- With tariff-related uncertainty beginning to recede, market attention has pivoted to the potential deficit implications of the “one big beautiful bill” currently under debate in Congress. Market participants are closely watching these developments, as yields on the U.S. 30-year Treasury bond approach the 5% threshold—reflecting heightened sensitivity to long-term deficit projections.

- Against this backdrop, Federal Reserve Chairman Jerome Powell made comments on Thursday that “higher real rates may also reflect the possibility that inflation could be more volatile going forward than in the inter-crisis period of the 2010s… We may be entering a period of more frequent, and potentially more persistent, supply shocks.”

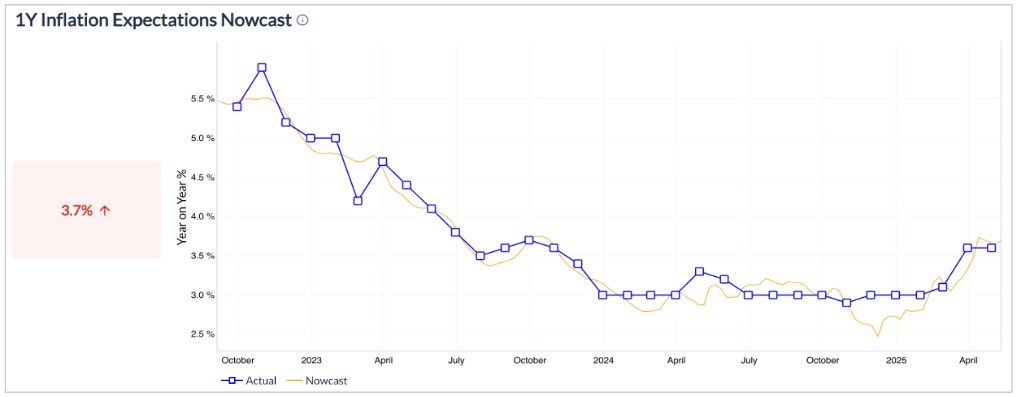

- While longer-term inflation expectations remain anchored within the Federal Reserve’s target range, shorter-term expectations have shown increased volatility. In light of ongoing uncertainty surrounding the reconciliation bill and its potential impact on future fiscal deficits — coupled with Jerome Powell’s remarks that the current environment may be more prone to inflationary shocks than the 2010s — closely monitoring near-term inflation expectations has become increasingly important.

- Occam continuously monitors one-year inflation expectations in real time, complementing the monthly data published by the Federal Reserve Bank of New York. The Nowcast is refreshed every Monday, so check-in the beginning of every week for the most recent updates. Subscribe today to stay ahead of the curve