After a challenging post-covid phase marked by subscription losses that impacted revenues and its reputation as a consistent generator of growth, Netflix has daringly implemented two significant (if controversial) strategic maneuvers to considerable success, emerging as one of the stand-out performers of 2023. The first initiative put an end to account sharing. Though some observers initially dismissed the announcement as an empty threat or even a misstep, data from occam suggests the initiative is likely accretive to BOTH subscriptions and Average Revenue per Membership (ARM). The second initiative introduced an ad-supported subscription tier. Thus far, the plan has shown to be an effective churn reducer and incremental on-ramp to price sensitive consumers. Below, we reveal how both maneuvers are growing Netflix revenues and expanding its prized subscriber base.

Account Sharing Impact

- For the purposes of this blog, we categorize Netflix subscribers as “account owners” (viewers with a subscription plan) and “account borrowers” (viewers who use the account owner’s password to access Netflix).

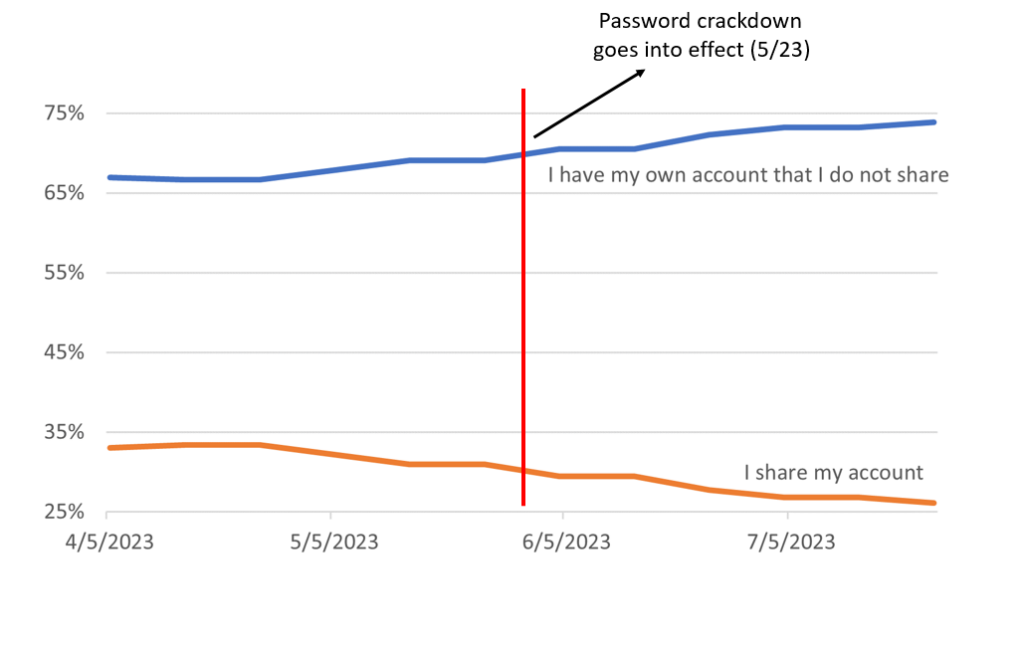

Since Netflix went live with its password crackdown on May 23, an increasing number of account owners have stopped sharing their accounts.

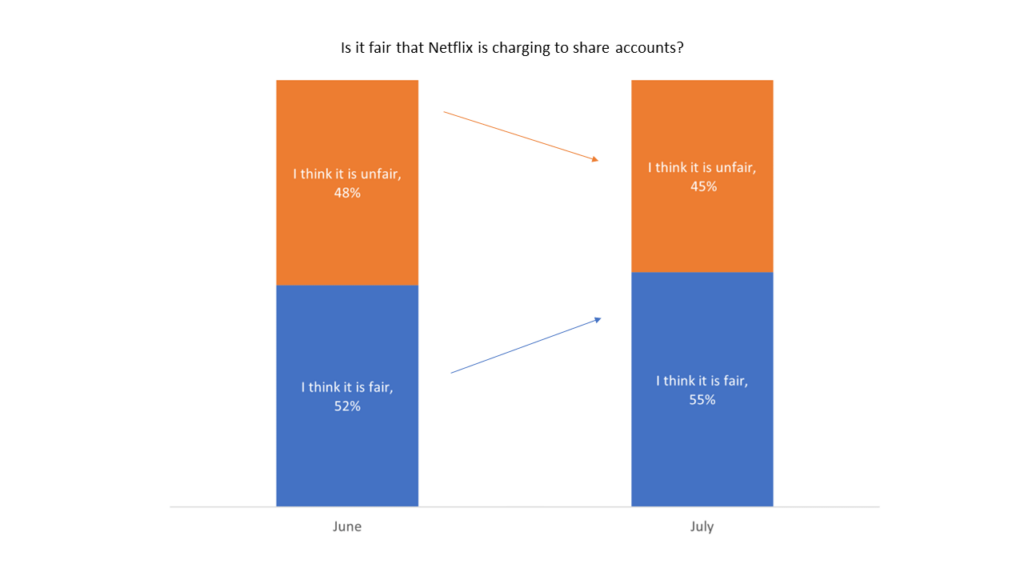

- Respondents are growing more accepting of Netflix’s new paid sharing policies.

Account Owners and Borrowers

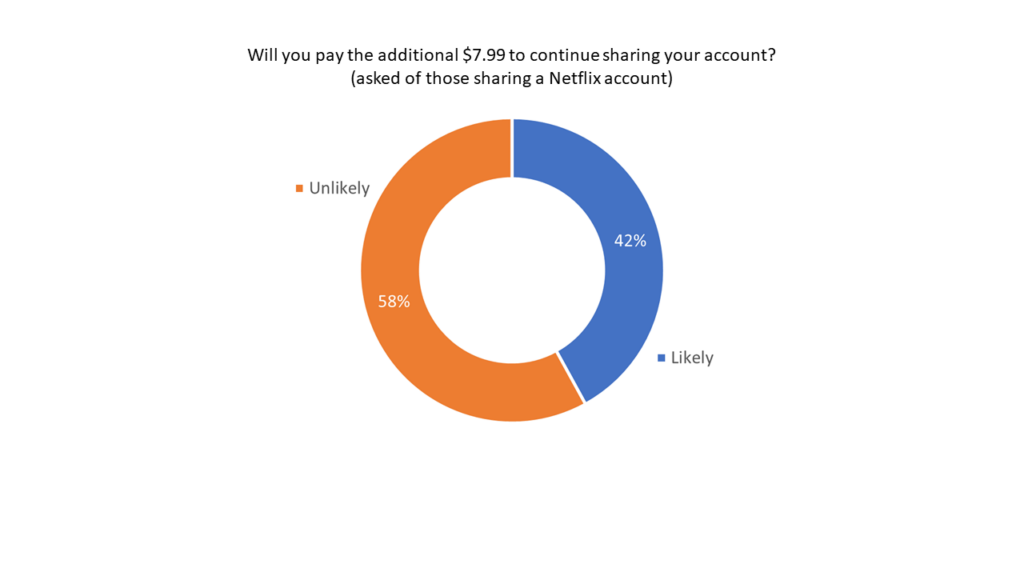

- According to occam, 40% of those subscribers who share their Netflix password plan on paying the $7.99 add-on fee to continue doing so.

- Over time, this should help the closely watched ARM (Average Revenue per Membership)* metric.

*According to Netflix, ARM is calculated by “dividing streaming revenue by the average number of streaming paid memberships by the number of months in the period.” Extra member accounts (borrowers) are not included in the count of paid memberships in the denominator but the $7.99 fee is added in the numerator as extra revenue.

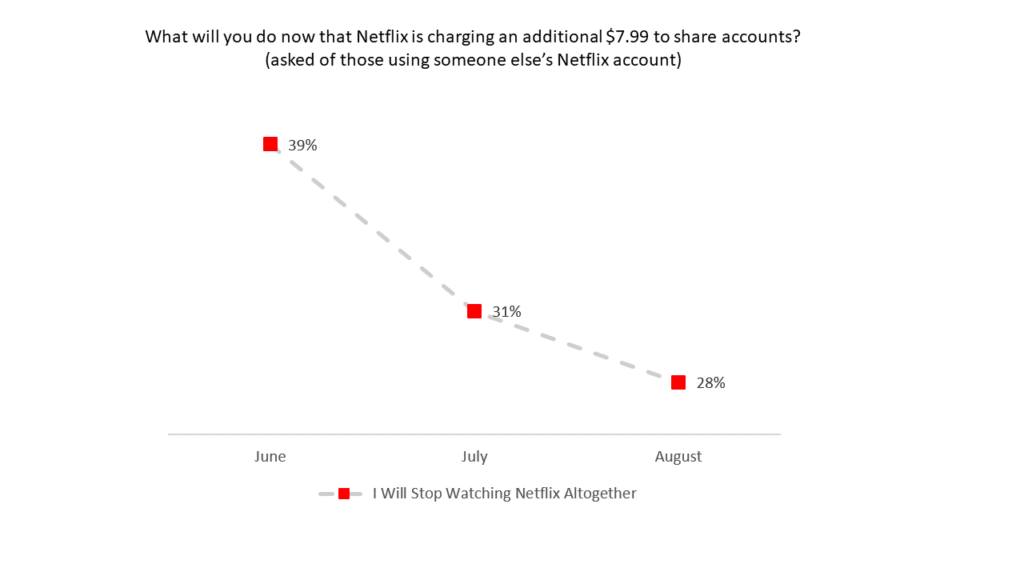

- Occam data reveals that since the introduction of paid sharing, there’s a declining number of account borrowers planning to quit Netflix. This suggests that most former account borrowers are likely to either become account owners or join existing accounts as add-on users.

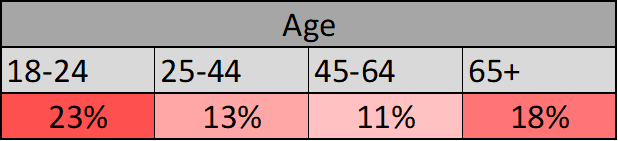

Demographics of Account Owners and Borrowers

- Younger respondents are more likely to be account borrowers.

- Lower income respondents are more likely to be account borrowers.

- The $7.99 sharing fee and the $6.99 ad-supported tier are opportunities to retain price sensitive former account borrowers.

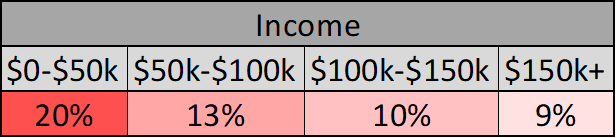

Subscription Plans

- In mid-July, Netflix discontinued its ad-free $9.99 Basic plan*, positioning the $15.49 Standard plan as the most affordable ad-free option for new subscribers. The ad-supported tier carries over at $6.99.

- Occam data suggests that new subscribers are on balance choosing the $15.49 Standard and $19.99 Premium plans over the lower priced $6.99 ad-supported tier.

*Current Basic subscribers are grandfathered in.

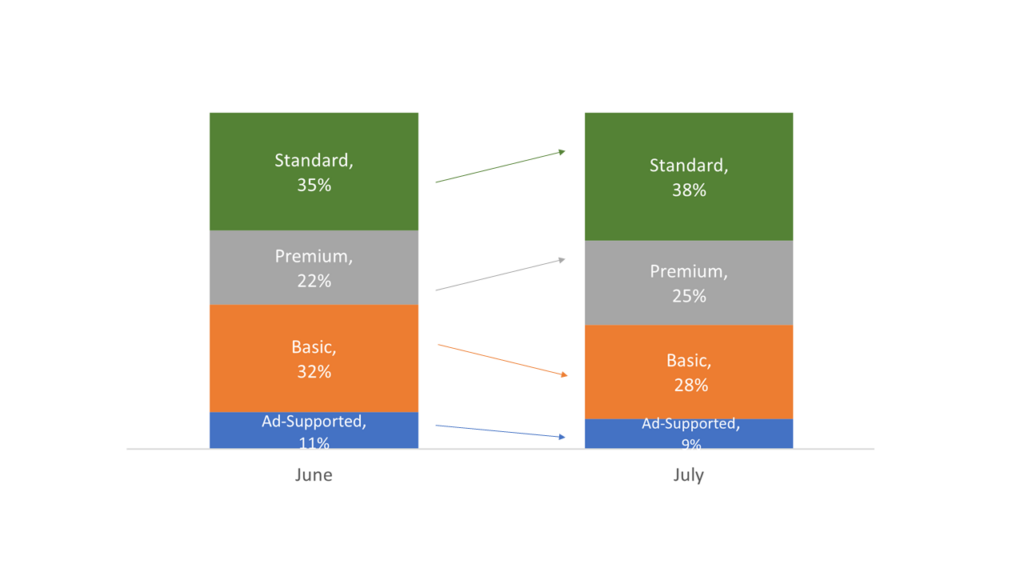

Ad-Supported Subscribers

- The ad-based tier is an important tool for Netflix in reacquiring former members who have churned.

- Furthermore, occam data below shows that only 19% of ad-supported tier subscribers have downgraded from a more expensive plan. A dominant 81% of those choosing the ad-supported tier are accretive to Netflix revenues.*

*Excluding ~8% of respondents that answered “Other”

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.