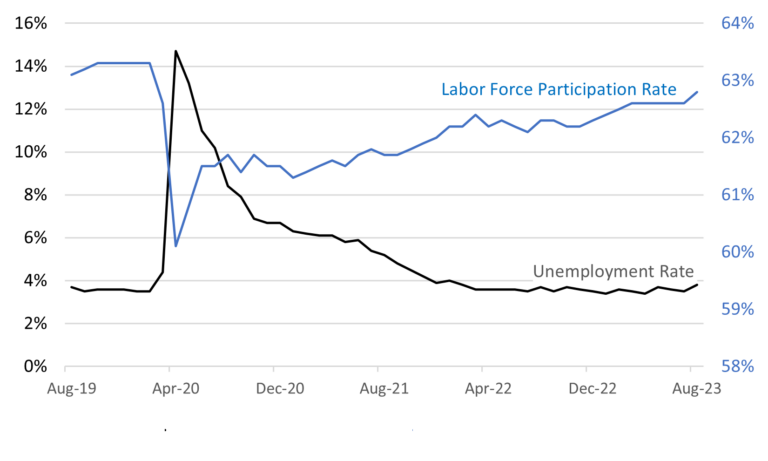

With the headline unemployment rate reaching lows not seen in decades, and the labor force participation rate rising to pre-pandemic levels, by outward appearances, the American job market is robust and stable. However, a closer look using occam data reveals some underlying vulnerabilities that are beginning to surface. Below, with insights and analysis from occam, we dissect the nuances of the present labor market and what may lie ahead for the American workforce over the coming months.

Unemployment vs Labor Force Participation Rate

- The unemployment rate is stable and near multi-decade lows, while the tight labor market and inflation have drawn many back into the workforce and have driven the Labor Force Participation Rate back towards pre-pandemic levels.

- There is preliminary evidence that the rise in the Labor Force Participation Rate has been helped by prime-age women with young children participating in the workforce at greater than pre-pandemic levels, thanks to the greater availability of work-from-home opportunities.

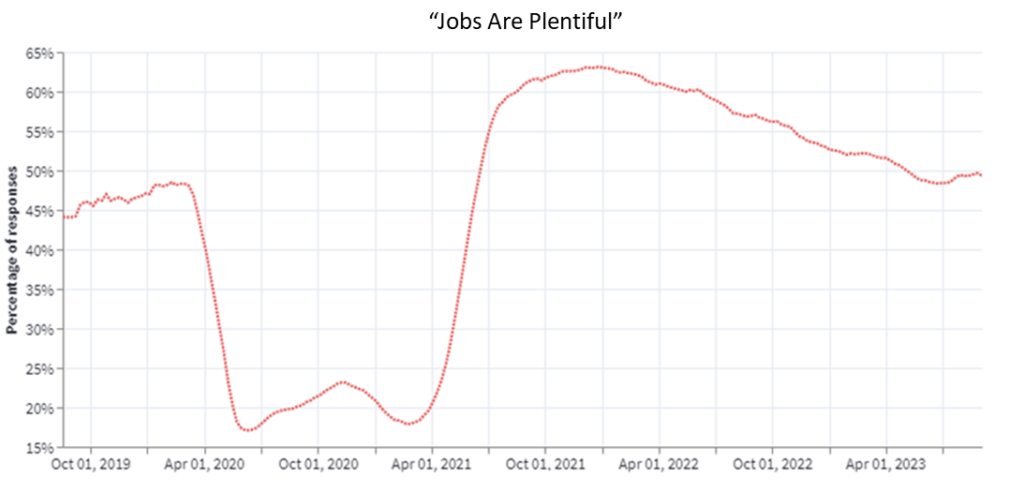

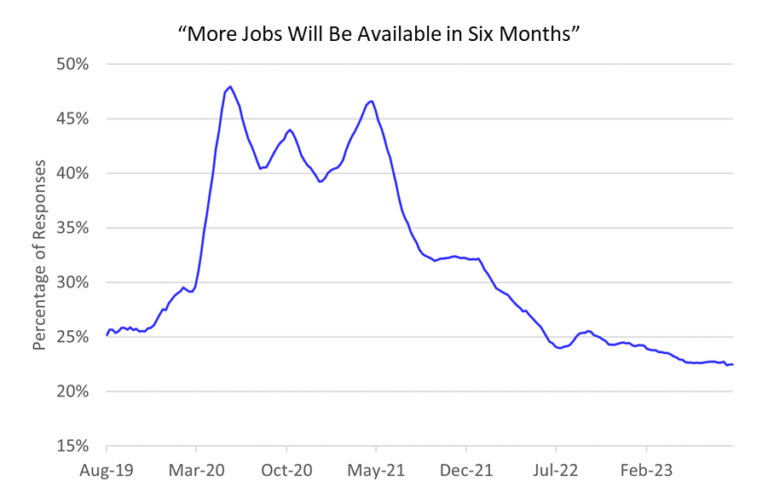

Job Market Conditions

- Despite a low and stable unemployment rate, occam shows that a declining number of workers are feeling that “jobs are plentiful”.

- Occam also shows a declining number of respondents believe that in 6 months there will be more jobs available than there are now.

Job Market Growth

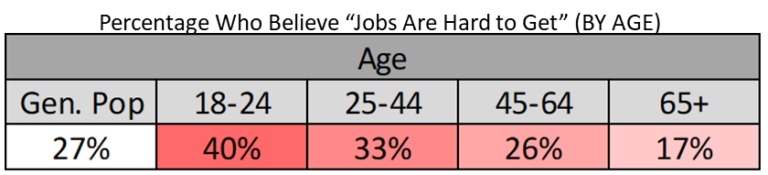

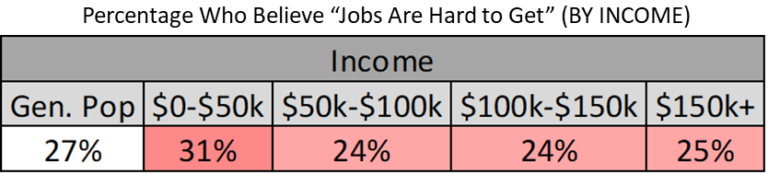

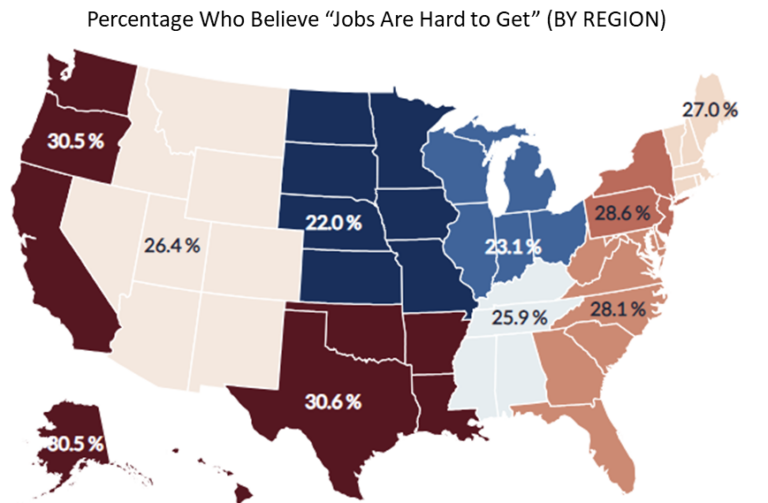

- Younger workers and lower wage workers are less enthusiastic than others about the current job market.

- Regionally, though the plurality of workers say jobs are plentiful, those in the west are the least optimistic about current conditions, while those in the midwest are most optimistic about current conditions

Worker Satisfaction

- The labor market appears to be tight enough still to keep workers choosy about the jobs they decide to hold and provide unions greater bargaining power.

- Will the ongoing surge in union activity lead to a further rise in wage inflation, or will the declining rate of job quitting and declining number of job openings hold wage inflation in check?

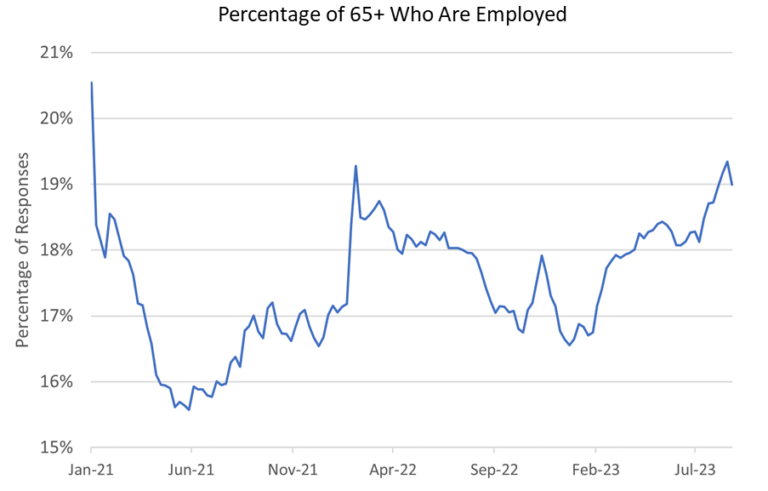

Unretired Workers

- The still-tight labor market and the increasing cost of living have continued to draw those over 65 back into the workforce, but there are signs that this trend could be coming to an end.

- The number of job openings and “quit” rates are both in distinct decline, particularly in the “leisure and hospitality” and “accommodations and food services” sectors, which may be natural destinations for seniors who choose to “un-retire” on a part-time basis.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.