Legacy sneaker giants Nike and Adidas are facing headwinds, grappling with excess inventory and criticism for a perceived lack of innovation in their sneaker lineups. Against this backdrop, On Running and Deckers’s HOKA, two lesser-known brands, are threatening to take further market share. Both had an impressive 2023, deploying marketing strategies rooted in meaningful innovation and positioning as premium sportswear. Below, occam provides an analysis of brand recognition, how these brands resonate with different demographics, and the qualities that consumers value in their products.

Footwear Market

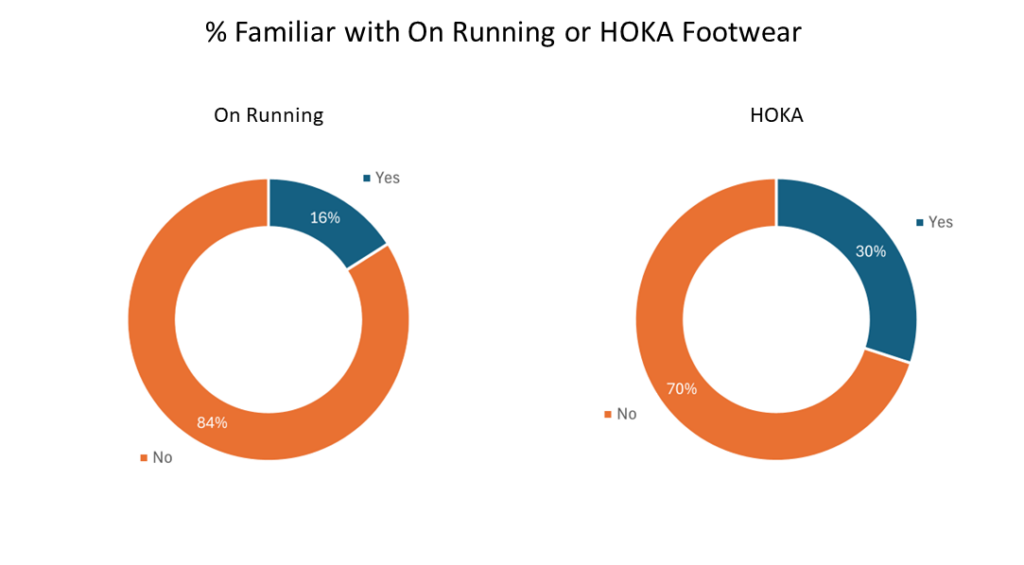

- Despite HOKA’s relatively modest global revenue of $1.41 billion (FY 2023), brand awareness is quite strong with 30% of respondents saying they recognize the brand. HOKA has long been well-regarded by runners of all types (from trail to marathon), but importantly, HOKA has also gained traction as mainstream athleisure, becoming a frequent choice as daily footwear among celebrities and general consumers alike.

- While many fewer respondents (16%) are familiar with the On Running brand, efforts are underway to enhance visibility. These efforts include collaborations with top athletes, like tennis legend Roger Federer (an investor in the brand), and with luxury retailers.

HOKA and On Running Customers

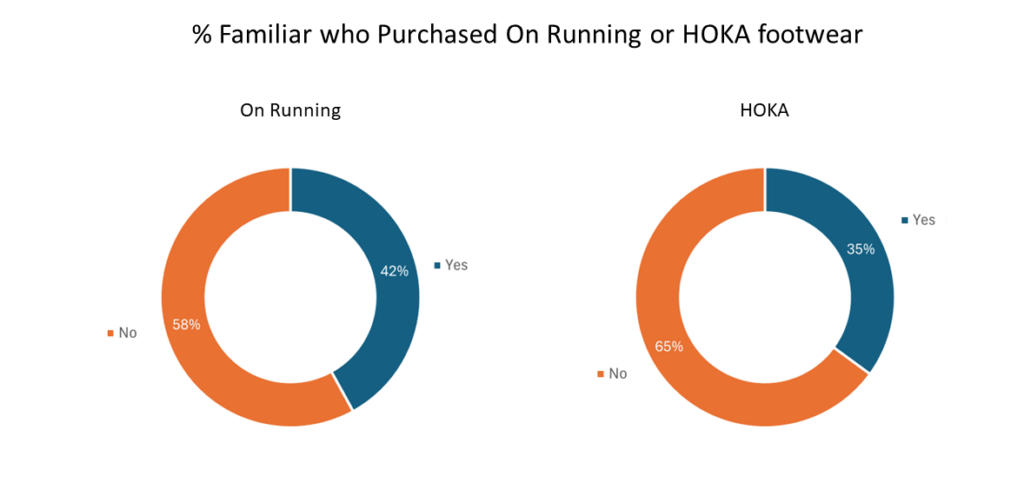

- 35% of individuals familiar with HOKA have purchased their shoes, but a larger 42% of those familiar with On Running have purchased their shoes. What might account for this differential?

- We suspect HOKA’s prominent logo increases brand awareness, resulting in a broad base of individuals who recognize the brand but don’t choose to purchase. In contrast, On Running’s understated and arguably cryptic logo means that fewer people learn the name of the brand with a quick glance, leading to higher a reliance on word-of-mouth and inquiries to learn the name of the brand (“What brand are those shoes?”) – this may result in a higher proportion of purchases among the smaller group of people who do become aware of the brand.

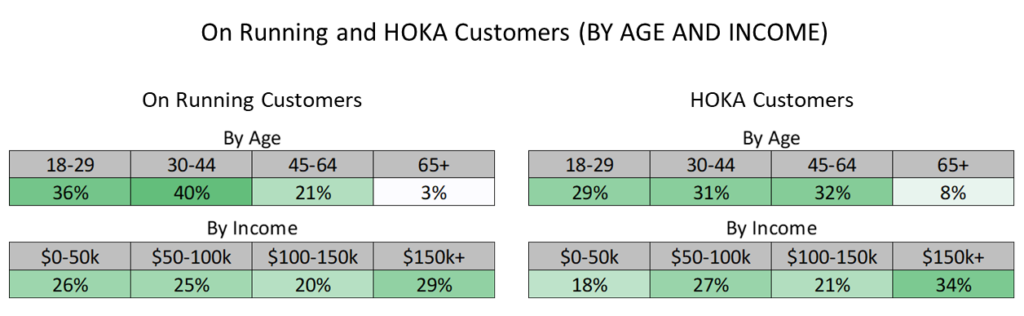

- On Running customers are concentrated in the18-29 and 30-44 age brackets. HOKA skews somewhat older, with comparatively more share in the 45-64 and 65+ brackets.

- For both brands, the highest $150k+ income bracket dominates lower income brackets, but HOKA customers appear to have a higher median income.

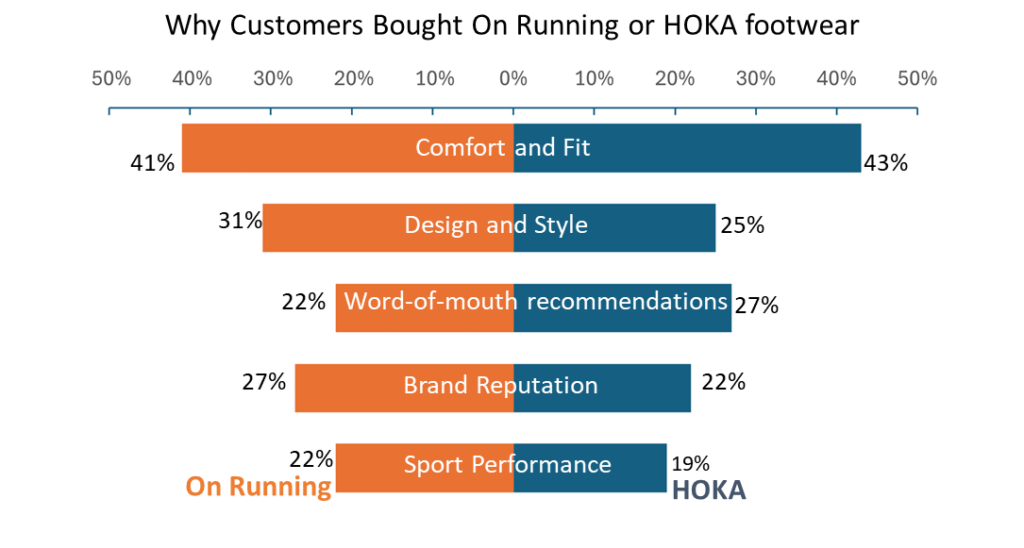

HOKA and On Running Products

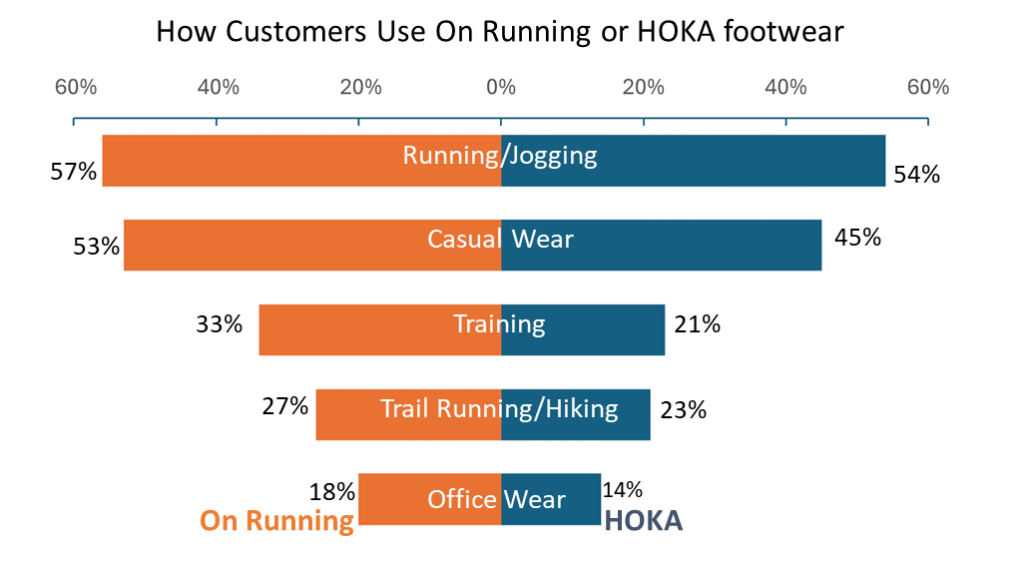

- Though primarily purchased for athletic use, respondents say that HOKA and On Running are almost as highly valued as casual wear, which squarely positions both brands as athleisure.

- HOKA’s success can partly be attributed to its “maximalist” design approach, which has resonated with many.

- Shoes designed with a maximalist philosophy usually involve enhanced cushioning and shock absorption, alongside increased support and stability. The HOKA ONE ONE is often acknowledged as the first maximalist shoe design.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.