China has finally put an end to its zero-COVID strategy, reverting factories back to full production. Nevertheless, the damage to iPhone 14 sales has been done. This upgrade cycle will not keep up with historical patterns and demand destruction is likely permanent. The good news, though, is Apple’s grip on their user base is stronger than ever, especially with Gen Zers. For bulls, this is likely worth more than a blip in near term demand.

Until recently, Apple seems to have avoided the worst of the post-COVID tech chaos, mainly due to the iPhone's popularity. However, last year's disruptions in China significantly reduced production to the point that Apple released a rare press release on Nov 6th describing the setback. All of this left observers wondering: will this impact demand?

AlphaROC’s data suggests near-term demand has indeed been affected. Consumers have shifted upgrade plans to later in 2023, and this might very well stymie the iPhone 14 cycle. Thankfully, for Apple bulls, brand affinity remains incredibly strong, especially among the youngest (and richest) consumers, meaning long term trends remain strong.

Our data continuously tracks interest in iPhone upgrades; as such, we were paying close attention as China’s zero-COVID strategy publicly unraveled. Suffice to say, upgrade demand has in fact softened in the past few months.

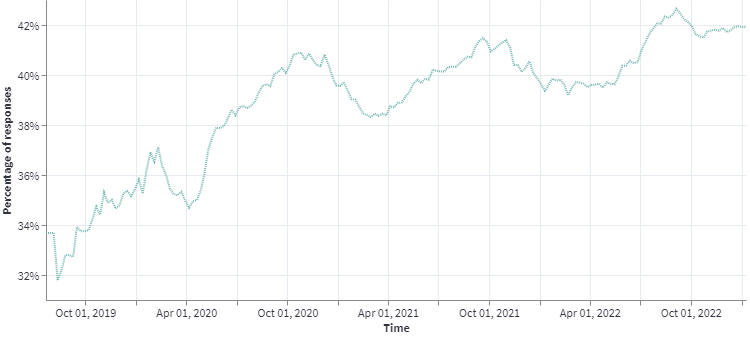

While near term demand is affected, we also track longer term demand trends. Here, the picture is quite different: long term replacement demand has kept pace with historical norms. More impressively, the sheer influence Apple enjoys amongst its customer base, which has only grown since the pandemic, should carve out a formidable future.

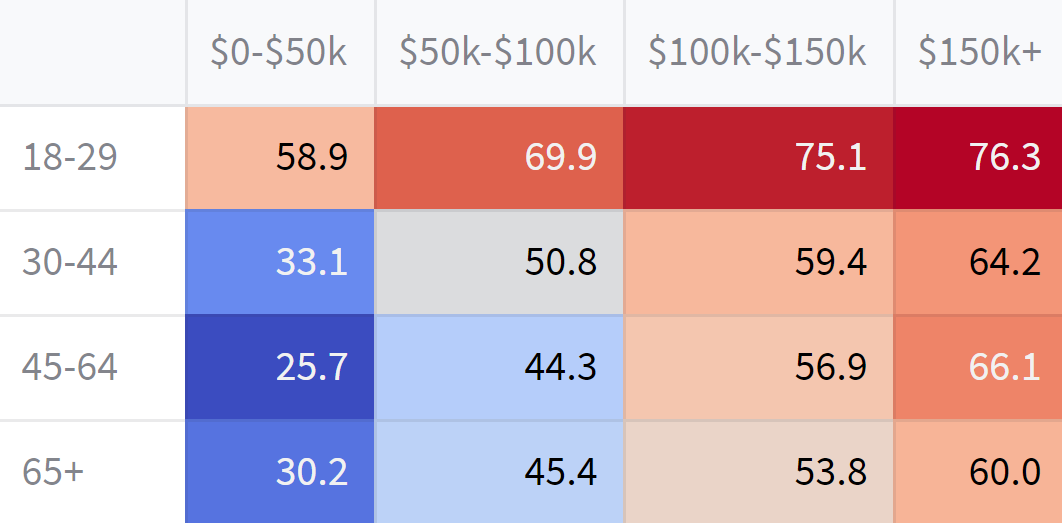

While many companies can say they target the youth market, few have as much brand affinity as Apple. Less surprising is how much brand affinity Apple has with affluent customers – arguably the least recession prone. Shipment delays have done little to change any of that.

Ownership

Who Owns What

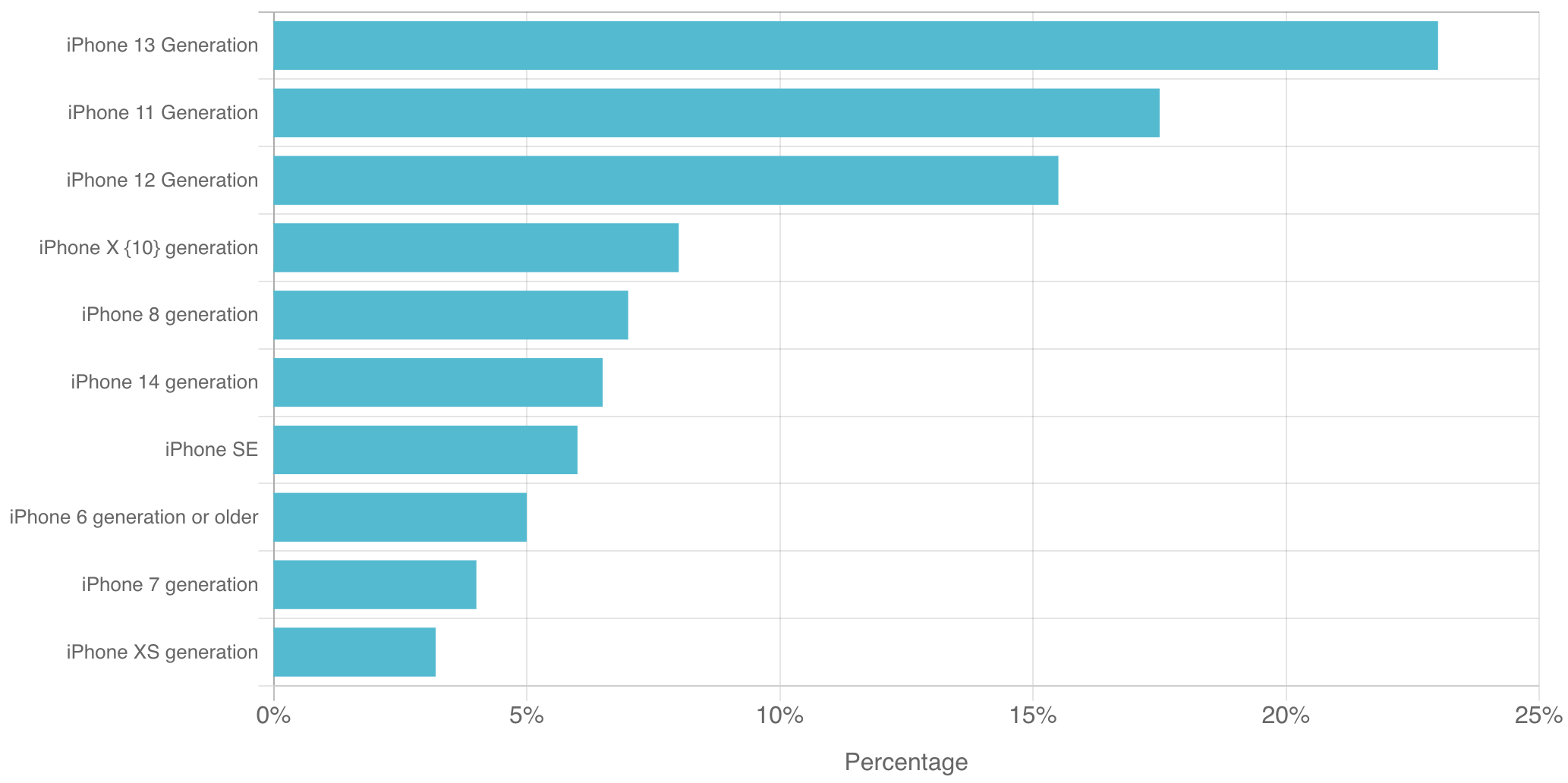

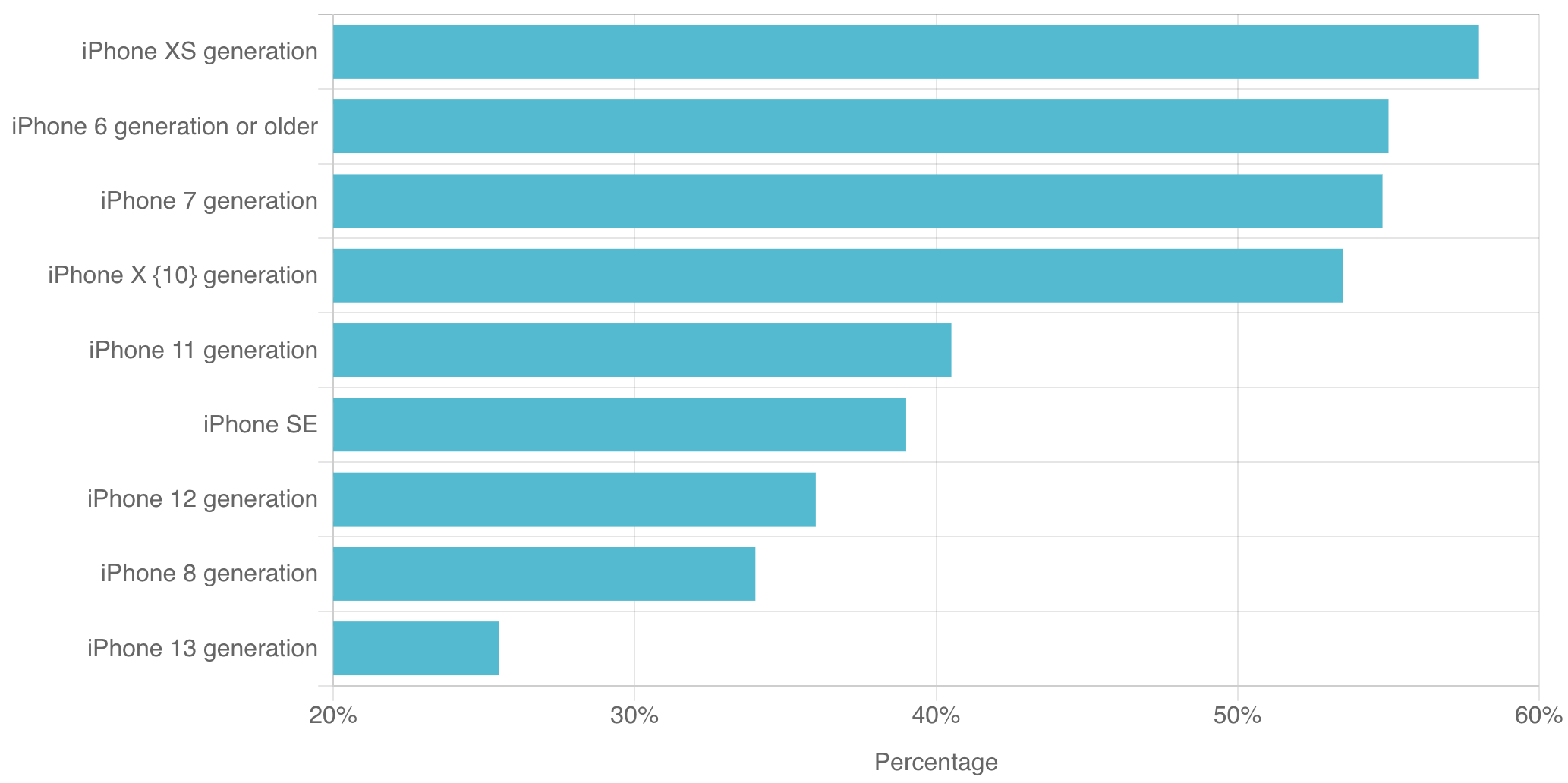

The newest models of iPhone (iPhone 13 and 14) capture 28% of customers; however, the iPhone 14 cycle is tracking below the iPhone 13 (only 6-7% of users)

Current model of iPhone owners

Purchasing

Love, Money, and iPhones

Young people have embraced Apple as one of the brands of their generation

Age and income of iPhone owners (%)

Brand Loyalty

Battle Hymn of the Apple Tribe

Throughout the pandemic and afterwards, fealty to Apple has amplified

iPhone users who will only consider Apple iPhones

Consumer Sentiment

Battery Life? In This Economy?

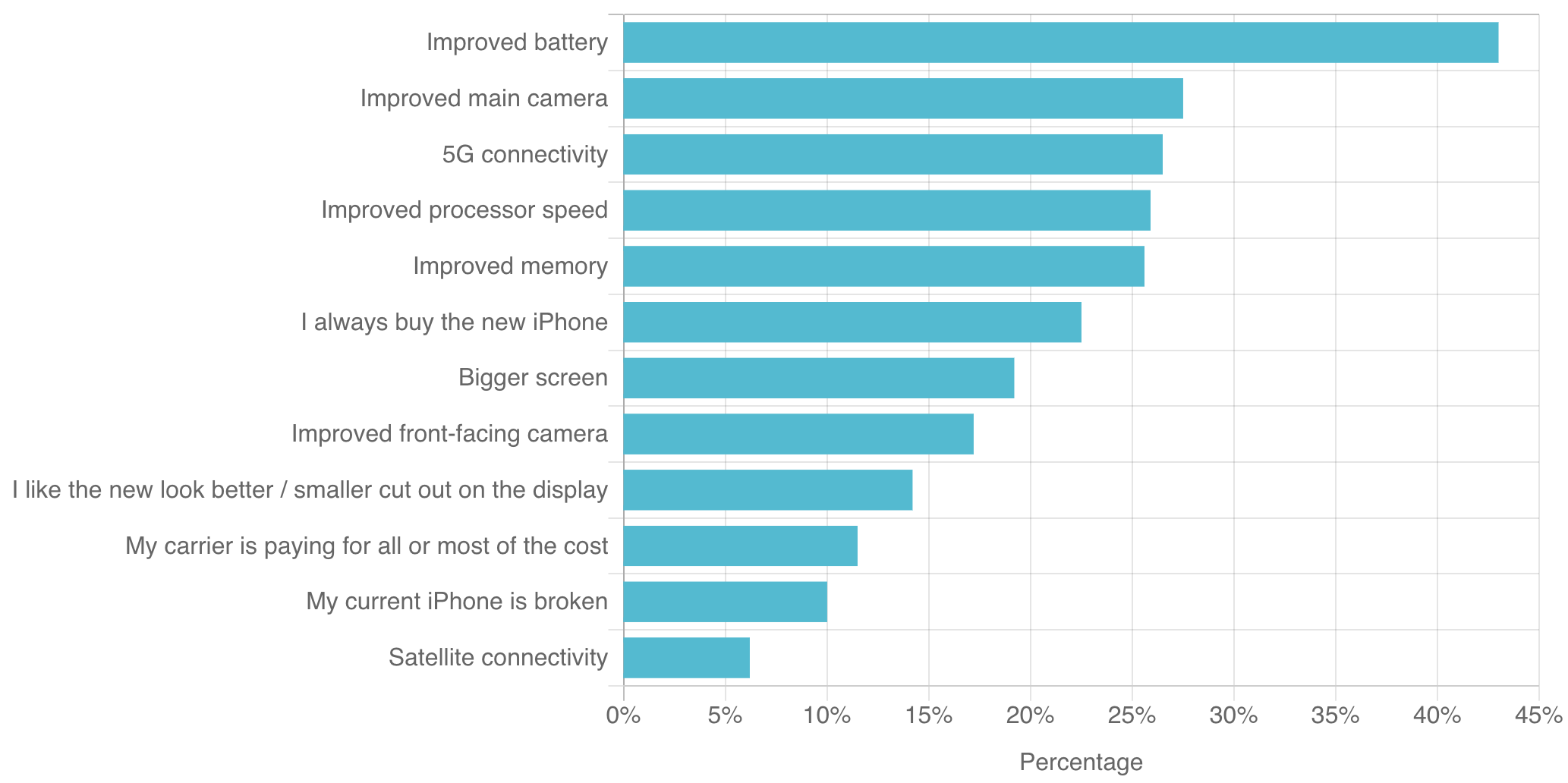

Battery life remains the clincher, but strong interest in 5G speed and processing power hints that the tech-savvy consumer may be the future

Primary reasons to upgrade

Upgrade Cycle

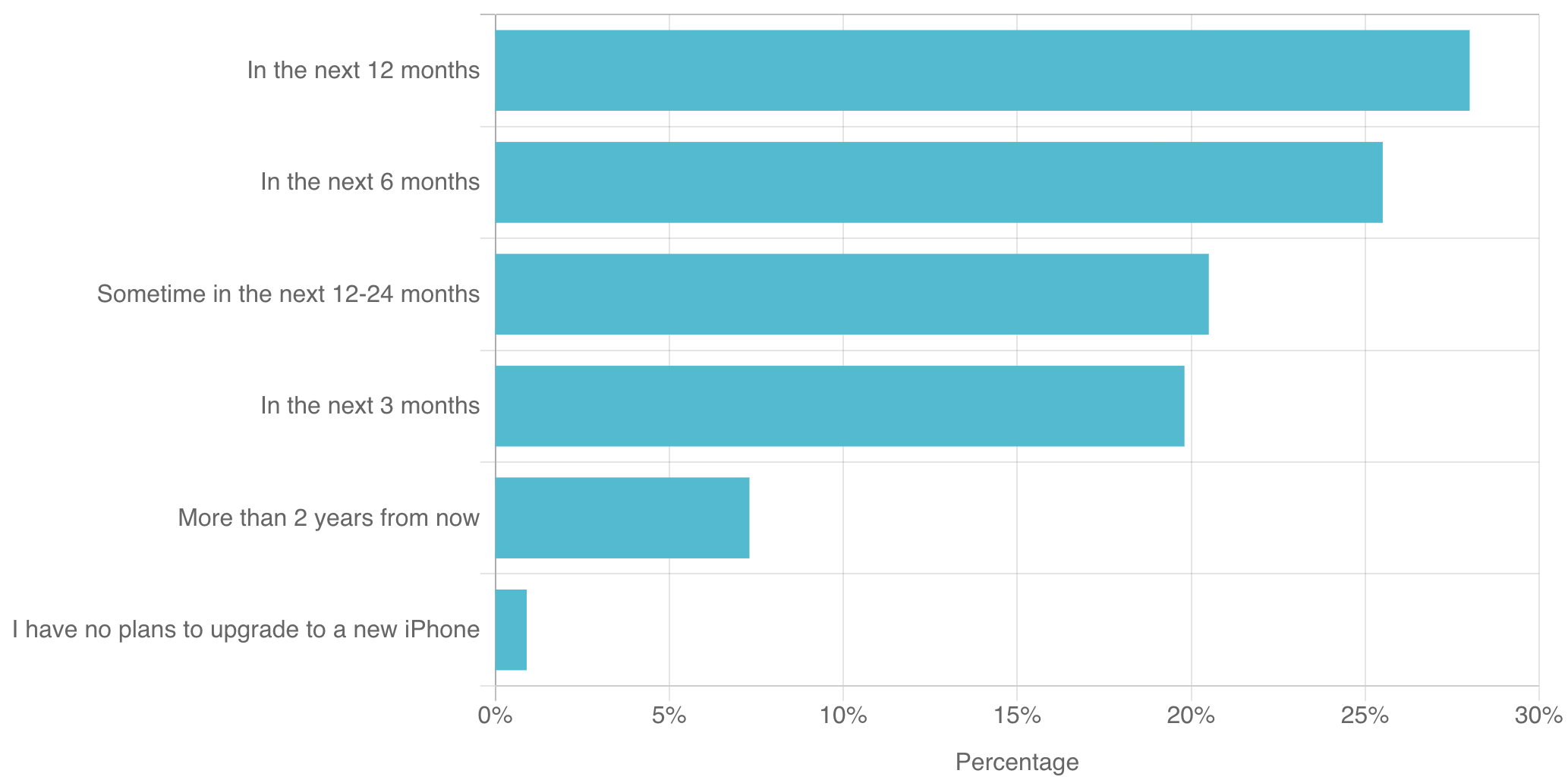

Average lifespan of an iPhone = 2.5 Years

Upgrade cycles waver from generation to generation. But people keep coming back

When iPhone users plan to upgrade

Upgrade Interest

If It Ain’t Broke, Still Fix It

Overall demand remains high - which means good things to come for future cycles

iPhone user base that desires an upgrade

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.