As Americans debate the complex issues around weight management and body image, the landscape of anti-obesity medications is undergoing a dramatic transformation. Prescription volume for GLP-1 agonist drugs such as Ozempic and Wegovy reflect a staggering 300% surge in prescriptions from 2020 to 2022. Despite facing criticism from advocates of the body-positivity movement and those cautioning against easy fixes to obesity, the demand for these medications has in particular significantly boosted market leader Novo Nordisk – so much so that the company has single-handedly begun to impact Denmark’s national economic statistics. The surge has also triggered a wave of new, potentially more effective treatments like Eli Lilly’s tirzepatide-based Mounjaro and Zepbound. Below, we delve into this remarkable trend, shedding light on the expanding public consciousness, the subtle demographic patterns around consumption, and the waning apprehensions concerning potential side effects.

Trends in Usage and Attitudes

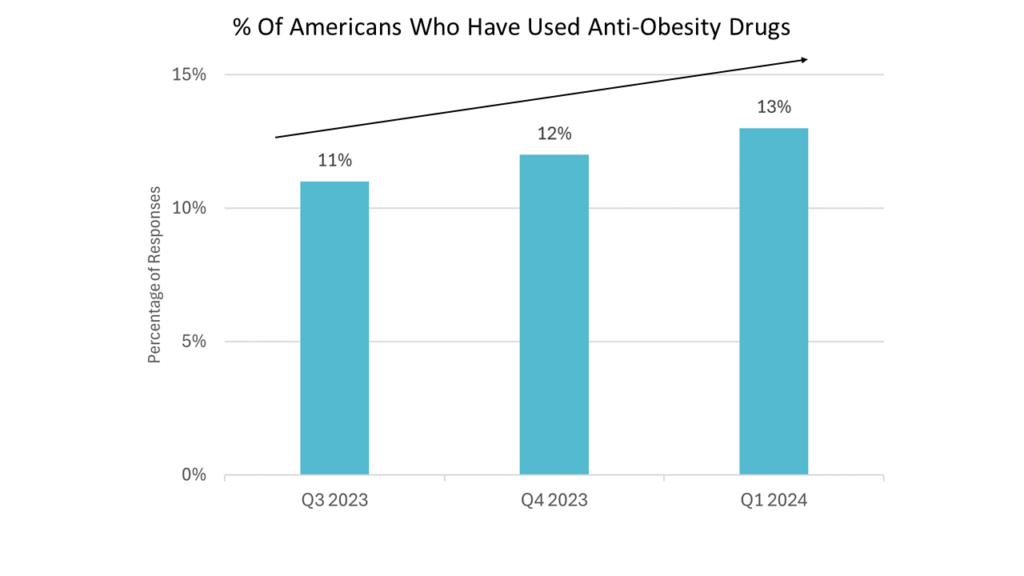

- In just a handful of months, occam shows a not-insignificant rise in the proportion of respondents who say they’ve used obesity meds (inclusive of GLP-1 agonists).

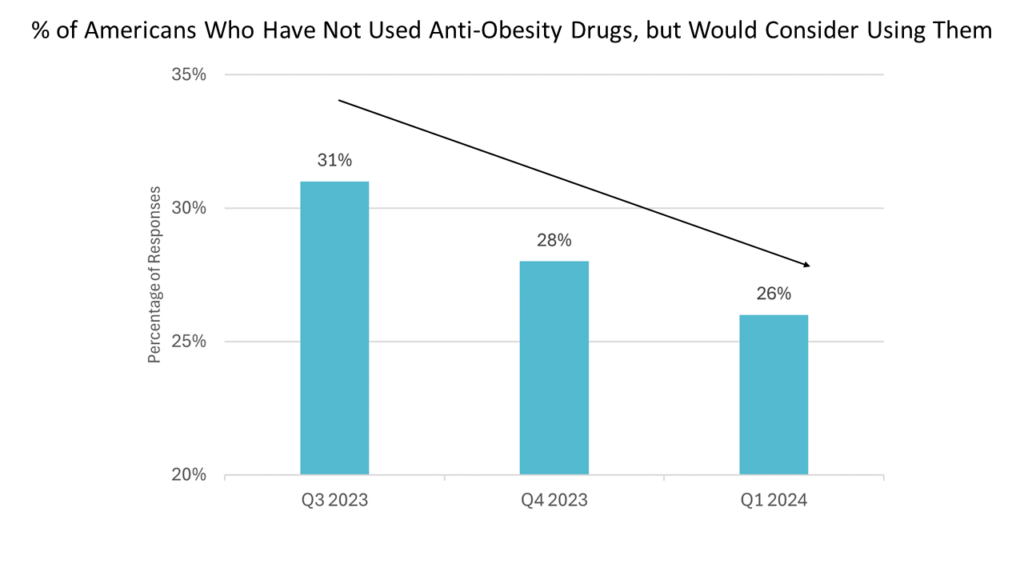

- As more people have started taking obesity medications, the proportion of those interested in trying them but who haven’t yet is decreasing.

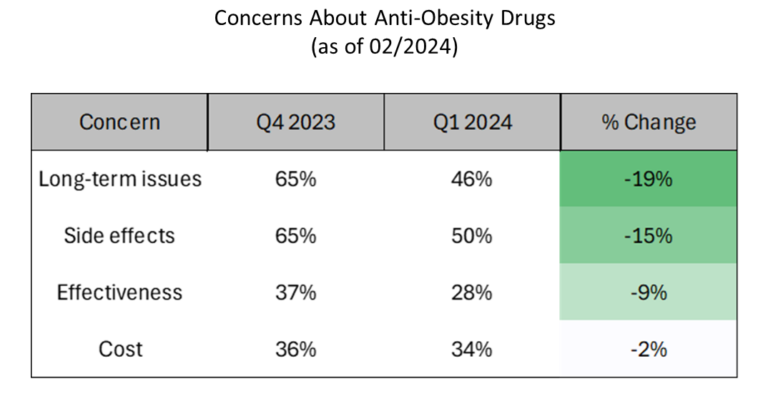

- As the popularity of anti-obesity drugs has grown, there has been a notable decrease in concerns about them, suggesting increased trust or acceptance of these medications.

- Cost concerns have experienced the smallest decline. Given that wholesale prices for GLP-1 agonists span roughly from $1,000 to $1,500 monthly, it’s understandable that price continues to be a significant issue for those without insurance coverage for these drugs.

Awareness

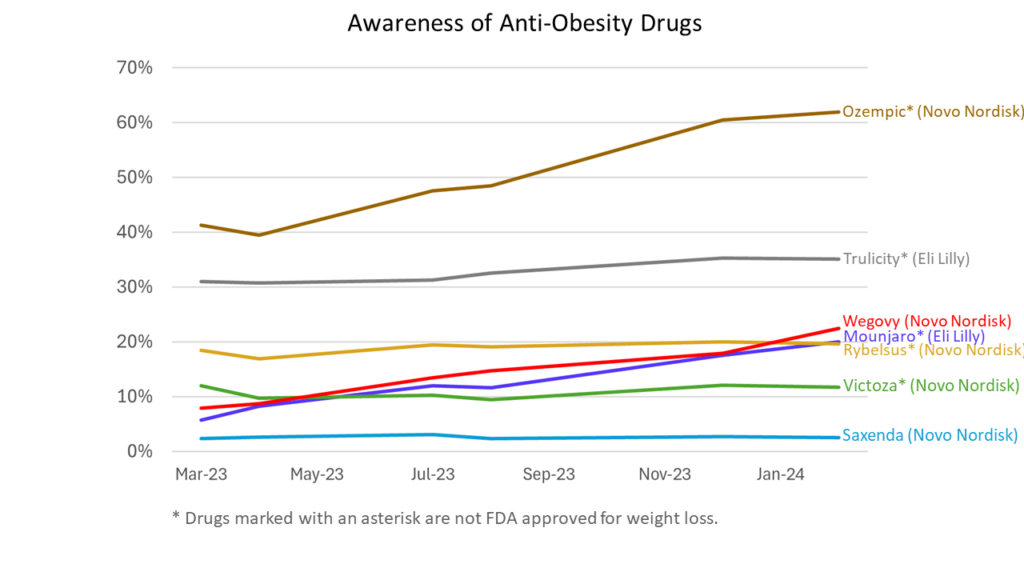

- Awareness about Ozempic and Wegovy has increased most dramatically over the last year.

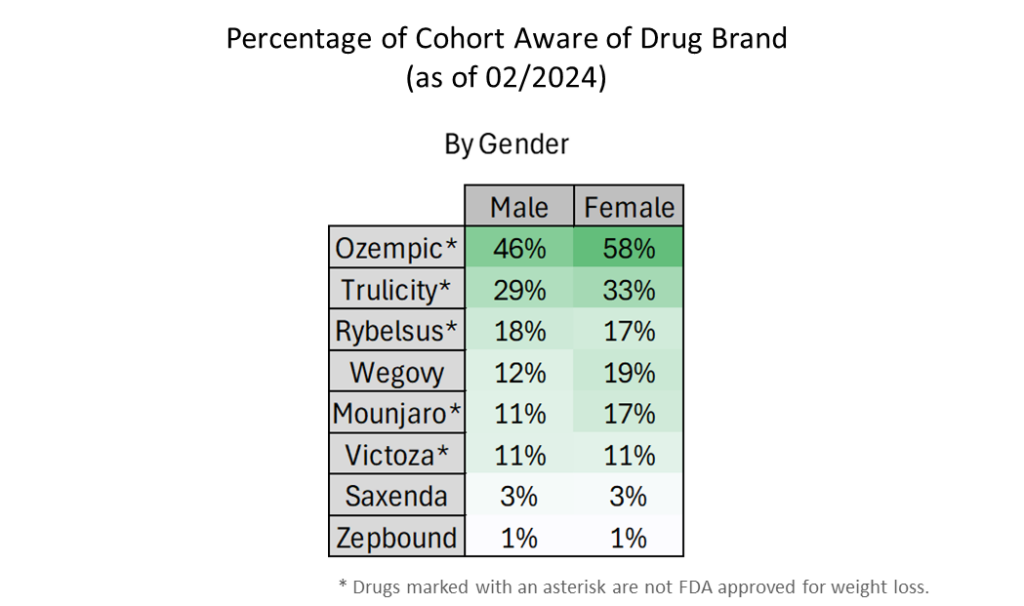

- Ozempic is easily the most recognized drug.

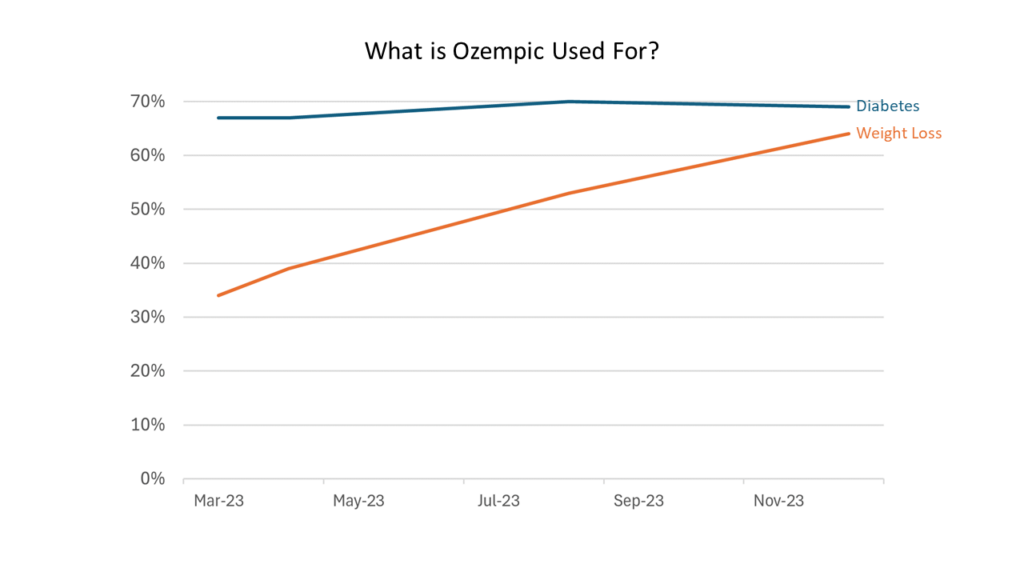

- Respondents increasingly categorize Novo Nordisk’s Ozempic as a weight loss drug, despite the fact that it is not FDA-approved for this purpose.

Demographics

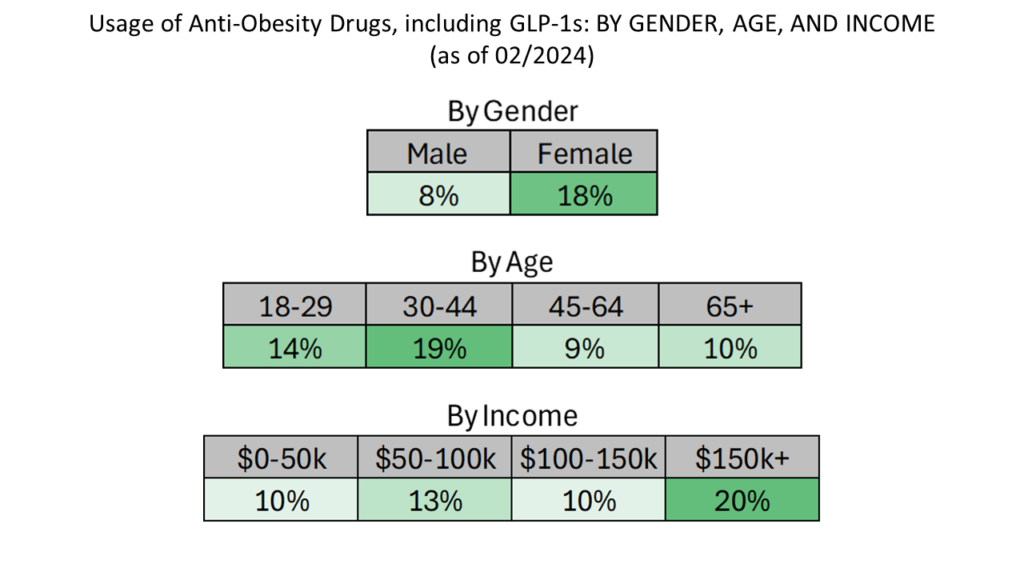

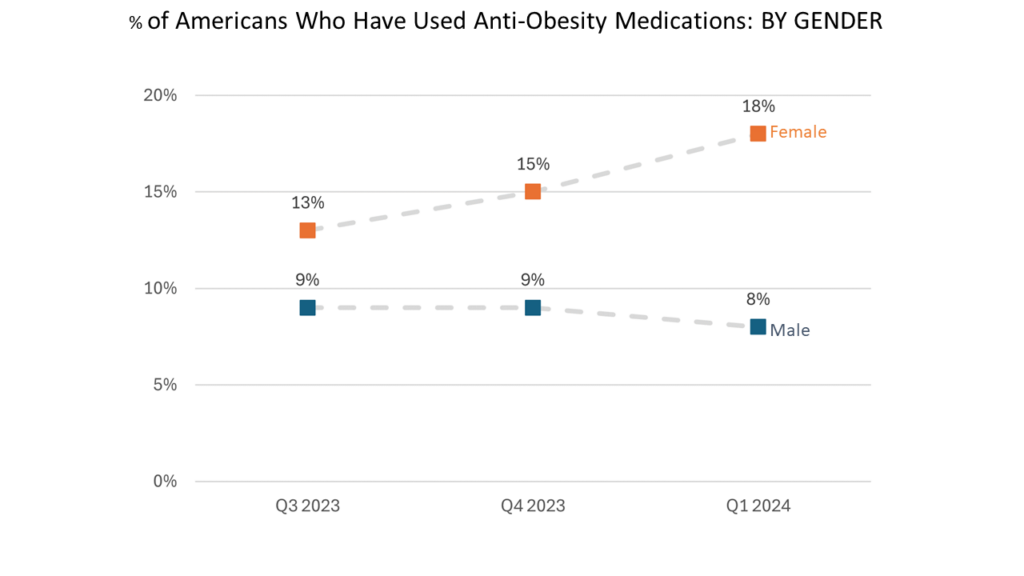

- Many more female respondents than male respondents have tried anti-obesity medications.

- Usage of anti-obesity medications is highest among the 30-44 age group, with markedly lower usage among older respondents.

- The highest income cohort shows much heavier use of anti-obesity medications. We speculate that affordability is at play.

- Data from Occam suggests that the rising use of weight loss drugs is being driven by women more than men.

- Overall, female respondents are overall more aware of the brand names of GLP-1 agonists.

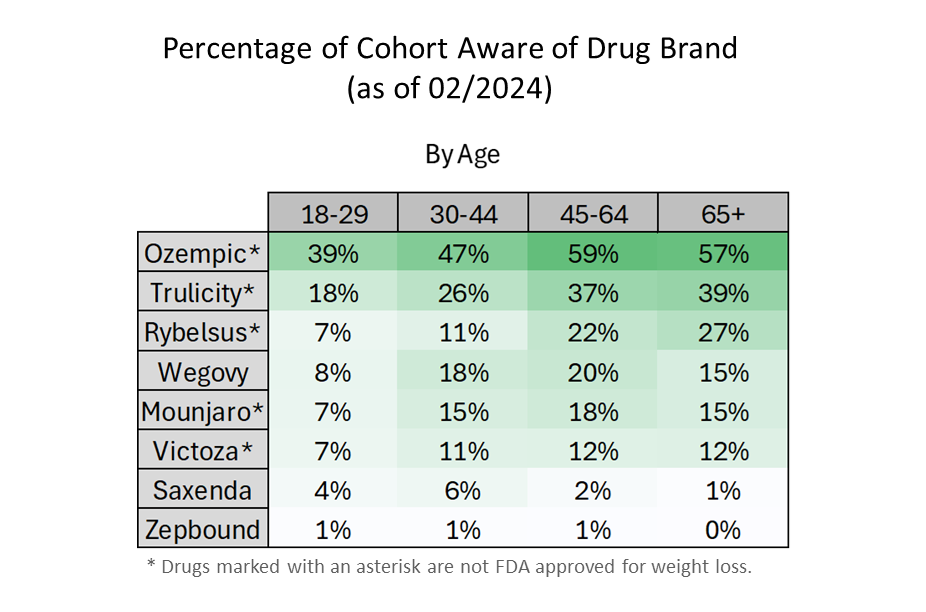

- Ozempic has the highest awareness across all age groups.

- Older adults are more aware of these weight-loss drugs than younger adults.

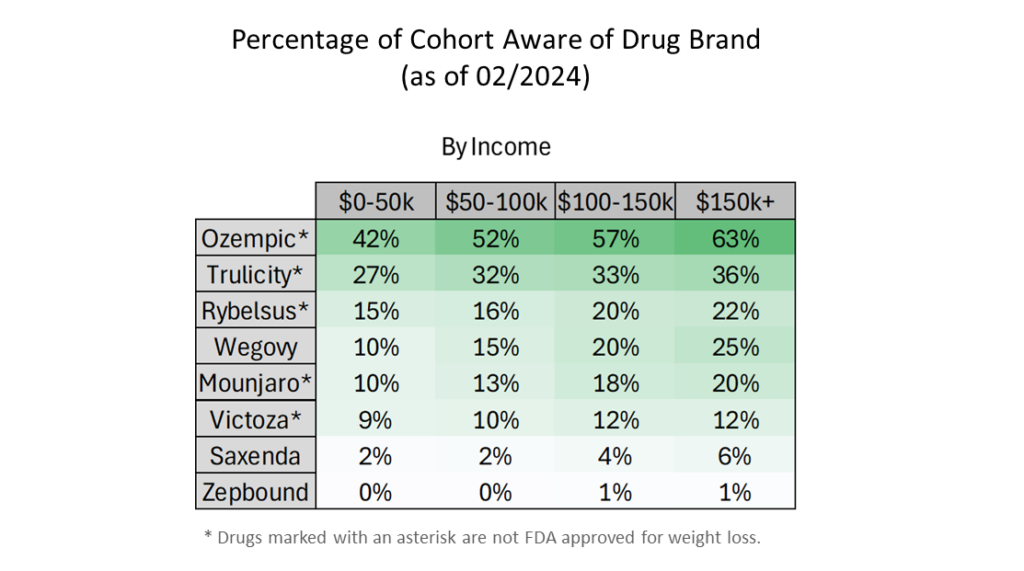

- Zepbound, which first became available on 12/5/2023, still has low name recognition. Lilly’s Zepbound is FDA approved for weight loss and has the same active ingredient as Lilly’s Mounjaro, which is approved only as a diabetes medication.

- For the $150k+ income bracket, awareness of all drugs is equal to or higher than that of all lower income brackets.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.