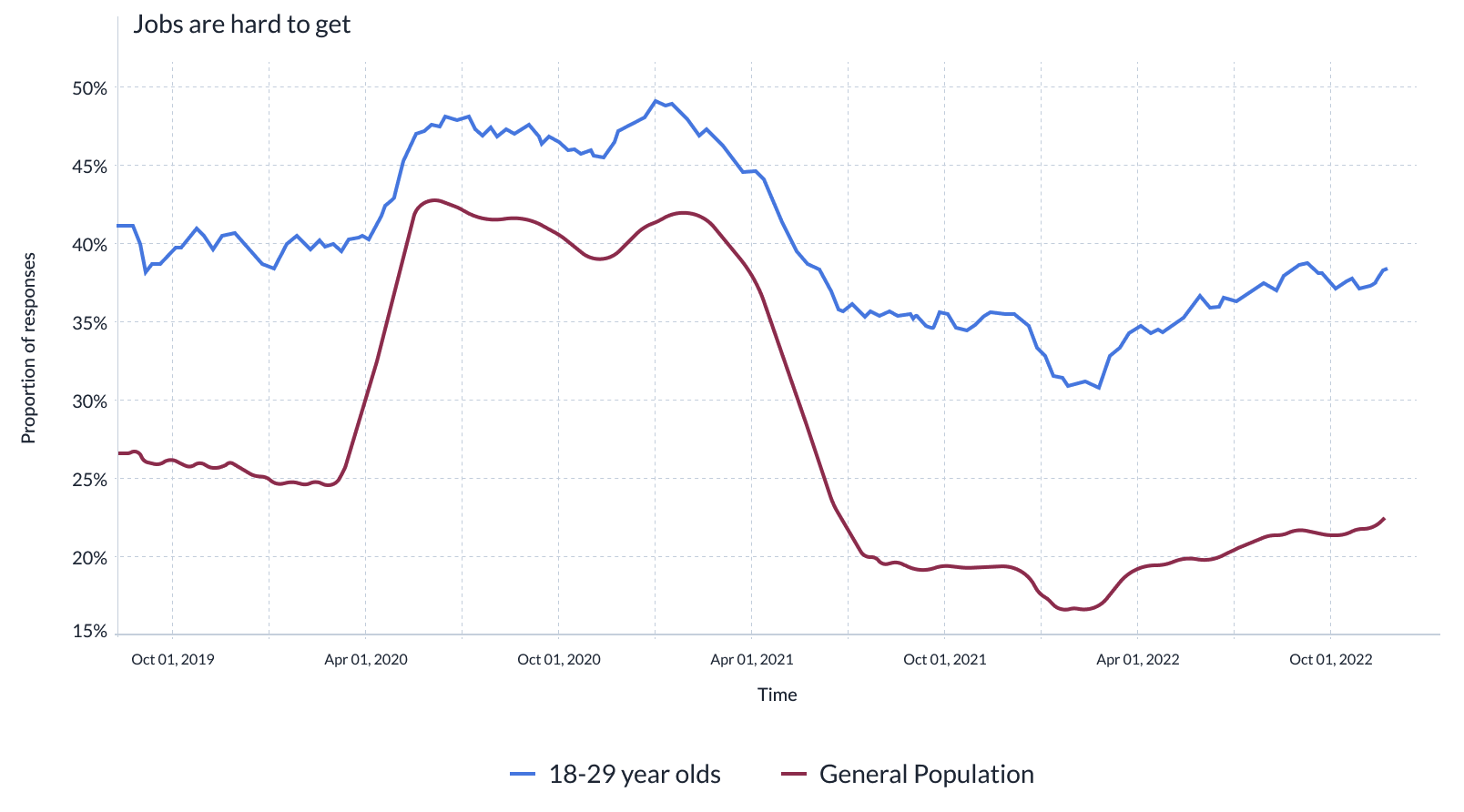

Young people – workers aged 18-29 – have held onto their angst, disproportionately viewing jobs as less plentiful and harder to get.

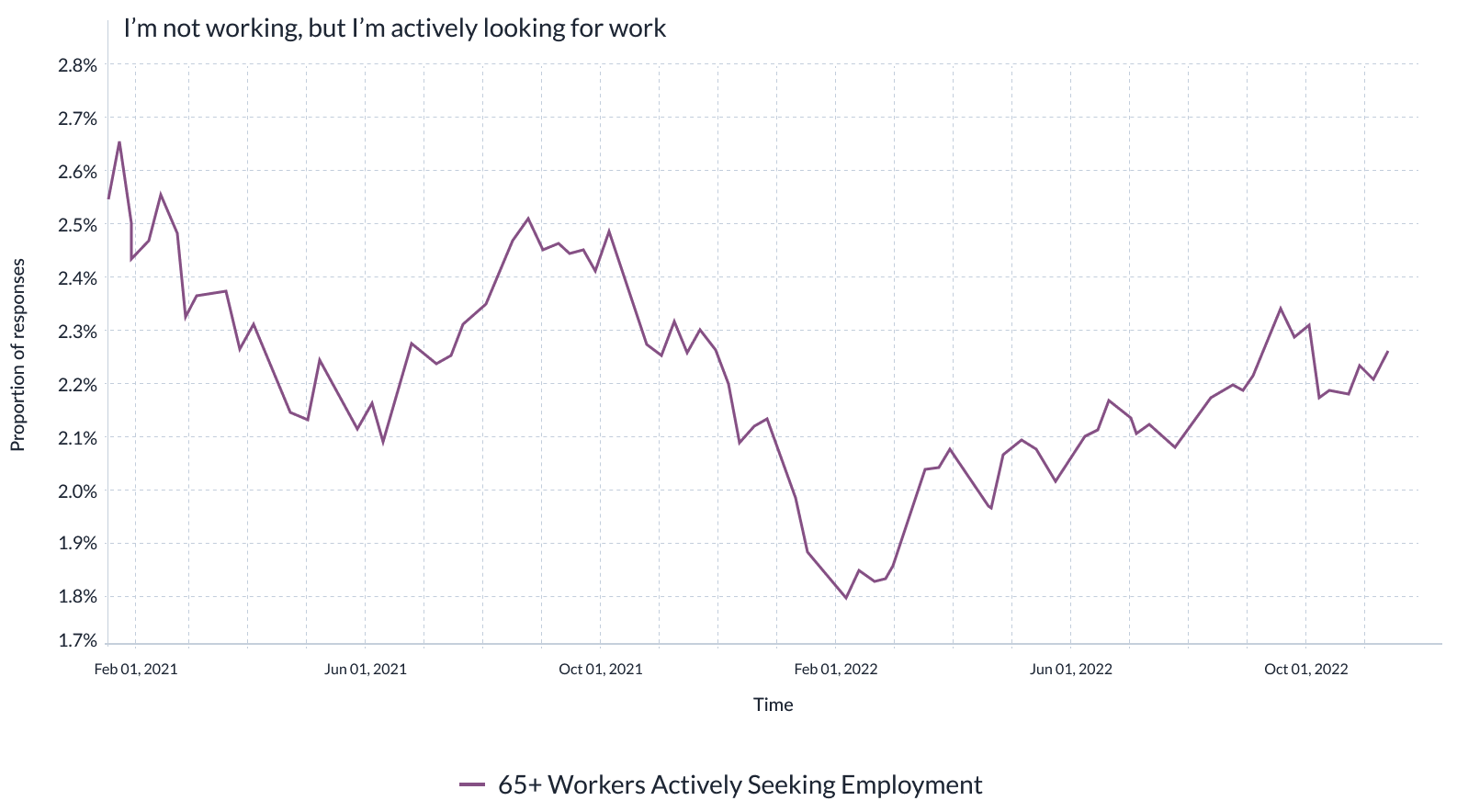

The older generation, on the other hand, have run out of stories to tell and want to return to the workforce. Originally, the pandemic meant 65+ employees could not retire fast enough, but this stunning reversal could become the big story that kicks off the new year.

Among the general population, workers are living in the now. Job growth expectations have peaked, and given the state of the economy, they could very well be right.

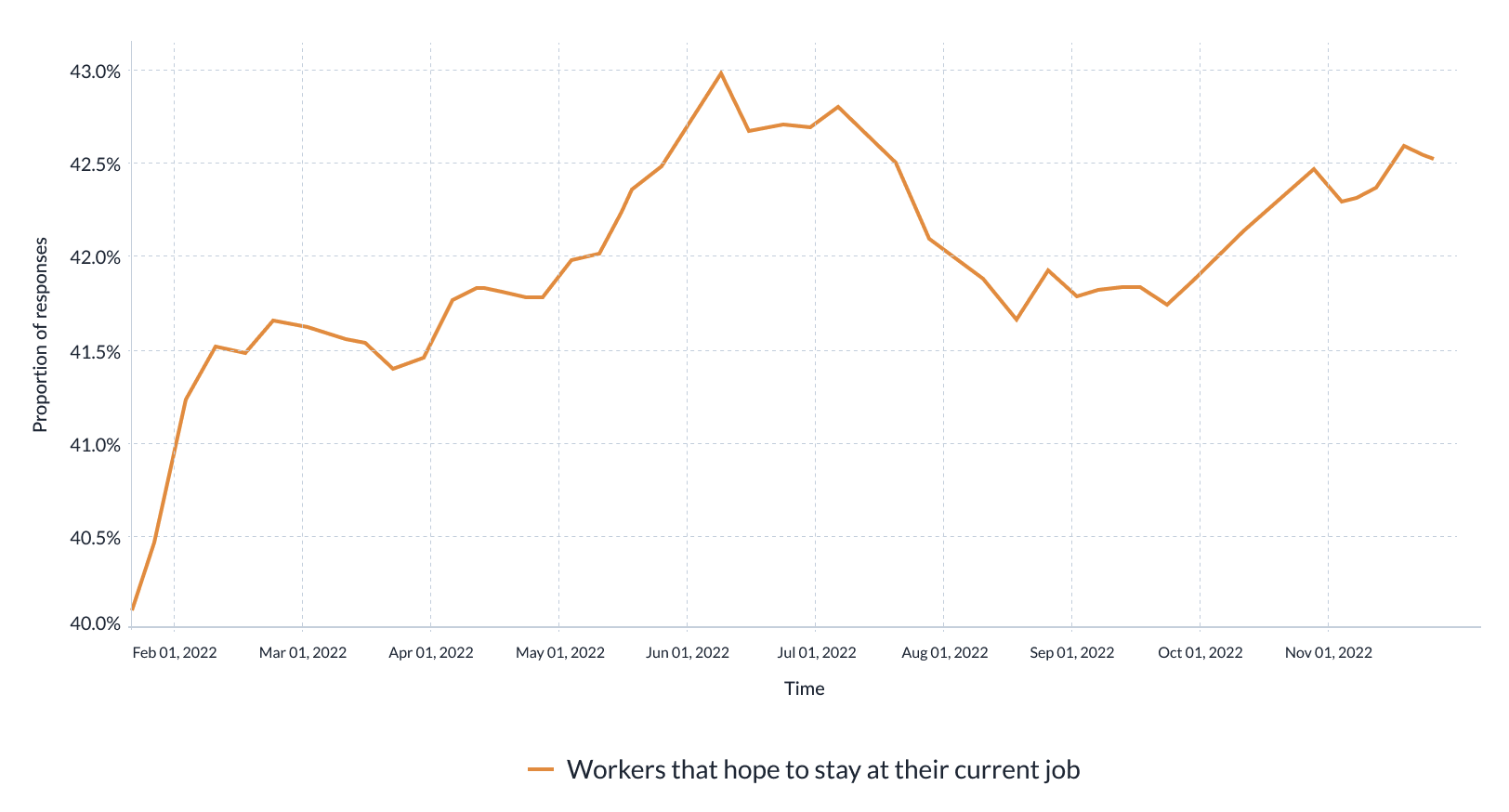

As we enter the holidays, employees indicate they are happy staying put. Over the past three weeks, there has been a rapid decline in the rate of workers seeking new opportunities. As such, employers can rest easy for as long as employees remain in their current jobs, they will not seek higher-paying ones. Future wage growth may be less consequential.

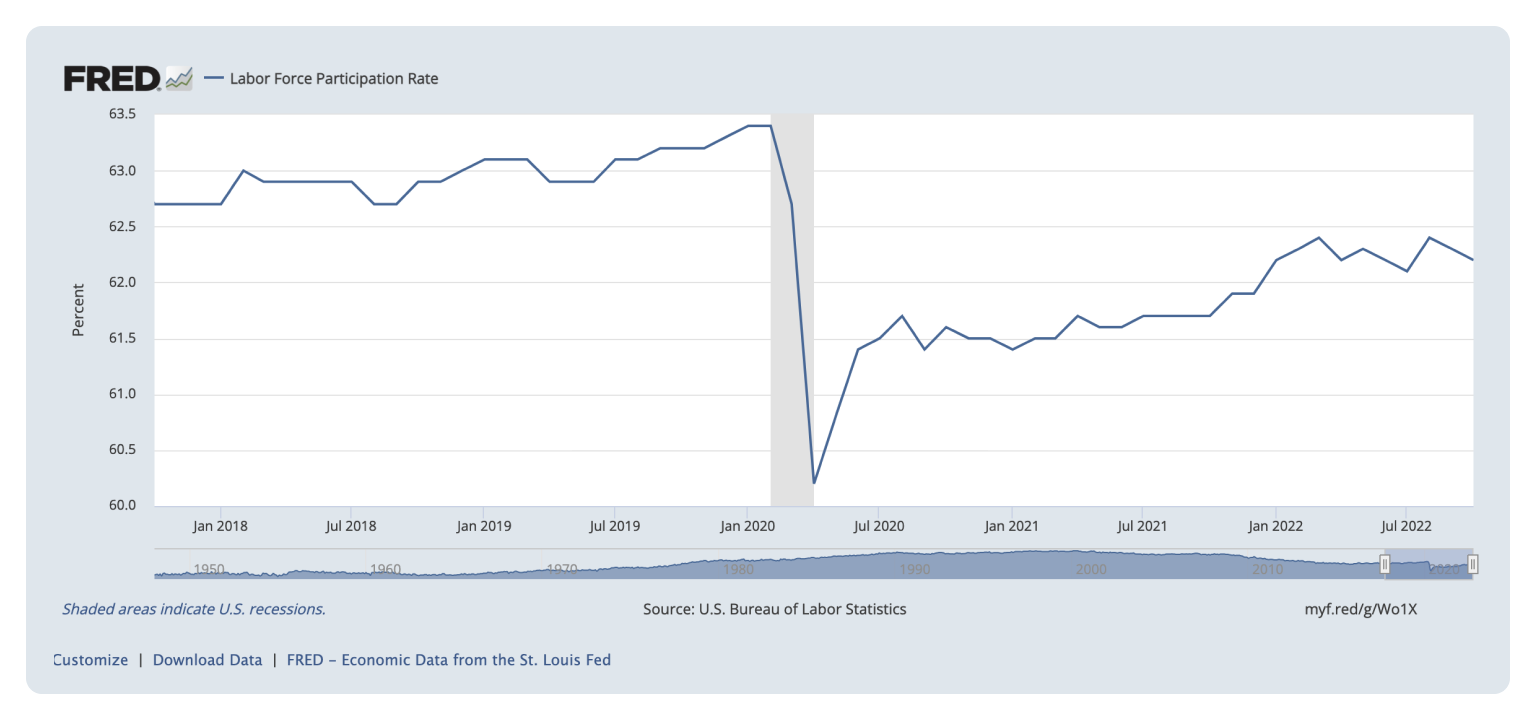

Labor Force Participation Rate

Labor force participation is still below pre-COVID levels

Labor force participation has not breached the Feb 2020 rate of 63.4%

Job Seekers

Americans actively looking for work

Households earning up to $50,000/year are returning to the labor force at a 50% faster rate

Employment Conditions

Job seekers are feeling less secure about the number of jobs available

Labor force optimism peaked late last year and has been declining ever since

Job market sentiment

Young people disproportionately say jobs are scarce

This also means the younger generation will be more actively seeking - another positive sign!

Job market sentiment

Never Too Old For This

Older employees who left the workforce in droves after the COVID crisis are officially back on the clock.

Job availability

Job growth expectations are lower than pre-pandemic levels

Workers are pessimistic about job growth - tipping the scale if favor of employers

Worker movement

Workers are staying put

There has been a rapid decline in employees seeking new opportunities - which is a positive sign for wage growth pressures

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.