Lululemon has maintained a dominant presence in the athleisure clothing sector, despite a steady influx of new competitors eager to capitalize on the industry’s momentum. Consumers have been drawn to athleisure apparel because of its ability to transition easily between workout and casual environments while maintaining a sense of style. Lululemon has carved a niche for itself by infusing its brand with an aspirational allure that suggests its wearers lead a lifestyle that is not only health-conscious but also affluent. Below, occam explores the demographics of Lululemon customers and its competitors, illuminating the brand’s significant role in shaping the athleisure landscape.

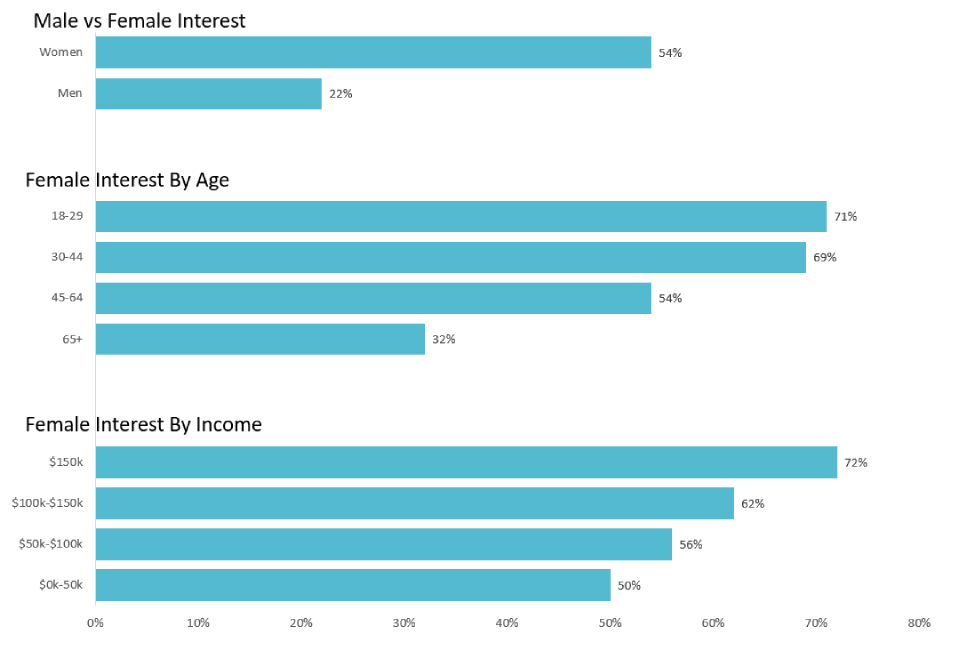

Demographic Breakdown of Americans Interested in Athleisure

- Athleisure interest skews female, younger, and higher income.

- Athleisure is gaining traction with men, with over 1 in 5 interested.

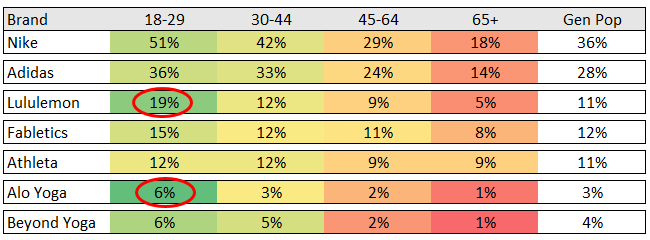

Interest in Athleisure Brands by Age and Income

- Across brands, young adults are the most interested in athleisure. However, Lululemon and Alo Yoga skew even more heavily towards this 18-29 age cohort. Athleta in contrast draws relatively more interest from a somewhat older demographic. (Green indicates over-indexing, and red indicates under-indexing, relative to the general population.)

- Across brands, high income consumers are the most interested in athleisure. However, Lululemon and Athleta skew particularly strongly towards the highest income cohort. (Green indicates over-indexing, and red indicates under-indexing, relative to the general population.)

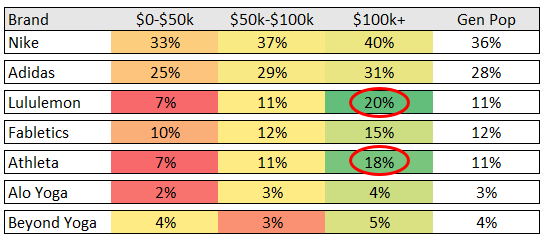

Athleisure Interest by Census Division

- Surprisingly, New England outpaces all other US Census divisions, including the fitness-focused Pacific division, in interest level in Lululemon, Athleta, and Fabletics. However, with mainstream athletic apparel brands like Nike and Adidas, New England’s interest level aligns closely with the other geographic divisions. We speculate that New England’s relative affluence may not only permit higher discretionary spending on premium brands like Athleta and Lululemon but also affords residents more time to invest in an active lifestyle.

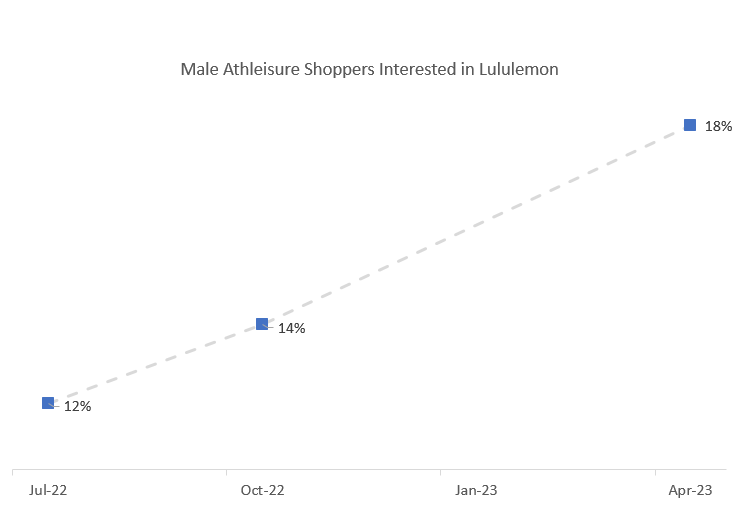

Male Interest in Lululemon Has Exploded

- Lululemon’s strategy to expand its male customer base is bearing fruit — of men interested in athleisure, the percentage interested in Lululemon has surged from 12% to 18% in under a year.

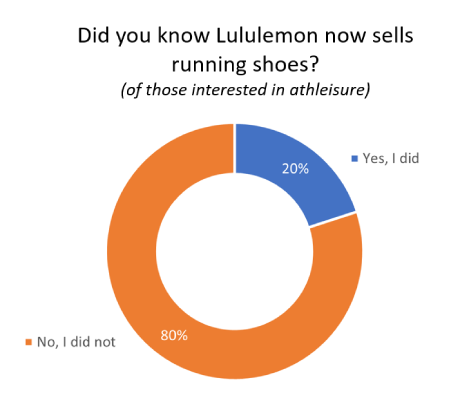

Awareness of Lululemon Running Shoes

- Though Lululemon introduced women’s running shoes only one year ago, 20% of athleisure enthusiasts are already aware of them.

- On the other hand, the fact that only 20% are aware of Lululemon shoes means most of the growth in awareness and sales lies ahead.

- Plans to expand into men’s footwear over the coming year represents additional untapped potential.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.