The last few months have been something of an acid test for Netflix, launching its Basic with Ads subscription tier after a very rough year. AlphaROC has an early read, and contrary to recent press, our projections have the streaming service back on track.

Whether you are a returning subscriber or have just recently subscribed to AlphaROC's Insights, our data on Netflix's response to the harsh subscription losses it faced last year should have everyone keeping a close eye on the streaming powerhouse. The launch of its fresh ad-supported tier has had a decent start, putting the company in a much better place for 2023 than 2022.

When Netflix launched its ad-based tier in the beginning of November, AlphaROC estimated that the move could add 6 to 14 million new subscribers, or around 10-25% of the company’s base. After 2 months, our data reveals that so far, new subscribers with ad-supported basic accounts have already added a few percentage points to the base. Assuming the same incremental growth, Netflix could very well exceed the lower end of our projections by the end of the year.

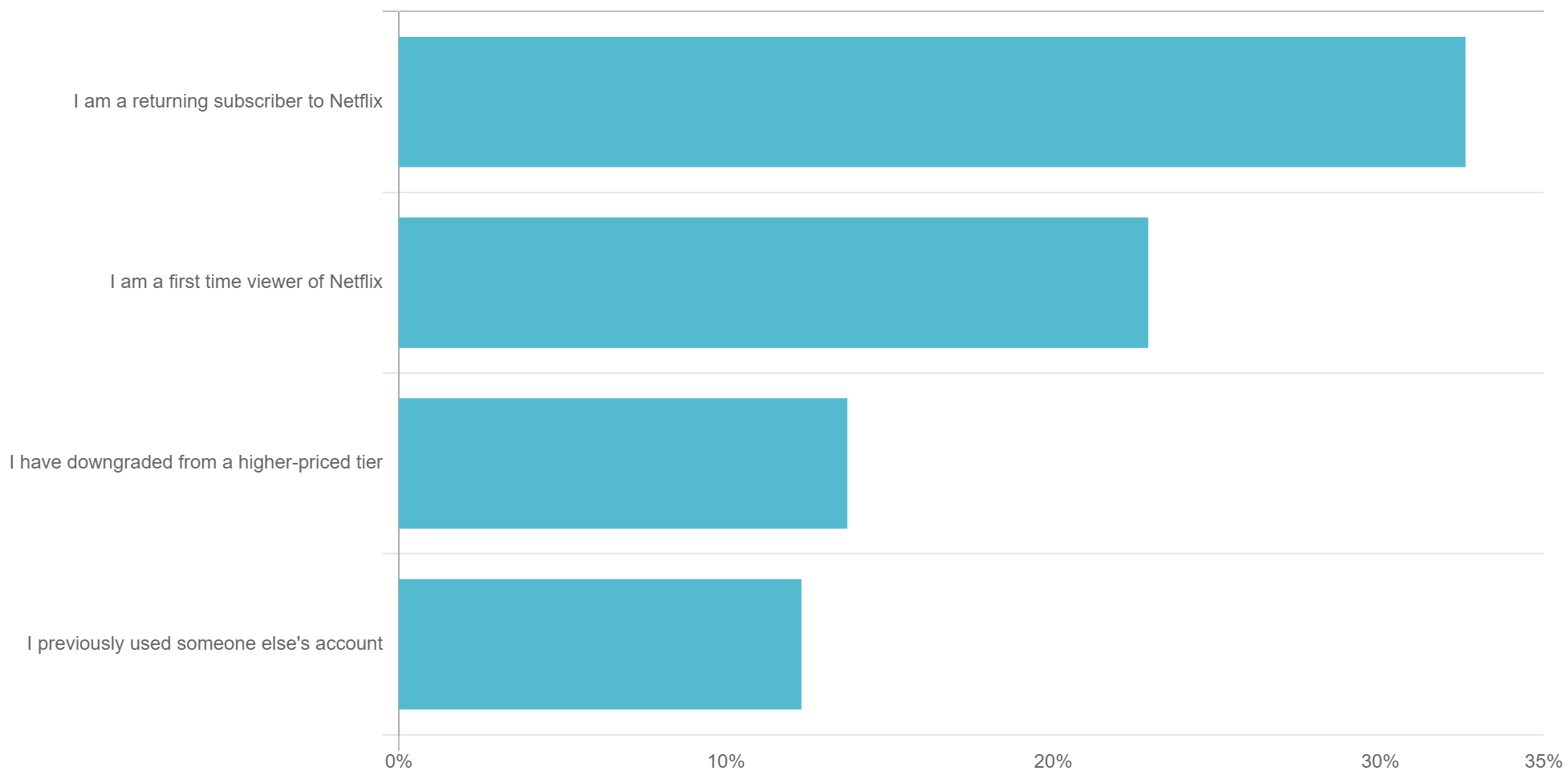

What made last year’s subscriber losses so shocking is Netflix’s relatively low churn rate. In fact, our data shows that a majority of current subscribers are Netflix veterans who subscribed more than three years ago! Thankfully, its new tier is exhibiting plenty of promise in this regard. For one thing, a majority of those with ad-supported basic plans are indeed returning subscribers, a perfect demonstration of how crucial a role the ad plan will play in making churn manageable again. Advertisers will be especially encouraged by the level of engagement from this tier; ad-plan users are actually streaming just as much as premium ones.

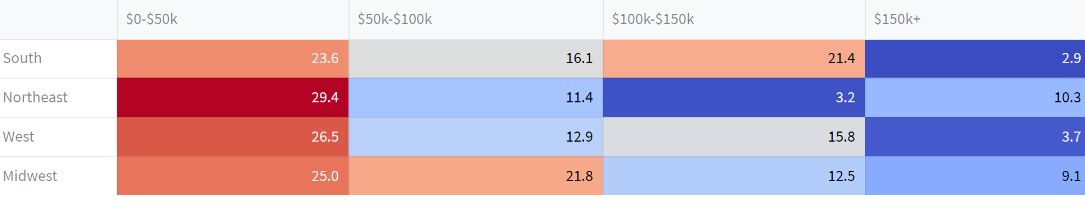

Moreover, though the ad-supported tier clearly attracts the price-sensitive, users come from every geography, age, race and gender. This will be a huge boon for advertisers, satisfying their hunger for viewer characterization.

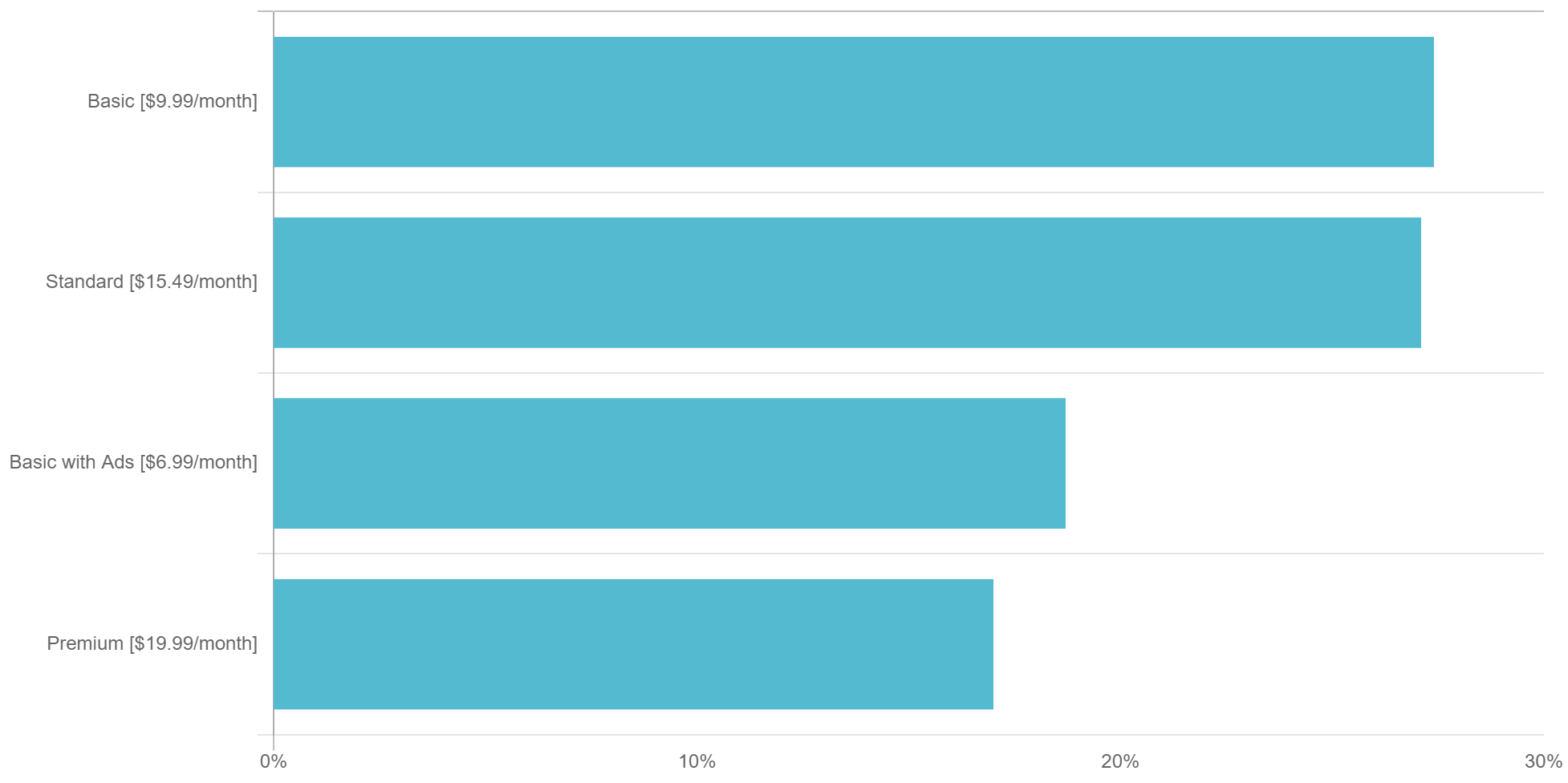

Ad supported tier

They're Still Watching

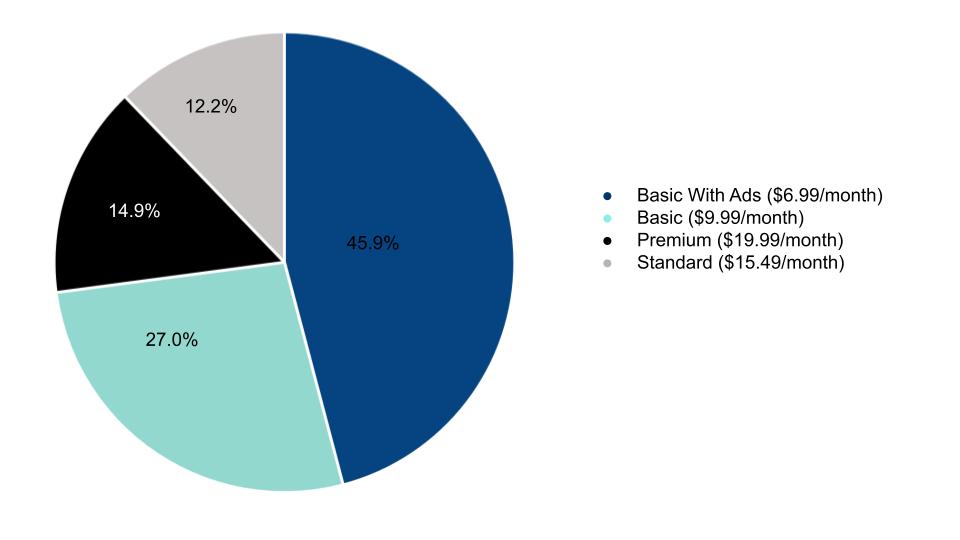

Almost 20% of subscribers are already on the ad-supported tier

Distribution of Netflix Subscibers

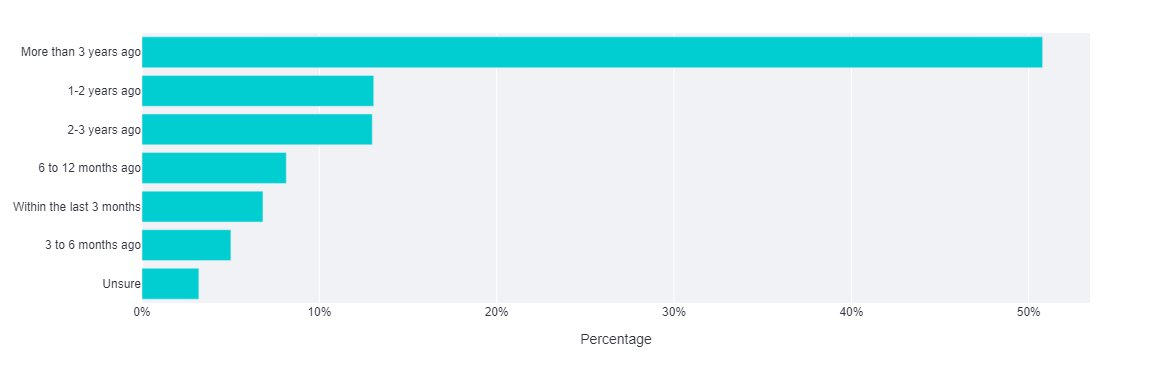

Churn trends

Can't Put A Price On Loyalty (Or Can You?)

More than half of Netflix subscribers have been with the service for over 3 years

TAM expansion

The New Frontier

Almost half of those who joined in the last 3 months chose the Basic with Ads tier

Ad supported tier

Not Enough Smart TVs In The World

The new ad-based tier has made important strides with returning and new subscribers, great for churn!

Where ad-supported subscribers are coming from

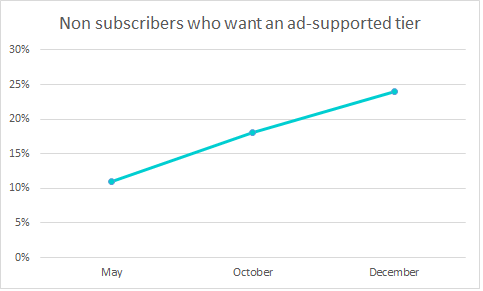

Intent

Everyone Needs An Ad-Break, Sometimes

Intent has steadily increased for an ad-supported tier

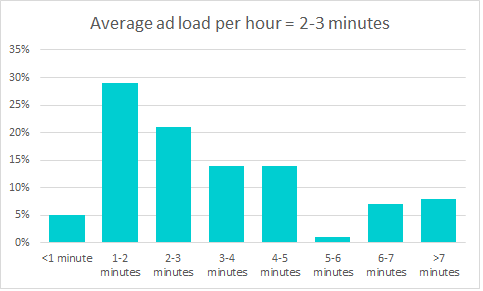

Ad load

Enough For A Bathroom Break and a Snack

Netflix describes the ad-supported tier as delivering 4-5 minutes of ads per hour. Early indication is ad load is still low

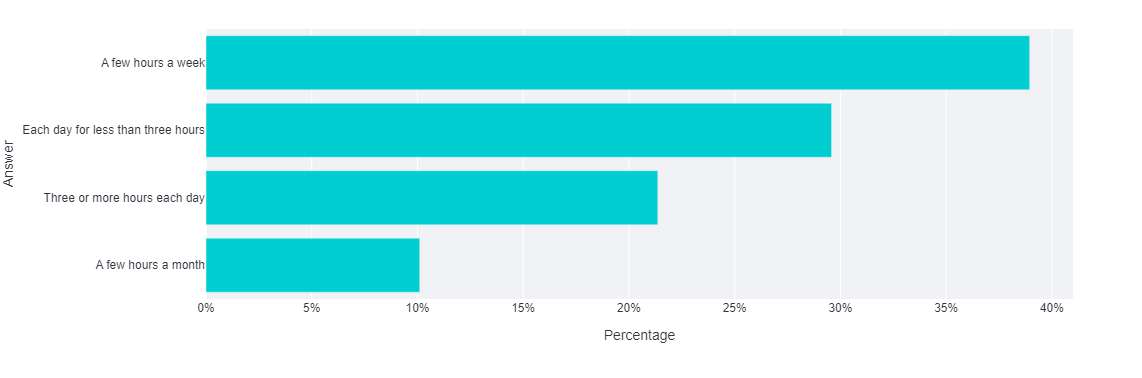

Engagement

Binge On, My Wayward Son!

High usage is a major advantage for advertisers

Demographics

Unity In Diversity (And Affordability)

Demographic slices = rich data for advertisers

Region and income of ad-supported subscribers (%)

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.