To say EV sales spiked last year is an understatement. Each quarter outperformed the last in terms of revenue as well as units sold, and tax credits from the federal government and state governments alike added to the EV's popularity. Even with this spike in demand, the U.S.' goal of 50% EV's by 2030 looks increasingly aggressive. Interest in EV's actually declined through the year, and range and affordability remain top of mind. To make matters worse, the EV's poster child, Tesla Motors, has complicated matters further as post acquisition of Twitter, founder Elon Musk is driving people away from the brand. All in all, until affordable, high range EVs become the norm, AlphaROC warns - be wary of the hype.

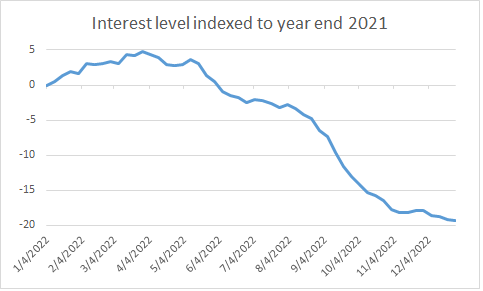

Towards the end of the year, the number of those likely to buy EVs has stagnated while disinterest has steadily climbed. Although the majority of consumers are buying into the promise of sustainable energy, the desired ranges they require for their potential EVs leave them with few options in the current catalog. With range and cost being two of the top three concerns for buyers, as they often have been, it seems unlikely the industry sees upside to the rosy estimates for 2023.

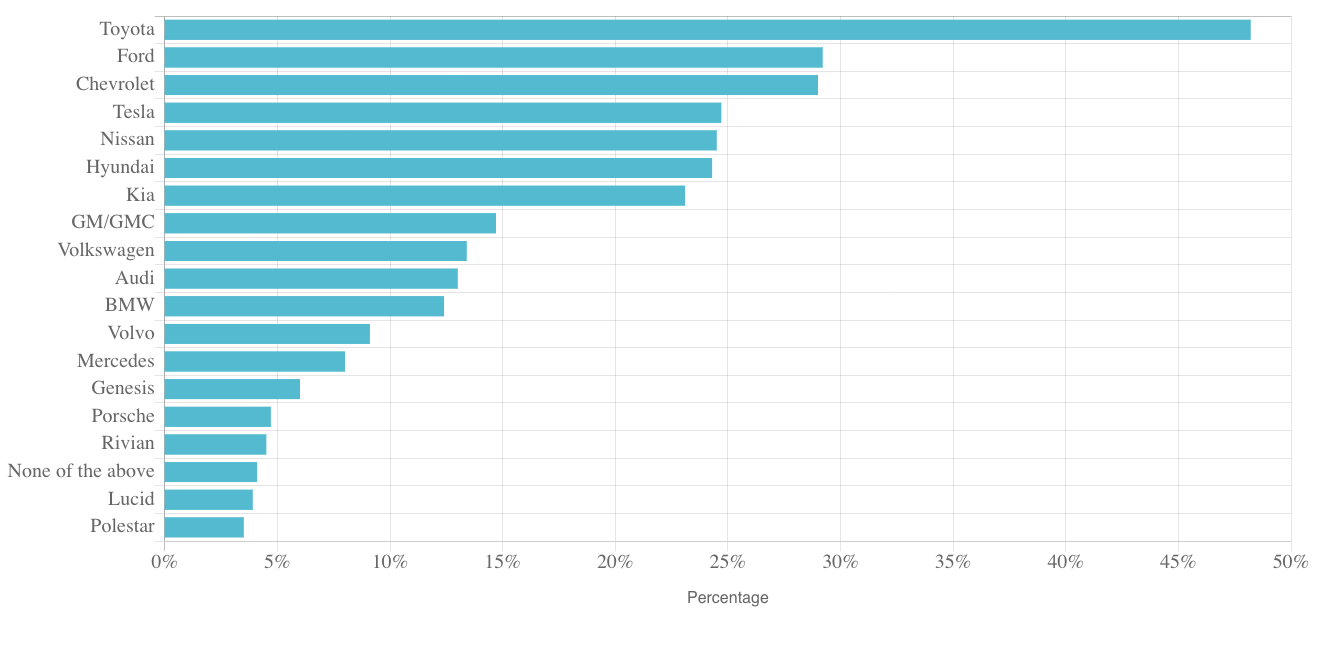

Tesla Motors is credited with popularizing the electric vehicle, and rightly so. They also remain the most important EV brand, outselling competitors by a wide margin. However, as Mark Twain famously said, “fame is a vapor, popularity an accident, and the only earthly certainty is oblivion”. CEO Elon Musk seems to have heard this message as he is alienating potential buyers. The positive side of this is legacy automakers are slowly but surely filling in the cracks and their brand affinity is high. Just look at Toyota’s EV buyer intent and they don’t even have a fully electric vehicle in the market! While mass market affordable EVs are not yet reality, most automakers are investing significant capital in making it happen. Though, in this case time may not be of the essence, as the majority of consumers do not expect to own an EV by 2030.

Market Sentiment

Only a Novelty - Just a Fad

Interest in buying electric vehicles declined throughout 2022

Not likely at all to buy an EV

Purchase Intent

The Power of Brand

Tesla slips behind legacy automakers Toyota, Ford and even Chevrolet, while barely keeping pace with Nissan and Hyundai

Brand purchase intent of EV buyers

Purchase Intent

Say it Ain't So, Elon!

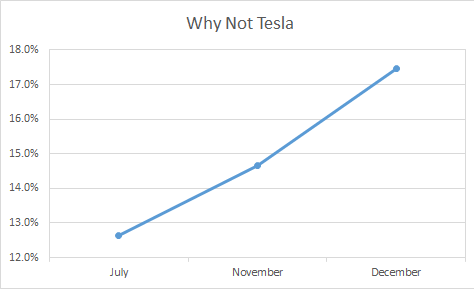

Consumers are slowly growing tired of the Tesla CEO

Percentage of EV buyers who cite dislike of Elon Musk as a reason not to buy a Tesla

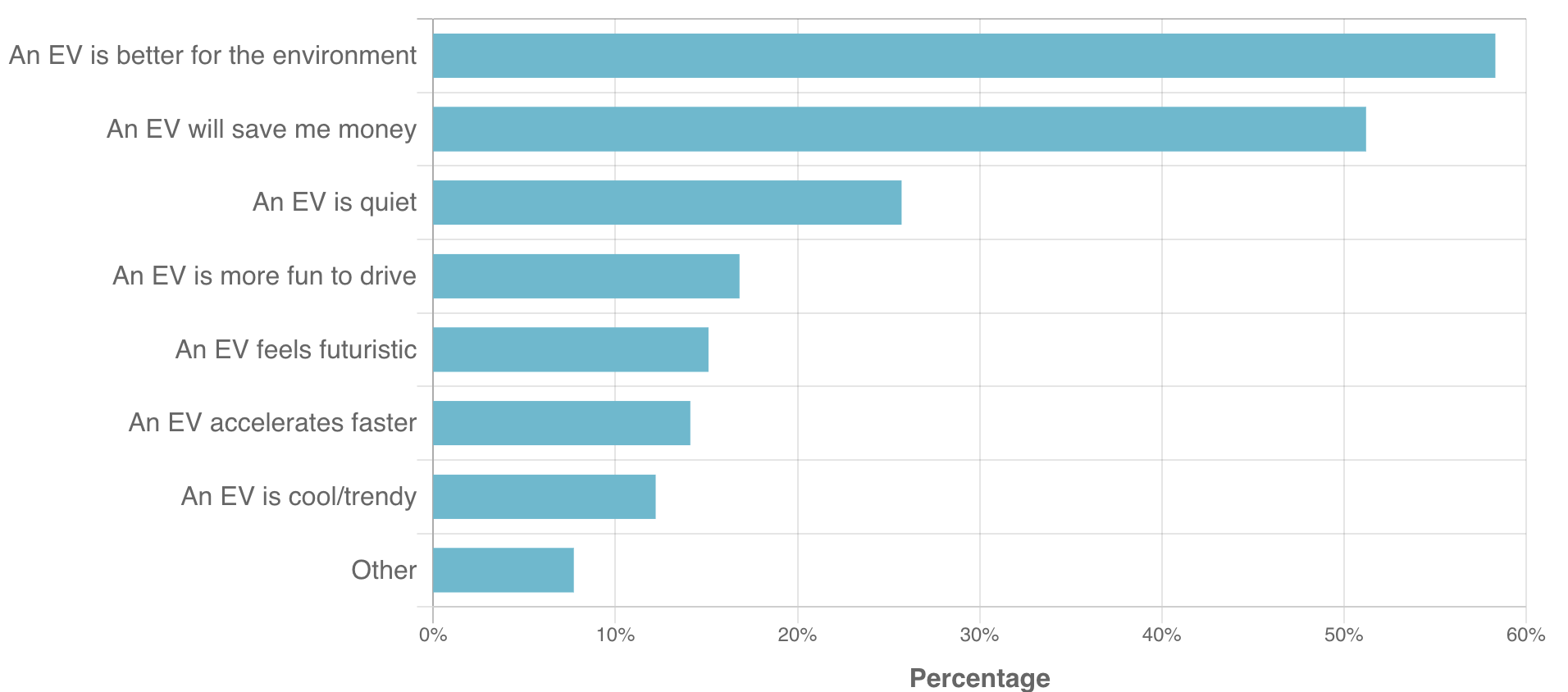

Features

Being Pretty Isn't Enough

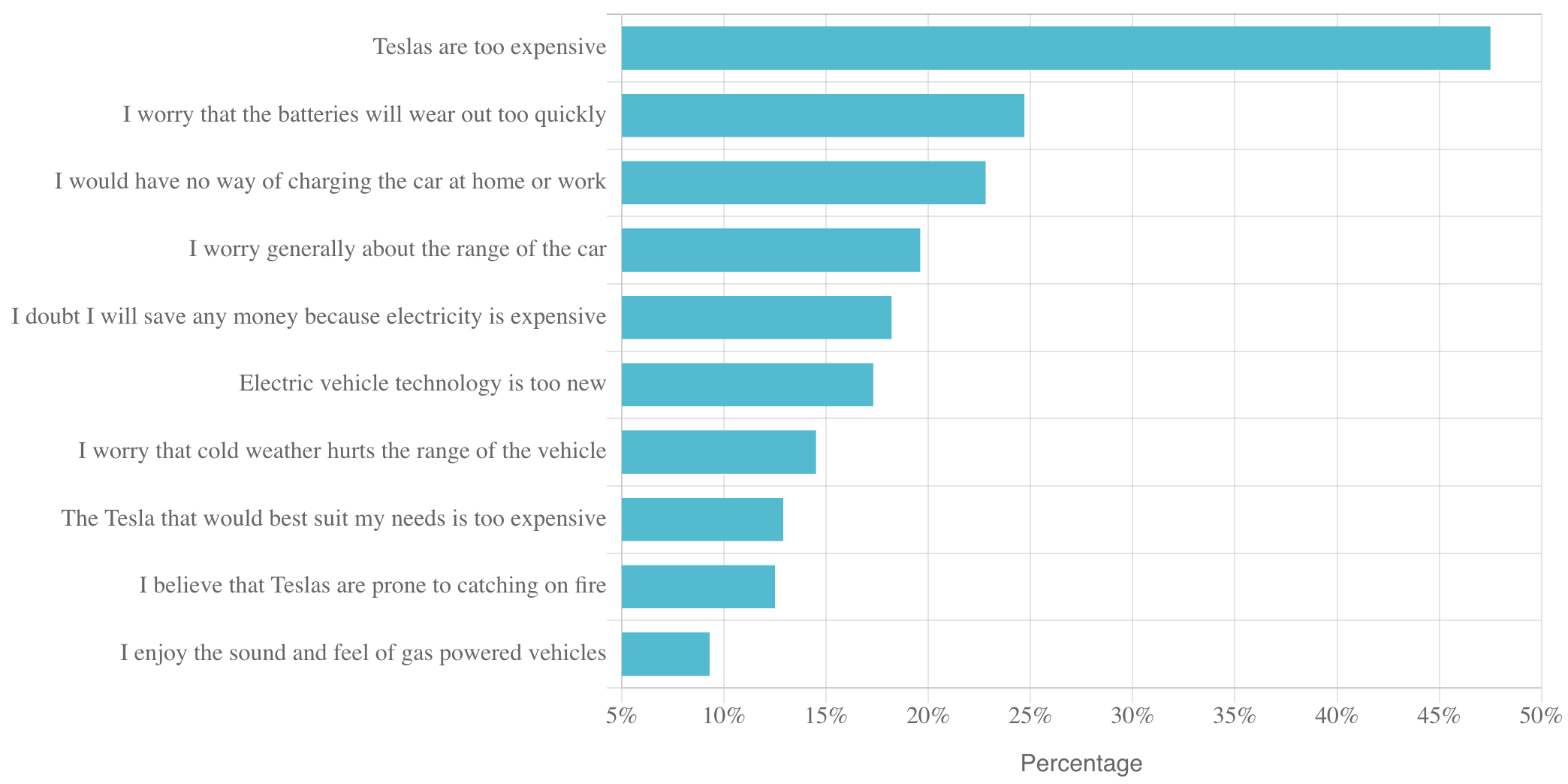

Using Tesla demand as a proxy for EV's - consumers are wary. Affordability, accessibility, and range are top of mind

Purchase Intent

The Future Can't Come Soon Enough

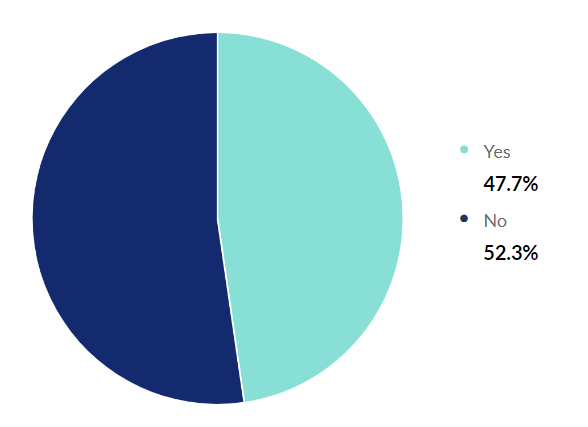

Industry observers should take note of the fact that over half of consumers do not expect an electrified future, even if OEMs are preparing otherwise

Will the car you buy in 2030 be electric?

Market Sentiment

The Bright Side

Those who want an EV want one for the right reasons

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.